When my beagle-blue tick mix, Whiskey, started acting strangely, I immediately felt scared. I had never seen a dog shake like that. She was having trouble standing up and was running into walls; her eyes were rolling and she was twitching. I knew I needed to talk to the vet right away.

A few hours later, our trusted veterinarian was patting her on the head and handing me a prescription and a full slate of instructions. Whiskey was back to her normal self. But now I had a new problem: a hefty vet bill.

As the owner of two dogs, I’m no stranger to expensive vet care. And of course, it’s worth it to me to make sure my pets are as healthy and well-cared for. If you’re like me, you might be wondering: When is it time to get pet insurance? And if so, which one is the best?

I decided to take a closer look at Embrace Pet Insurance to see if they were as good as I’d heard.

What is Embrace Pet Insurance?

One of the top names in this growing industry, Embrace Pet Insurance is a pet insurance company that aims to help you provide the best care possible for your cat or dog.

They offer a number of different plans, so you can customize your pet’s insurance plan, monthly premiums, and annual payout limits to your exact needs. Plus, they have terrific support and service, so you never have to feel like you’re alone in trying to figure it out.

How does Embrace Pet Insurance work?

Like other best pet insurance companies, Embrace Pet Insurance works by protecting your pet in case something unexpected happens. It gives you peace of mind knowing you’ll be able to afford care for your pet even if something costly comes up, such as an accident or illness.

You pay a monthly premium, just like you would with car insurance, and when it comes time to make a claim, you pay a deductible and Embrace reimburses you for the rest, up to a set amount according to your policy terms.

Embrace offers a variety of ways to customize your policy and terms so you get exactly the coverage you want.

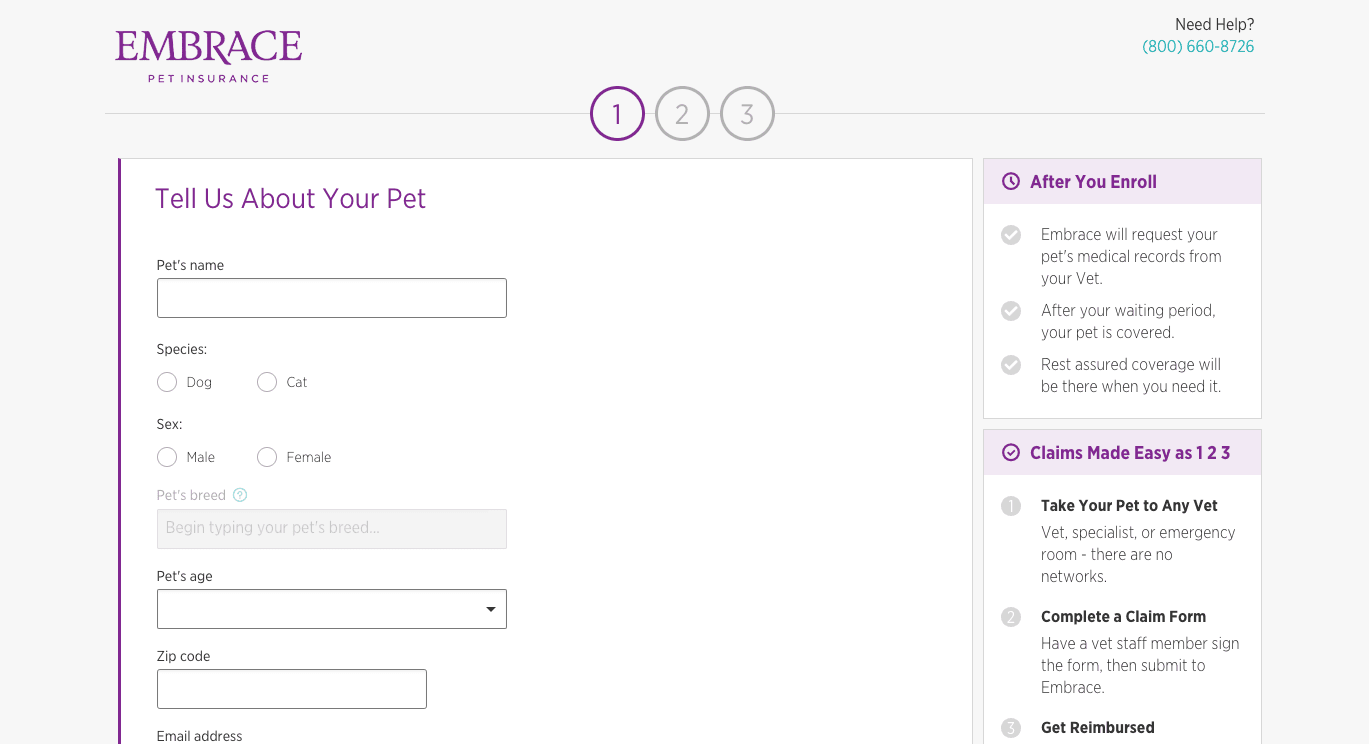

Signing up for Embrace is easy. I went to their website and clicked “Get a Quote.” The website walked me through the sign-up process.

First, I entered a little bit of information including my state (PA), Whiskey, my nine-year-old mutt with the heart of gold, and added some contact information for myself, too, using my email address.

I understand from Embrace that premiums can vary by location and there may also be other variations depending on the state.

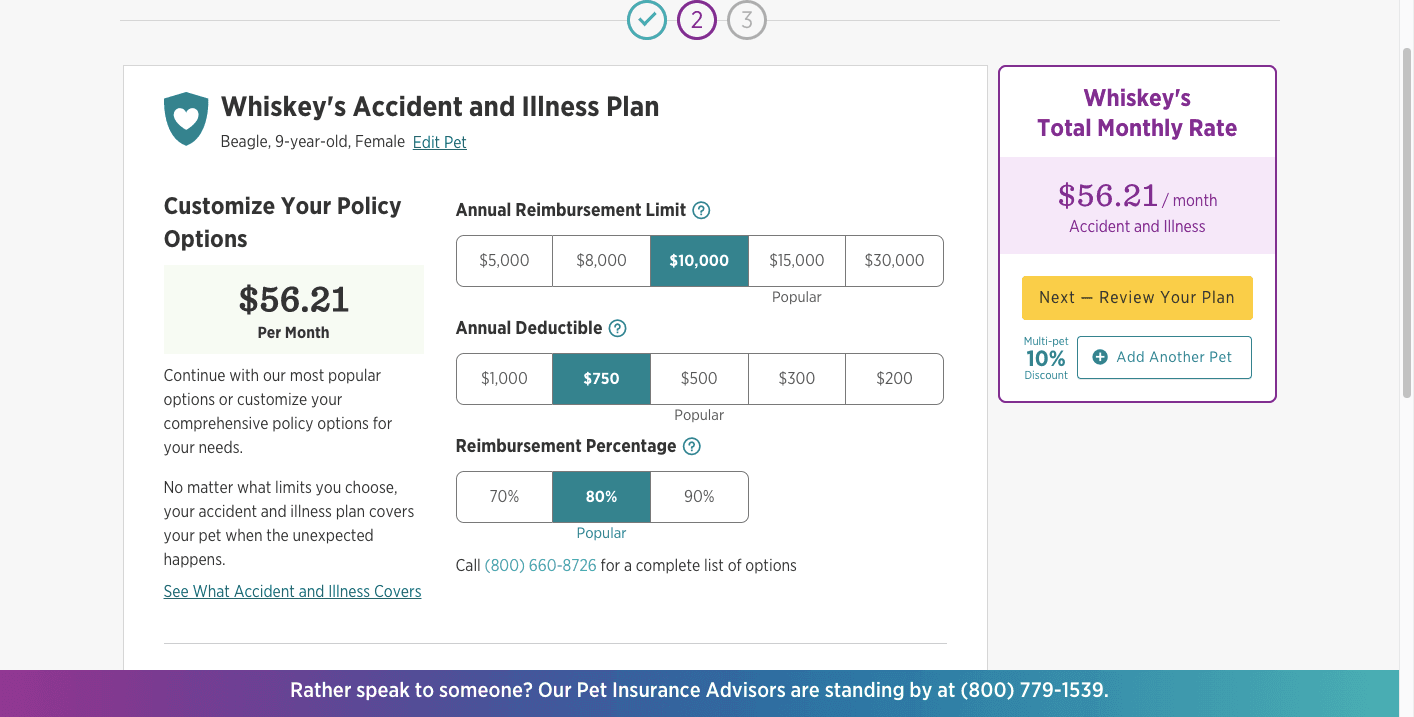

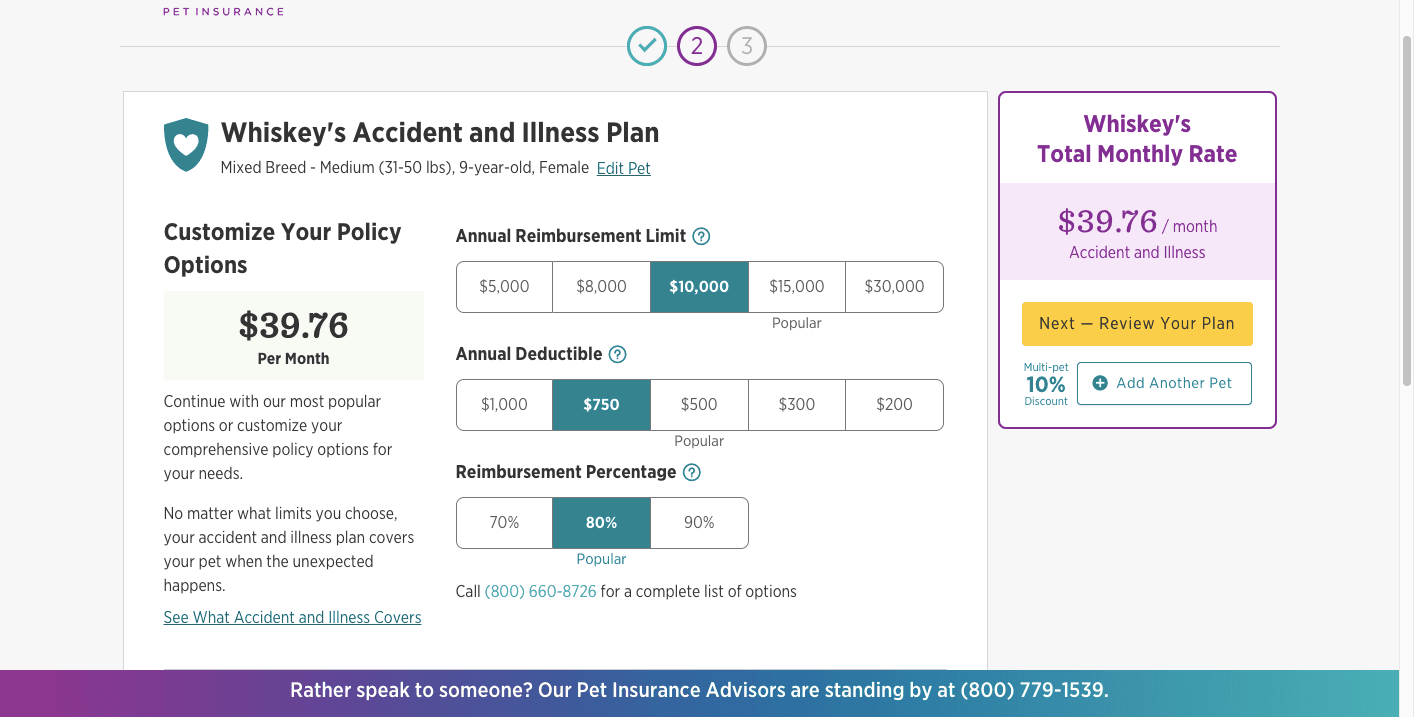

Then, I was able to explore the different insurance options and see the effect on the monthly rate.

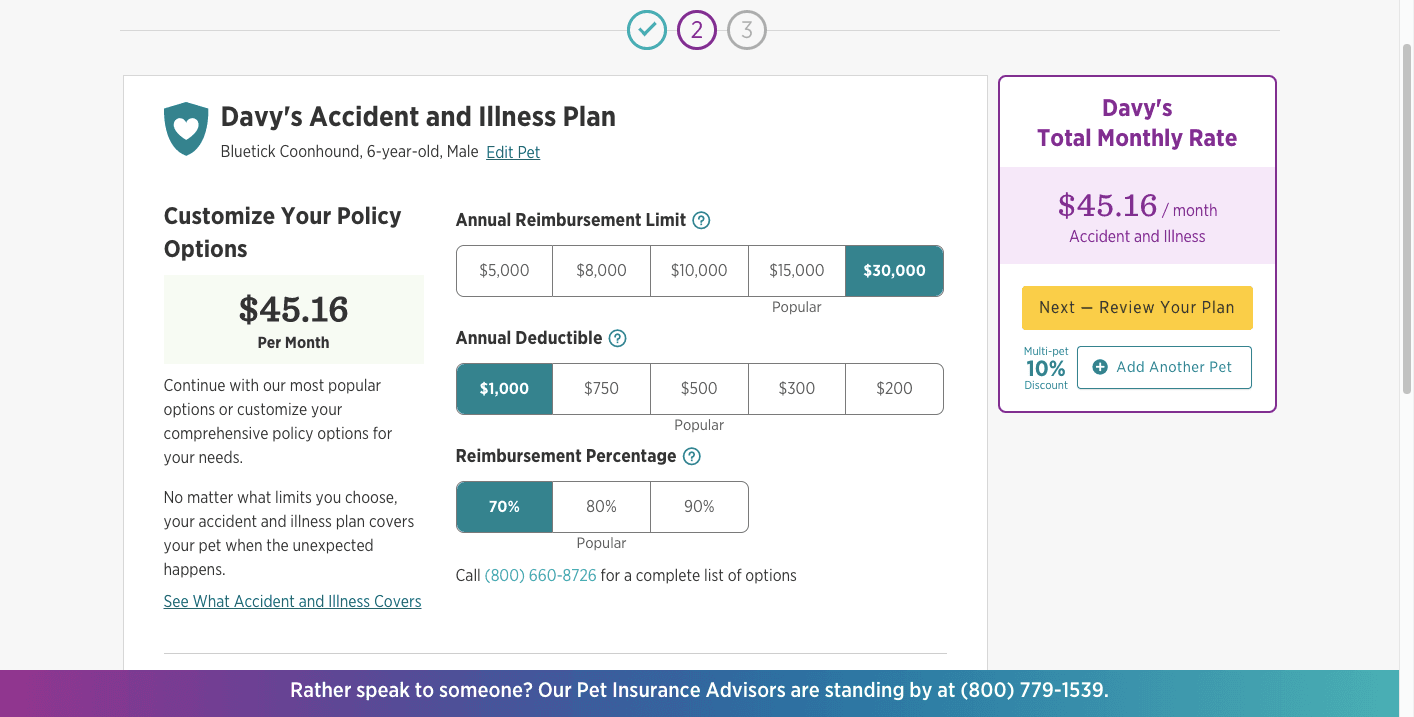

I was able to select from five different choices of annual reimbursement limit:

- $5,000.

- $8,000.

- $10,000.

- $15,000.

- $30,000.

I could also choose my deductible, ranging from $100 to $1,000, and reimbursement level — 70%, 80% or 90%.

By altering these different variables, I could easily change my monthly premium:

The site clearly showed me what I would be getting for my money.

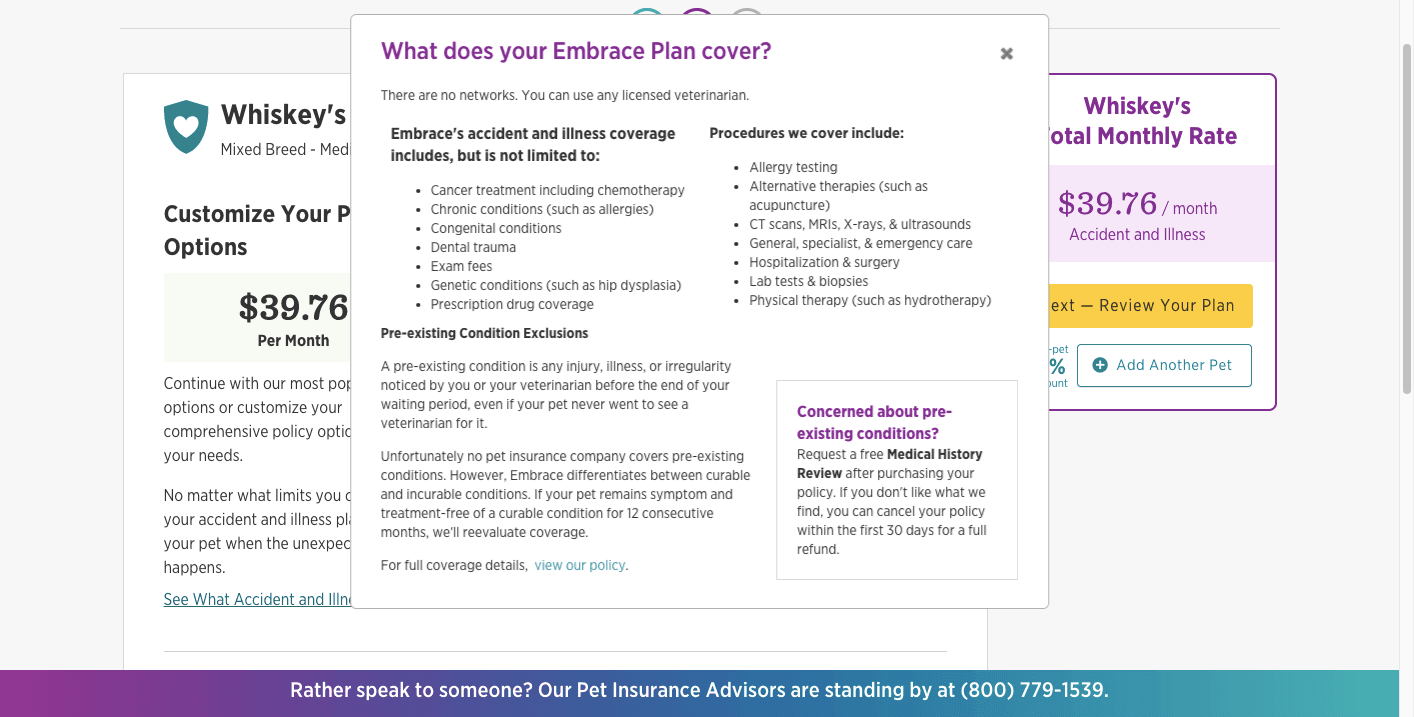

Some of the procedures they cover include:

- Allergy testing.

- Acupuncture (my vet offers this service).

- Scans and x-rays.

- Lab tests.

- Surgery.

- Physical therapy.

The site also let me know what kinds of conditions and treatments the plan would cover:

- Cancer treatment.

- Allergies.

- Genetic conditions.

- Dental trauma.

- Prescription drugs.

Plus, care can cover exam fees. I could tell right away that Whiskey’s most recent trip would probably have been covered under this plan since it wasn’t for a pre-existing condition.

How much does Embrace Pet Insurance cost?

The policy premium will vary depending on the breed, sex, age, and location of the pet along with how the pet parent personalizes their policy parameters. The health status of the individual pet is not taken into consideration during the quoting process.

You can customize your monthly premium to a price that suits your budget and desired coverage levels.

Discounts available with Embrace

I found as I was signing up that there were a number of discounts available for pet owners. I qualified for an instant 10% discount by signing up my second dog, Davey (he’s a Blue Tick Coonhound but I suspect a little Dalmatian, too).

Other discounts include a 10% multi-pet discount and a 5% active or retired military discount* (note that the active or retired military discount is not available in TN and NY).

Monthly billing fees are waived if the policy is paid annually.

Embrace Pet Insurance features

Embrace Pet Insurance covers a broad range of conditions and illnesses and also offers optional wellness plan coverage, which you don’t see with other plans.

Extended coverages

The coverage available under Embrace protects your pet in case of accident or illness, although some exclusions do apply — notably, no pre-existing conditions are covered.

Wellness plan

Embrace’s Wellness coverage is not exactly an insurance product; it’s more of a rewards system for your pet’s routine care, grooming, and training costs. It’s an optional add-on.

Exam fees

The Accident and Illness coverage includes coverage for exam fees.

Genetic conditions

Some dogs are more prone to conditions such as hip dysplasia; Embrace will cover these conditions.

Preventable conditions

Even preventable conditions such as heartworm, parasites, or fleas, are covered.

Behavioral conditions

If your pet has behavioral problems (for example, anxiety), you can get coverage through Embrace as long as it isn’t pre-existing. That could be helpful if they need medication.

International coverage

You can even get coverage for your pet while traveling internationally for up to six months.

Flexible payment policies

You don’t want paying for pet insurance to be as painful as a big vet bill. Embrace offers some features that make paying your premium easy.

Waiting period

After you sign up, there is a two-day waiting period for accidents and a 14-day waiting period for illness.

Embrace Pet Insurance also has a 6 month waiting period for orthopedic conditions that applies to dogs only. This can be reduced to 14 days with the completion of an exam and orthopedic report card upon enrollment.

Direct pay

You can elect to have your premiums withdrawn directly from your bank account.

Diminishing deductible

You may have a vanishing deductible with your car insurance. Embrace’s diminishing deductible works in much the same way: an amount taken off your deductible for every period without a claim.

Here’s how it works: Embrace reduces pet parents’ annual deductible by $50.00 each year that they do not receive an accident or illness claim reimbursement back. Pet parents may still submit claims, but if it was applied to their deductible and they did not receive any reimbursement back, Embraces will still reduce their deductible by $50.00. This should be changed to for every period without an accident or illness claim reimbursement.

Cancellation anytime

If Embrace doesn’t work for you, you aren’t locked in. You can cancel anytime.

My experience using Embrace Pet Insurance

I thought the sign-up process on Embrace’s website was really great. I appreciated being able to see every combination of coverage and premium so I could tell what the best value was going to be for me and my dogs. Plus, I did my research and read outside reviews of Embrace’s customer service and their history of paying claims.

When I saw a few cases of dissatisfied customers, Embrace always reached out to the customer directly, followed up on their case, explained their position or policy terms in easy-to-understand language, and shared heartfelt concern for the pets in question.

I felt that their love for animals was clearly evidenced, and I felt comfortable exploring my pet insurance options with them, even when compared to other competitors. My dogs are like my kids, and I don’t want to take a chance when it comes to their health. I also want to make sure that any pet insurance company I work with is going to pay claims fairly and be worth the money.

Who should use Embrace Pet Insurance?

If you worry you’ll find yourself at the vet’s office on a regular basis, pet insurance might be a good move to help you cover the costs.

Owners of pets with breed-specific conditions

If your dog or cat is susceptible to certain conditions because of their breed, you’ll do well with Embrace.

Owners of younger pets

Your premium may rise as your pet gets older; age is a factor in premium costs.

Owners worried about affording a steep, surprise vet bill

If peace of mind is worth more to you than a dollar amount, pet insurance will help you be able to afford the very best care for your fur baby, regardless of price.

Who should not use Embrace Pet Insurance?

You should price out pet insurance very carefully before signing up, especially if you’re watching your dollars. That goes for any pet insurance company, not just Embrace.

Pet owners with a vet emergency fund

If you have savings set aside especially for vet care for your healthy pet, Embrace Pet Insurance may be redundant. You can simply use your stashed cash to cover the occasional vet visit.

Pet owners whose pets have pre-existing conditions

As with any pet insurance (or other insurance for that matter), pre-existing conditions are a difficult topic to navigate. If your cat or dog has pre-existing conditions, they’ll be excluded from your Embrace pet policy, therefore making this pet insurance not as valuable.

Pros & cons

Pros

- Great customer support — Transparent pricing on their website, too.

- Routine care plan — Coverage you’re likely to use.

- Diminishing deductible — A great perk if your pet stays claim-free.

- Quick reimbursement — Embrace is fast to pay claims.

Cons

- Rate increases — You may see rate increases year-over-year.

- Age limit for new enrollments — Once a pet is insured they are insured for life. Embrace does not drop pets or reduce coverage due to age or health status. Accidents covered at any age, but illness stops at 14; this age limit only applies to new enrollments.

The competition

When buying insurance for your furry friend, it pays to shop around. See how Embrace stacks up to competitors to find the best rates for your specific situation.

| Insurance Company | Reimbursement | Annual limit | Deductible |

|---|---|---|---|

| Embrace | 70%-90% | $5,000 – $30,000 | Deductible amount depends on policy |

| Lemonade | 70%-90% | $5,000-$100,000 | $100 – $500 |

| Pumpkin | 90% | $10,000 or $20,000 for dogs; $7,000 or $15,000 for cats | $100-$250 |

| Healthy Paws | Up to 90% | No annual limit | Deductible amount depends on policy |

Embrace Pet Insurance vs Lemonade Pet Insurance

Lemonade Pet Insurance has started to disrupt the pet insurance industry, offering low-cost insurance starting at just $10/month! They offer insurance for both cats and dogs, and they cover everything from diagnostics, to medications, to procedures such as surgeries and emergency care if your pet experiences accidents or illnesses.

Lemonade Pet Insurance offers comprehensive coverage, industry-leading tech, and strong customer service at a great value. Policies are super customizable, so you can build the right policy for your pet without paying for stuff you don’t need.

Lemonade also offers a number of Preventative Care packages that can help cover the cost of wellness exams, heartworm tests, fecal tests, bloodwork, CT scans, ultrasounds, and vaccines.

Lemonade features a quick and easy online application process that doesn’t take long to get a quote. You’ll also get a 10% bundle discount if your home is already insured with Lemonade. And the cherry on top? You also have free access to Chewy’s Connect with a Vet service through the Lemonade app, so there’s no need to call up your vet for simple questions.

» MORE: Read our Lemonade Pet Insurance review

Embrace Pet Insurance vs Pumpkin Pet Insurance

Pumpkin seeks to simplify the pet insurance process, offering a simple plan to help make the best pet care possible for all.

Pumpkin offers top of the line pet insurance for pet owners that want the very best for their pets. The goal of the company is to provide pet insurance with a holistic approach. Instead of only waiting for the worst to happen, Pumpkin takes preventative measures to help your pet stay healthy at all times.

- Affordable preventative care

- Digital reminders

- Another monthly bill

- Not available in every state

Pumpkin was started after its founders took a look at other pet insurance options on the market and found that some were missing one crucial component – preventative care. Pumpkin believes all parents should be able to give their pets medical care if they’re sick or hurt, and preventive care that keeps them healthy throughout their lives. Their optional preventive plan pays for an annual wellness exam, vaccines, and lab tests to detect parasites, and that alone will cover many pets’ annual medical needs.

For annual limits, you have a couple of options depending on the type of pet you have. Pumpkin offers every family a generous 90% reimbursement rate on eligible vet bills: up to an annual coverage limit of $10k or $20k for dogs, and $7k or $15k for cats.

» MORE: Read our Pumpkin Pet Insurance review

Embrace Pet Insurance vs Healthy Paws

Healthy Paws is a top competitor for Embrace Pet Insurance, offering coverage that comes close to Embrace’s, although they don’t cover preventable or behavioral conditions.

Healthy Paws has a simplified pricing structure, too, with no annual cap on benefits, unlike Embrace.

Healthy Paws also does not offer a wellness plan like Embrace does.

Summary

Pet insurance is not the right path for every pet owner. If you’re blessed with a puppy or cat who’s healthy and resilient, you may only need the occasional vet visit, paid for out-of-pocket.

But if you’re worried how you would pay for a catastrophic event such as an accident or surprise illness, Embrace Pet Insurance will ease your mind and buffer your wallet.

Since there is a waiting period before coverage kicks in, it makes sense to sign up as soon as you decide if Embrace Pet Insurance is right for you, so that your sweet pet is covered as soon as possible.