Student loan debt might just be the biggest financial problem facing today’s 20- and 30-somethings. Got student loans you can’t wait to pay off? Welcome to the club.

As of 2018, Americans owe more than $1.5 trillion on student loans. That’s more than on credit cards and auto loans combined.

Education is essential to increasing your lifetime income, so don’t feel bad about borrowing for your degree. That said, you want to ensure your student loan debt doesn’t crush your dreams before you can even get started. If you’ve got a lot of student loan debt — $20,000, $30,000, $50,000 or even $100,000 or more — we can help.

Organizing your student loan debt

Student loan debt can make you feel as if you’re a slave to your lenders, but having student loans doesn’t have to be a life sentence. Nor does having student loan debt mean you can’t have a life.

The best thing you can do is to confront your student loan debt as soon as possible and make a long-term plan for how you to pay it all off. Ideally, you would do this during the grace period after graduation during which many federal loans do not require payment. But even if you’ve already been paying on your student loans for a few years, it’s never too late.

Determining how much student loan debt you have

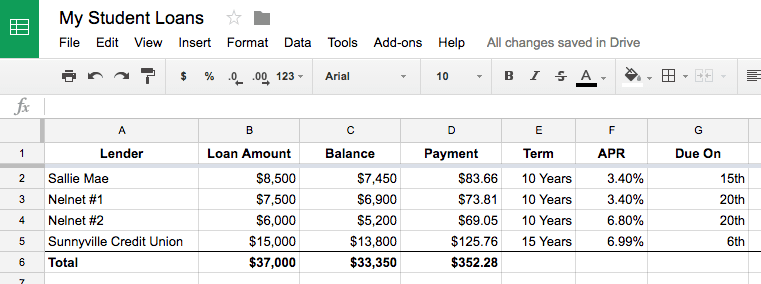

Do you know how much you owe? If not, the first step is to make a list or spreadsheet of all of your loan balances, interest rates, monthly payments, and due dates.

In a Google Sheet, it looks something like this:

This exercise is helpful for several reasons. It’s difficult to climb a mountain you cannot see. While staring down the “big number” — the amount you owe on your student loans — can be scary, it also provides your goal.

I’ve also found that seeing your numbers can actually put your mind at ease. Your total debt might seem insurmountable, but you might find your total monthly payments are manageable. And your balance decreases with every monthly payment.

It can be helpful to add a column that focuses on how much you’ve repaid instead of how much you still owe.

Affording your student loan payments

With your student loan details in front of you, determine whether your total monthly payment is manageable.

Are you earning enough money to pay both your student loans and other necessary expenses each and every month? If not, there are two things you need to do:

- Figure out ways to cut other expenses and earn more money

- Reduce your student loan payments with federal loan assistance or refinancing

Whatever you do, you do NOT want to stop paying your student loans — or even pay them late. Timely loan payments are essential to building a good credit history and defaulting on federal student loans carries extreme consequences: The government can garnish your wages, withhold tax refunds, and deny future benefits like Social Security.

If you cannot afford your student loans, ask for help! More on that below.

Making your student loans manageable

Ideally, your combined housing payment (rent or mortgage) and total debt (student loans, other loans, and credit cards) should not be more than 40% of your pre-tax monthly income. For example, if you earn $2,500 a month, pay $800 in rent and owe $400 in student loans, your housing and debt is 52% of your income, which is high. That said, I know from experience that when you combine big student loan debts and low entry-level wages, the 40% debt-to-income ratio can be a difficult target to achieve.

Getting your housing and debt payments under 40% of your income will make a world of difference in your financial health. You’ll have more money to enjoy life. You’ll be able to build a bank account buffer so you’re not living paycheck-to-paycheck and, eventually, be able to to save money for larger purchases. You’ll feel like you’re making progress.

Getting by with really big student loan payments

In reality, I know housing and debt make up well more than 50% of income for many young people. I’ve been there. Although it’s possible to survive in this scenario, it creates two problems:

- You have little money leftover to save or enjoy

- Your finances are more at risk of being derailed by an unexpected expense or loss of income

If you’re a doctor, lawyer or another professional with a stable six-figure income, you might be totally comfortable laying out more than 40% on loans and housing because the money left over is ample. If you’re living with student loan payments and a housing payment that are more than 40% of your income, you might choose to continue with that precarious situation until you can increase your income, but you may also want to explore federal payment options and/or refinancing to reduce your monthly payment amount.

Making a student loan payoff plan

Decide whether you are comfortable managing multiple student loans or whether to consolidate them into one or two larger loans.

With your loan balances in front of you, it’s time to determine the smartest way to pay off your student loans according to your budget and other goals.

Consolidating your federal student loans can make life easier because you’ll have one or two loan payments instead of a dozen. In some cases, consolidation can also lower your interest rate.

If you intent to stick it out with multiple loan payments, make sure you have your due dates organized. Most lenders will adjust your due date if you call and ask. Consider making all of your loans due on the same date or splitting them into two groups (for example, making half due on the 1st and half due on the 15th of each month).

If a few of your loans have much higher interest rates than the others (this is common if you’ve taken out private student loans, which tend to have higher APRs than federal loans), you might consider repaying some of this debt early.

In general, you can send in larger student loan payments to pay down your loan balance faster without penalty. This saves you money on interest and will pay your loan off faster. Loans with interest rates greater than 7% are good candidates for early repayment. More on this below.

Reducing your student loan payments

If you can’t afford your student loan payments or your combined total debt and housing payment is more than 40% of your take-home income, you may want to explore ways to reduce your loan payments so your monthly cash flow is more manageable.

Federal loan assistance programs

Federal student loans come with a number of benefits that can help you make your student debt more affordable. These include deferment, income-based repayment plans and even forgiveness in certain situations.

Pause payments with deferment or forbearance

If you temporarily cannot afford to make loan payments at all, forbearance and deferment are two options that will suspend your loan payments without harming your credit score. You must apply for these programs through your servicer, and interest will continue to accrue on your loans in many cases, but these options can give you time to find work, get additional education, or recover from illness.

Reduce payments with income-based repayment

If you’re working but your student loan payments are eating up too much of your monthly income, there are many federal student loan payment options that can reduce your payments. For example, under an income-based repayment plan, you pay a reduced monthly amount as low as 10% of your monthly income.

Keep in mind that income-based repayment can dramatically increase the amount of interest you will pay on the loan and, in some cases, mean that you’re not actually paying down the loan at all because your reduced payments only cover accruing interest, not principal. That said, you may also become eligible for student loan forgiveness under an IBR plan. If you continue to qualify for income-based repayment, your student loan debt may be forgiven after 20 years and in only 10 years if you work in a qualifying public sector or non-profit job.

Consolidate payments

Finally, we mentioned above, federal student loan consolidation can, in some cases, reduce your monthly payment and interest rate. The primary benefit of consolidation, however, is combining loans into a single balance and due date.

Student loan refinancing

If your federal loans carry high-interest rates or you have private student loan debt, you could be able to save a lot of money and reduce your total monthly payment by refinancing your student loans.

To qualify for student loan refinancing you’ll need a stable job and good credit or a creditworthy co-signer.

When you refinance, a new lender gives you one big loan and pays off all of your other loans. You also get to choose how long to take to repay your loans, which can reduce your monthly payment by stretching your payoff period. For example, your payment will go down if you refinance 10-year loans into a 15-year loan, but you’ll pay more interest overall.

Finding and applying for student loan refinancing has become easier thanks to marketplace websites that compare the best student loan refinancing companies in one place.

How much could you save by refinancing your student loans?

Our favorite one right now is Credible. The company shows you if you’re pre-qualified for refinancing in minutes and lets you compare real-time refi rates before you apply. It’s free to use and there’s no obligation to finance.

Check your rate and payment with Credible—it’s fast, free, and checking rates won’t affect your credit score:

You can use Credible to compare refinancing offers from multiple lenders at once. Each lender has different benefits and interest rate ranges, so if one Credible lender can’t give you the interest rate you’re looking for, another one might.

Rates starting at 5.48% fixed APR (with autopay)* and 5.28% Var. APR (with autopay) See Terms*.

- Single application form

- Personal information is not shared

- 100% free to use

- Limited lending opportunities

» MORE: Read our full Credible review

Other lenders like SoFi and Earnest are making student loan refinancing easier with online applications and approval processes that look at more than just your FICO score.

Paying off student loans early

Most people can’t wait until their student loans are gone entirely. While paying off your student loans early can save money and free up money in your monthly budget, it’s not always the best option.

Pros of paying off student loans early

Paying off your student loans early frees you from debt faster and provides a guaranteed return on your money by saving thousands of dollars in interest.

Let’s say you have a $10,000 student loan with a 10-year term at a 5% APR. If you make the 120 scheduled monthly payments of about $106, your loan will be paid off in 10 years and you will have paid roughly $2,728 in interest on top of the original $10,000.

If, however, you doubled your monthly payment to $212 from the beginning, you would pay off your loan in four years and five months and pay only $1,157 in interest. Doubling your payment gets you out of debt in less than half the time and for less than half the interest.

Cons of paying off student loans early

You can’t go wrong paying down your student loan debt early, but you only have so much money to spread over many different goals. Hanging onto your cash provides some benefits.

Money you use to pay down your student loans early is

- Money you cannot invest long-term in the stock market

- Money you cannot save in case of an unexpected expense or job loss

- Money you cannot save for a once-in-a-lifetime opportunity

Whenever you have an opportunity to pay down debt early, the first step is to look at the interest rate you’re paying. It’s always better to be earning interest than paying it, but the lower the interest rate, the less incentive you have to save or repay debt. You want to invest in high interest rates and borrow at low interest rates.

If for example, you have a student loan at 3% but can invest and earn 7%, the better mathematical play is to invest any spare money and take the 4% profit. Of course, paying down debt is a guaranteed return whereas investing involves risk. The choice is yours.

Personally, I believe the better argument for not paying off student loans early is the need to hold onto your cash for other reasons.

Student loans are not lines of credit. That means once you pay money toward the loan, you can’t borrow it back if your car suddenly coughs up its transmission.

Yes, hanging onto cash in a 1% APY savings account might not seem to make sense when you have student loan debt at higher rates, but cash provides you with the ability to whether financial setbacks and take advantage of financial opportunities. Cash provides an emergency fund to cover unexpected expenses without taking on more debt. Cash also enables you to take advantage of opportunities, whether they’re financial, such as starting a business, or personal, such as taking a sabbatical to travel the world for a month.

The point is, you’re only young once. If you’re smart and hard-working, you’ll pay off your student loan debt in due time.