If you’re looking for a direct lender who cuts out the red tape and gives you a low-interest rate student loan (or student loan refinance) – with no fees – you need to check out Earnest.

You can get a rate quote in just two or three minutes, without affecting your credit score. And if you get a loan through Earnest, you’ll enjoy complete flexibility in determining your monthly payment, even while your loan is in repayment.

What is Earnest?

Based in San Francisco, CA, and launched in 2014, Earnest provides private student loans, student loan refinances, and even personal loans.

Earnest is designed for those who are seeking private student loan financing, or the ability to refinance their current student loan debts into a new loan with a lower interest rate and/or a lower monthly payment.

The company has Better Business Bureau rating of “A+”, the highest rating on their scale ranging from A+ to F.

What loan programs does Earnest offer?

Private student loans

Earnest offers six different types of private student loans for current students:

- Undergraduate private student loans

- Graduate private student loans

- Cosigned private student loans

- Business school loans

- Medical school loans

- Law school loans

Private loans come with the following features:

- Nine-month grace period

- The ability to skip a payment once each year

- Provides up to 100% of your school’s certified cost of attendance

- The minimum loan amount is $1,000, up to the full cost of your attendance

- Loan terms of five or seven years if you are qualifying alone, or five to 15 years if you are qualifying with a cosigner

Even though a nine-month grace period is offered, you will still have the option to make fixed payments as low as $25, or interest-only payments, to lower the amount of principal that will be due once the grace period ends.

To qualify for a private student loan, you must:

- be enrolled in school full-time, have attained the age of majority as defined by your state of residence

- be either a US citizen or permanent resident

- have at least three years of credit history with a minimum FICO score of 650, with no bankruptcy on your credit report, and no accounts currently in collection have a minimum annual income of $35,000 per year

If you don’t meet the above qualifications, you can add a cosigner to your loan.

Unlike some private student loan lenders, Earnest does not offer the ability to have a cosigner released from the loan. The cosigner must remain on the loan until it is paid in full.

Unfortunately, if you’re from Alaska, Connecticut, Hawaii, Illinois, New Hampshire, Nevada, Texas, or Virginia, you’re not eligible for private student loans.

Student loan refinances

Minimum loan amount: $5,000

You can use the student loan refinance program to refinance both federal and private student loans. The minimum loan amount is $5,000, and the maximum is up to the full amount you owe on existing student loan debts.

You must be a US citizen to qualify

To qualify, you must be a US citizen or permanent resident alien, at least 18 years of age, and be the primary borrower on the student loans you want to refinance.

Available in most states

Student loan refinances are available in the District of Columbia and all states except Delaware, Kentucky, and Nevada.

In addition, if you are still in school, you must be enrolled less than half time, with your student loans already in repayment status.

You must be employed to qualify

You must be employed with consistent income, or have a written job offer for a position that starts within six months.

Credit score minimum: 680

The minimum credit score requirement is 680, your student loans must all be in good standing, you must be current on your rent or mortgage payments, and not have a bankruptcy on your credit report or any accounts recently in collection.

You have to spend less than you earn

You must also spend less than you earn, have at least two months of normal expenses in savings, and show a pattern of increasing bank account balances.

Personal loans

Loan amounts from $5,000-$75,000

Earnest makes personal loans available in amounts ranging from $5,000 all the way up to $75,000.

Personal loans are available for just about any purpose including weddings, home-improvement, vacations, moving and relocation, engagement rings, debt consolidation, and medical expenses.

Prohibited loan purposes include tuition, business capital, and purchase money real estate loans.

Earnest doesn’t just consider your credit score

Earnest goes beyond your credit score alone in determining your eligibility.

They also look at your personal savings patterns, education and earning potential. The combination of all factors will make it easier for them to offer you the lowest possible rate.

Short application

When you make an application, the loan decision will typically take between five and 10 business days. If your loan is approved, the funds will be transferred in your bank account just one or two business days after signing your loan documents.

You must be a US citizen to qualify

To qualify, you must be a US citizen or a permanent resident alien and be at least 18 years old.

Earnest personal loans are available in the District of Columbia and all states except Alabama, Delaware, Kentucky, Nevada, and Rhode Island.

Minimum credit score: 650

The minimum credit score is 650, and you must not have declared bankruptcy within the last three years. In addition, you cannot have any open collection accounts.

You must also spend less than you earn, have at least two months of normal living expenses (including housing) in savings, and show a pattern of increasing bank account balances.

My experience using Earnest

Wanted to share a bit more about what it was like to use Earnest.

First and foremost, you’ve got to know that Earnest provides three different loan types: new private student loans, refinancing of existing student loans, and personal loans.

The sign-up process is similar for all three types. For simplicity’s sake, I’ll demonstrate the sign-up process for student loan refinances below.

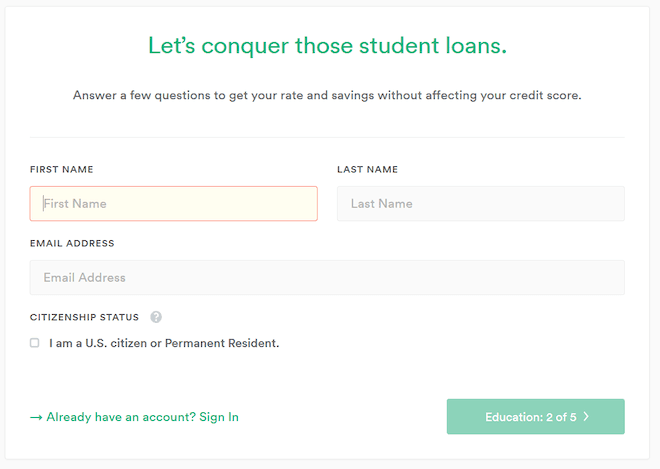

The application process uses five input screens, with the first asking for basic information:

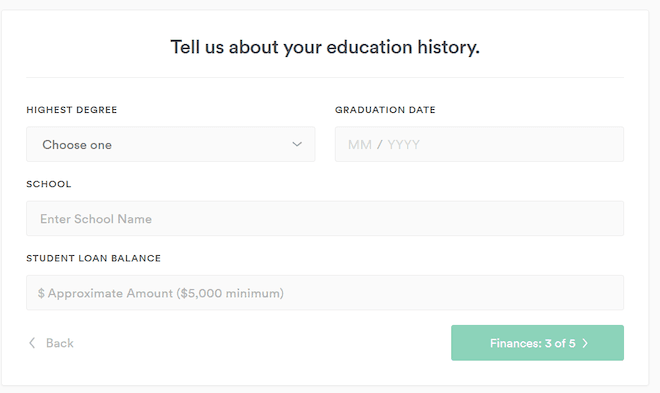

On the second screen, you’ll be asked to provide your education history:

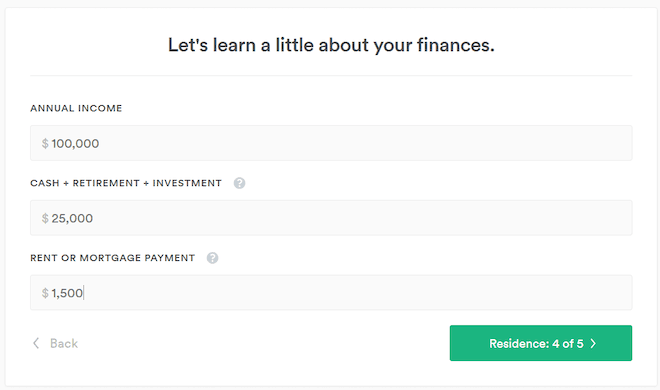

The third screen will ask you about your financial situation, including annual income, liquid assets, and house payment.

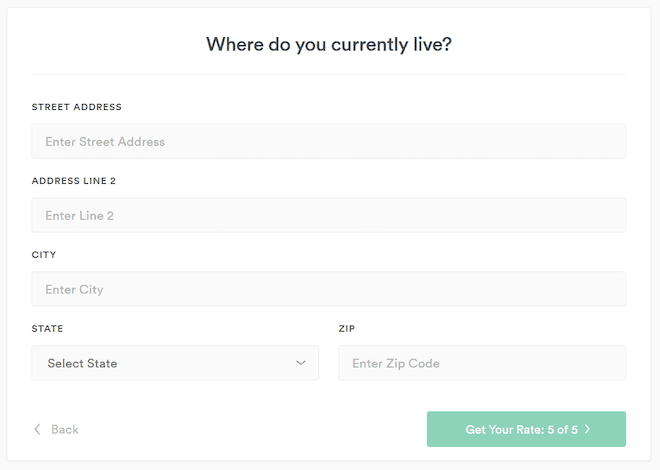

Input screen number four will ask for residential information.

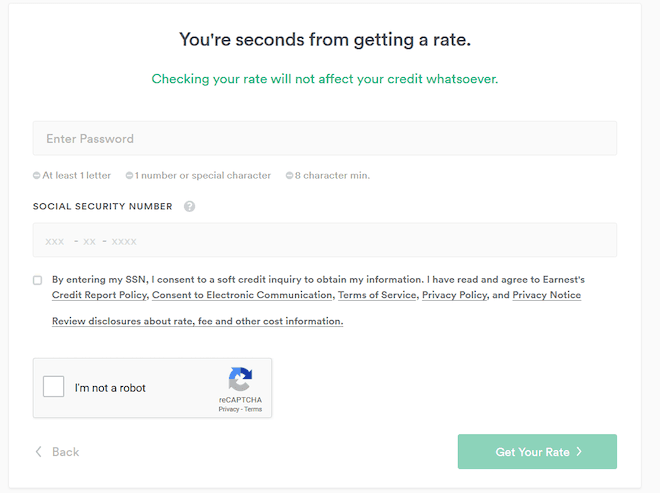

Screen number five will ask you to create a password as well as to enter your Social Security number.

You’ll also need to check a box acknowledging several disclosures, and an “I’m not a robot” box.

Once you’ve completed this screen, you’ll check the green “Get Your Rate” button, and your rate will be provided.

The entire process can be completed in just a couple of minutes.

Ernest uses a “soft credit pull”, so your credit score won’t be dinged by an inquiry from the platform. Naturally, once you make a formal application, a hard credit pull will be conducted. You’ll also be required to provide documentation proving your education, income, and existing loan balances.

How much does Earnest cost?

Earnest does not charge an application or origination fee on its private student loans or student loan refinances. There are also no prepayment penalties and no late fees.

Private student loans

On private student loans, variable rates start at 4.49% APR, while fixed rates start at 4.49% APR (both including the 0.25% Auto Pay Discount).

Student loan refinances

Interest rates on student loan refinances for variable rates are 4.99% – 8.94% APR (includes 0.25% autopay discount), while fixed rates are 4.96% – 8.99% APR (includes 0.25% autopay discount).

The exact rate you’ll pay will depend on your borrower profile, which will include both your credit score and your income. The fee ranges include a 0.25% Auto Pay discount.

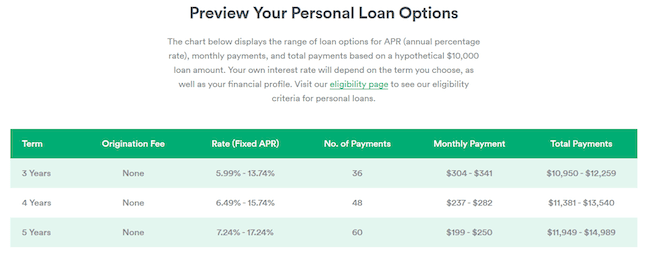

Personal loans

Personal loans are available at fixed rates starting at 5.99% APR.

However, unlike many personal loan lenders that charge origination fees of between 1% and 6% of the amount borrowed, Earnest has no origination fees with their personal loans, and no fees at all for that matter.

Earnest features

Earnest private student loans and student loan refinances offer the following benefits and features:

Choose your preferred payment amount based on your budget

You can file a request to change your payment amount by specifying the amount you want the payment to be.

There is no limit on the number of change requests that will be honored. But expect the change to take one or two months before it takes effect.

Increase your payment anytime to pay off your loan faster

If you want to pay off your loan faster, you can do it by adding additional principal payments to your regular monthly payment. There are no prepayment penalties for making additional payments.

Adjust your payment date any time

Once your loan is in place, you will have the option to change your payment date based on personal preference. You can choose a new payment date that falls between the third and the 22nd of the month. Once you request a change in the payment date, it will take one or two months for the change to become effective.

Skip a payment and make it up later

You’re eligible to skip one monthly payment every 12 months. However, you must make six consecutive on-time monthly payments to be eligible, and your loan must be in good standing.

To skip a payment, you’ll have to complete a formal request no less than five business days before the due date of the payment you want to skip.

Be aware however that any skipped payments will also extend the length of your loan, and accrue additional interest.

Forbearance

Earnest offers forbearance under the following situations:

- Involuntary decrease in income, such as a reduction in hours, unpaid leave or change from full-time to part-time employment.

- Involuntary loss of employment, defined as termination, at no fault of the client.

- Significant increase in costs that are essential to the home or family, such as medical expenses, emergency home repairs or childcare.

- Unpaid maternity or paternity leave.

If any of the above apply, you’ll be eligible for up to 12 months forbearance. However, you must have made at least the first three month’s payments on time.

Simple daily interest will continue to accrue on your loan while it is in forbearance.

Who is Earnest best for?

Those looking for either private student loans or a student loan refinance

Earnest is an excellent choice for anyone who is looking for either a low-cost private student loan to finance their education, or a low-cost student loan refinance to provide a lower rate and monthly payment on existing student loans.

Borrowers looking for a low-cost personal loan

It’s also an excellent choice if you need to borrow money for a personal loan. Not only are the interest rates on Earnest personal loans lower than most of the competition, they also charge no origination fee. Most competing personal loan lenders charge interest rates as high as 36%, and origination fees up to 6% of the loan amount.

Proceeds from an Earnest personal loan can be used for just about any purpose, and are available in amounts up to $75,000. Most other personal loan lenders cap loan amounts at either $35,000 or $40,000.

Who shouldn’t use Earnest?

Anyone who is not currently employed, or doesn’t have any immediate employment prospects

Earnest requires that you are either currently employed with a consistent income pattern, or that you have a written promise of employment within six months of application. If you don’t have either, you’ll need to wait to apply.

Earnest also requires that you have a pattern of being able to live on less than you earn. This must be evidenced by savings sufficient to cover at least two month’s living expenses, including housing, with a pattern of an increasing savings balance.

Anyone with fair or poor credit

Earnest has a minimum credit score requirement of 650. If your score is lower, you’ll need to take steps to increase it before making an application.

Also, be aware that your credit score will be a factor in determining the interest rate you will pay on your loan. The higher your score, the lower your rate will be.

Those looking to refinance federal student loans: proceed with caution!

We don’t mean to imply that you shouldn’t apply for an Earnest refinance if you have federal student loans. If it makes sense financially, as it will reduce your interest rate and monthly payment, it may be worth doing.

Just be aware that you’ll be refinancing from federal loans to private loans, and in the process, you’ll be giving up certain benefits provided by federal loans. Those benefits will enable you to either reduce your monthly payments consistent with your income or even to have your loans forgiven.

For example, income-based repayment plans (IBRs) allow you to lower your monthly payment to a small percentage of your income.

Meanwhile, the public service loan forgiveness (PSLF) program can provide for debt cancellation after 10 years of employment with a government agency or a nonprofit organization.

Pros & cons

Pros

- No fees — That means no application or origination fees.

- Low rates — Earnest offers lower interest rates than the competition on all loan programs.

- Skip a payment — You can skip one payment every 12 months.

- Set your own payment — You can adjust your monthly payment based on personal preference.

Cons

- No cosigner release — A cosigner must remain on the loan until it is fully paid.

- Not available in all states — Earnest is licensed in 42 states and the District of Columbia.

- Not available for poor credit — Depending on the loan type, a minimum credit score of 650- 680 is required.

The competition

| Lender | Available loans | Direct lender or marketplace | Upfront fees | Minimum credit score | Maximum loan amount |

|---|---|---|---|---|---|

| Earnest | Private student loans, student loan refinancing, personal loans | Direct lender | None | 650 | Up to the amount of school -related expenses or existing student loan debt; $75,000 on personal loans |

| Credible | Private student loans, student loan refinancing; personal loans; mortgages | Marketplace | None | 600 | Up to the amount of school -related expenses or existing student loan debt; $600 – $200,000 on personal loans |

Earnest vs Credible

Credible is a direct competitor to Earnest in that both serve the private student loan and student loan refinance markets. Both also offer personal loans for just about any purpose. Credible also offers home mortgages.

Credible is an 100% free to use aggregator that checks personalized rates from multiple lenders to help find a loan that works best for you, with options for many different college and university degrees to fit your goals.

Rates starting at 3.98% fixed APR (with autopay)* and 4.98% Var. APR (with autopay) See Terms*.

- 100% free to use, done online

- Partners have no origination fees or prepayment penalties

- Credible Private Student Loans Best Rate Guarantee (Terms Apply)

- Limited opportunities shared based on prequalification

The main difference between the two is that while Earnest is a direct lender, Credible is a student loan marketplace, with loans provided by several participating lenders.

For this reason, Credible may be a better choice if you have a credit score below 680, and may be in need of a lender that will provide a loan or refinance for fair or poor credit.

» MORE: Read our full Credible review

Summary

Earnest is an excellent choice if you’re looking for either private student loans or to refinance existing student loans, and want some of the lowest interest rates available from any lender.

Earnest loans come with no fees, including no late fees or prepayment penalties, and offer flexible repayment terms to fit your budget. They even allow you to skip one payment every 12 months.

Earnest offers something that not all private student loan lenders do, and that’s the potential for forbearance if you are facing a crisis that is not of your own doing.

They also allow you to add a cosigner to your loan if you’re not fully qualified but be aware that there is no provision to have your cosigner released, short of paying off the loan completely.