If you’re one of the many 20-somethings looking to reduce their vet visit fees by finding an affordable pet insurance provider, Lemonade Pet Insurance is your answer. They’re one of the best pet insurance companies that’s both affordable and easy to use.

Lemonade Pet Insurance offers comprehensive coverage for your furry friends with all the bells and whistles (if you want them). They also have a variety of policies to choose from, so you can find one that fits your needs and budget.

Lemonade Pet Insurance offers comprehensive coverage, industry-leading tech, and strong customer service at a great value. Policies are super customizable, so you can build the right policy for your pet without paying for stuff you don’t need.

- Superb technology-led experience

- Offers some of the best value

- Instant claims payout

- Free access to Chewy’s Connect with a Vet service

- Not available everywhere

- Older pets may not qualify

- No exotic pet insurance

Pros & Cons of Lemonade Pet Insurance

Pros

- Superb technology — Lemonade’s A to Z user experience sets the bar for others to follow. Have you ever heard of an insurance app scoring 4.9 out of 5 in the App Store?

- Astonishingly low rates — Its premiums can’t be beaten. Lemonade likely offers the best value for your pet’s comprehensive coverage.

- Instant claims payout — After uploading their claim and vet bill through the app, over 40 percent of Lemonade users’ claims are handled instantly.

- Supports charitable causes — Lemonade donates unclaimed premiums to the charities chosen by its customers.

Cons

- Not available everywhere — Currently, Lemonade is ‘only’ available in 37 states + D.C.

- Older pets may not qualify — Lemonade may not cover dogs and cats over certain ages, based on their breed.

- No exotic pet insurance — If you’re looking to insure a pet that isn’t a cat or a dog, you’ll have to look elsewhere.

What Is Lemonade Pet Insurance?

Lemonade launched its pet insurance policies at the perfect time.

There’s a weird trend going on in the Millennial age group. Young folks are spending billions on veterinary care, but at the same time, only 2% of them work with pet insurance companies, according to the New York Times.

This is like every Millennial suddenly buying a car tomorrow, and only 1 in 50 choosing to buy car insurance.

Car insurance is mandatory, but I still think that if it were optional, Millennials and Gen Z are smart enough to buy it. So why aren’t we buying pet insurance?

It’s likely because a) We don’t realize it exists, or b) We don’t think our pet will need enough care to justify paying for insurance premiums.

Both are mistakes. In reality, one in three pets will make an emergency trip to the ER, costing their owners between $800 and $1,500 on average. Emergency surgeries can cost tens of thousands of dollars that, without insurance, you’re 100% on the hook for.

That being said, I know plenty of friends my age who’ve looked at paying $150 per month for this type of insurance and concluded, “I’ll take my chances.” Fair.

But Lemonade doesn’t cost $150 per month. Or even $100.

Try as low as $10.

Yes, that’s how low Lemonade pet insurance policies start. And that’s not for a laughably barebones insurance policy, either. These policies are super customizable, so you can build the right policy for your pet without paying for stuff you don’t need.

What does Lemonade Pet Insurance cover?

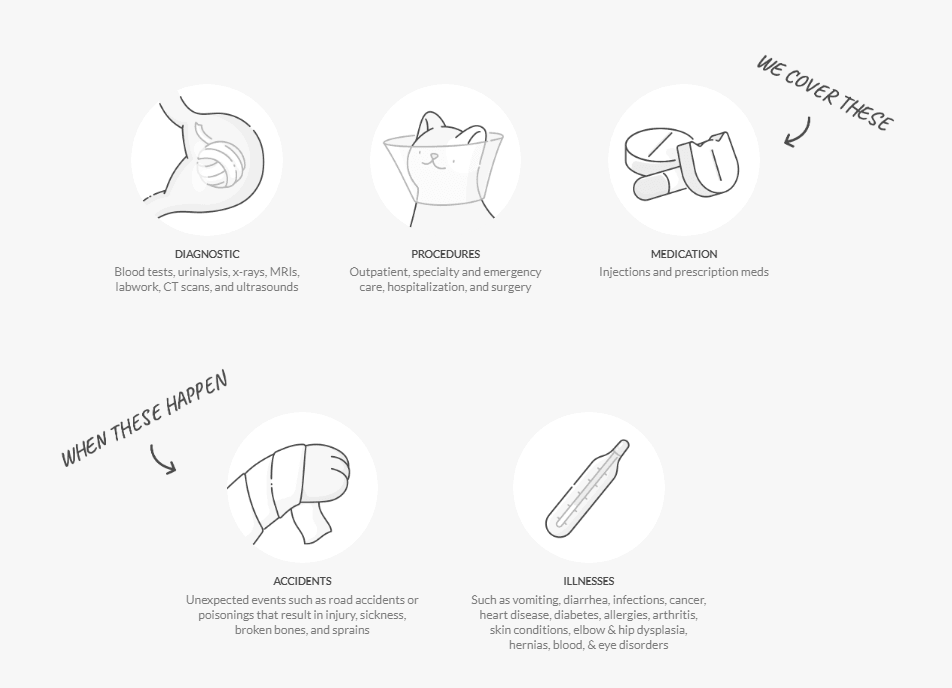

Lemonade offers insurance for both cats and dogs, and here’s a breakdown of what even the most basic policy covers:

- Diagnostics like blood tests, CT scans, and more.

- Procedures including outpatient, inpatient, surgeries, ER, and more.

- Medications including injections at your vet and prescriptions.

- Accidents like poisonings, broken bones, sicknesses, sprains, and more.

- Illnesses like vomiting, diarrhea, and well, I’ll let you read the unpleasant list on Lemonade’s site.

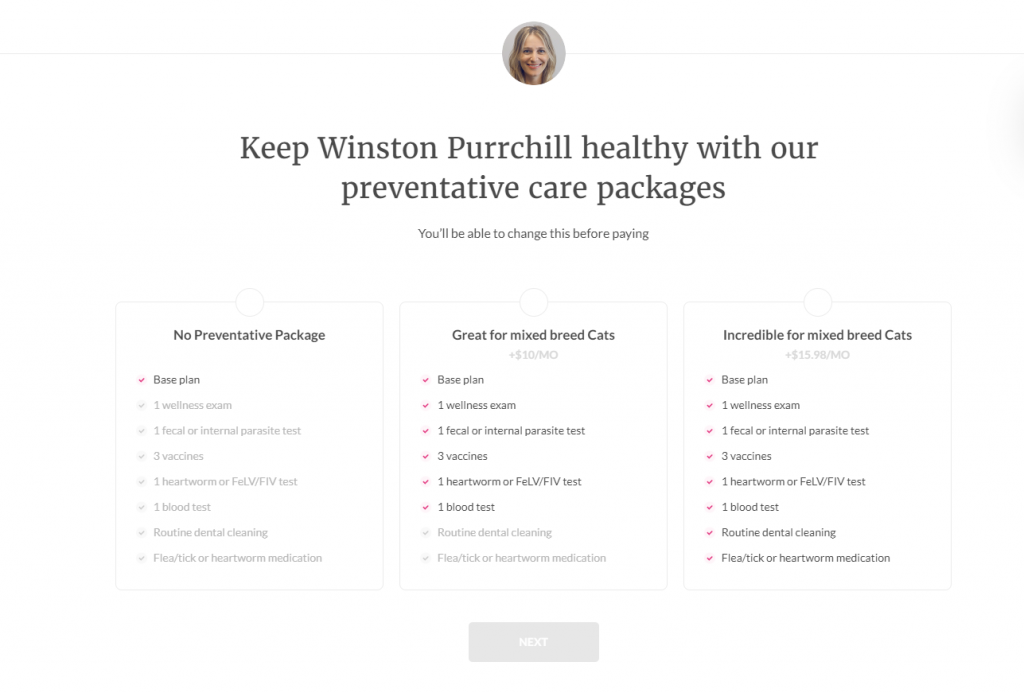

Lemonade also offers optional “Preventative Care packages” that covers more preventative care, like:

- Annual checkups

- Heartworm tests

- Fecal tests

- Bloodwork — which can detect early signs of disease

- Vaccines — including Rabies, DHLPP, Bordetella, and more (three per year)

Lemonade also offers a Preventative Care package specially designed for puppies and kittens, which offers coverage for more vaccines, tests, and vet visits, plus helps cover things like a spay/neuter procedure and microchipping.

How Does Lemonade Pet Insurance work?

Signing Up

Head to Lemonade, and you’ll find a nice, neon pink call to action to start a quote.

Then, Lemonade’s chatbot, “AI Maya,” makes a bold claim: She won’t just give you a quote. She’ll give you an awesome price in mere seconds!

Let’s see if the promise holds.

Maya will ask for your pet’s details following a few basic personal details.

Several cat puns later, Maya begins “tabby”-lating your quote.

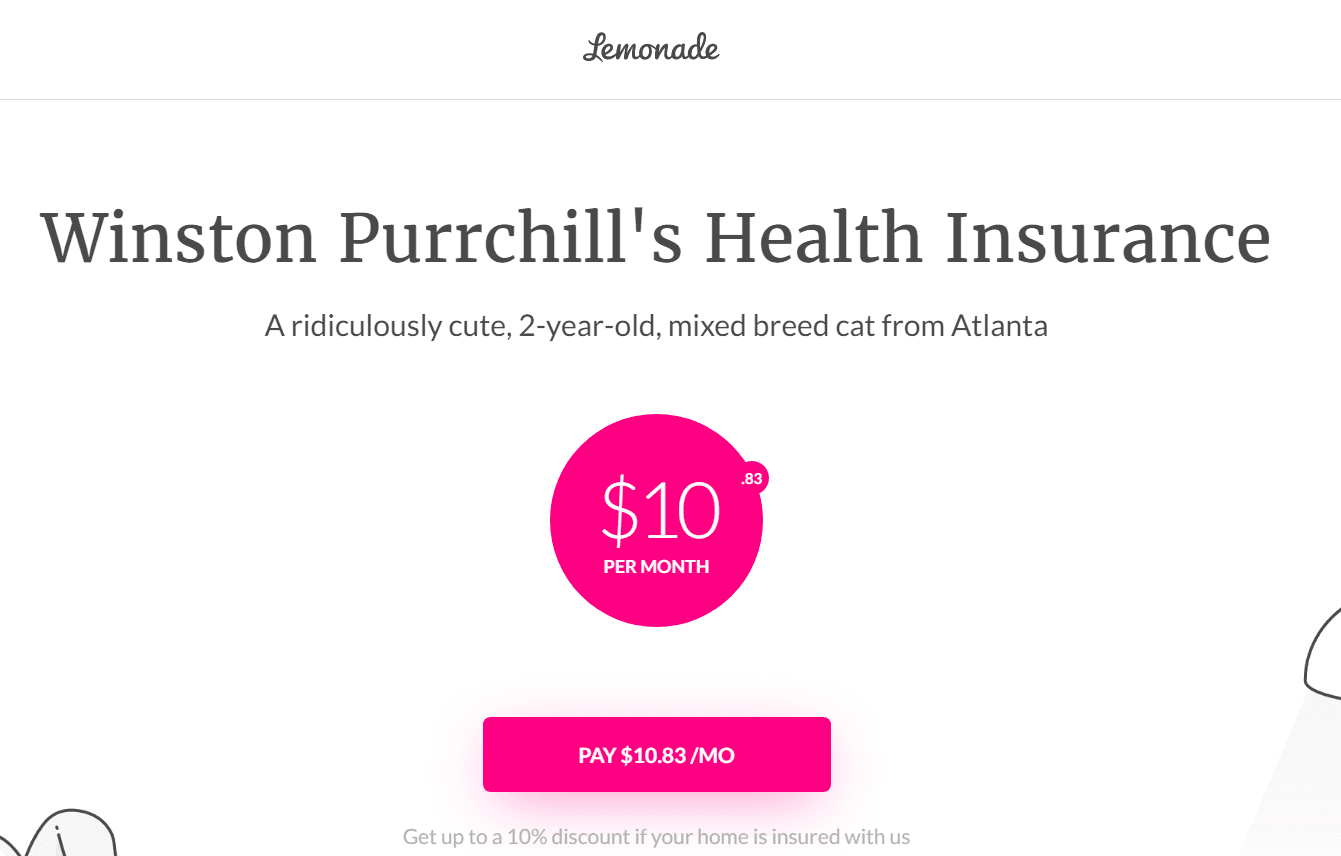

As promised, I got a quote in seconds…and it was indeed an awesome price.

Like a baroque painting or a balcony view of Tuscany, I took a moment to marvel at the staggeringly low price Lemonade is asking for pet insurance. I review many insurance companies, and you should know that before Lemonade came along, the industry average was closer to $50.

A colleague at another finance site wrote that “Lemonade’s competitors should be nervous.”

You’re probably wondering how Lemonade is so affordable, and I’ll indeed get into that later. For now, let’s continue the quote. At this point, Lemonade reminds you what’s covered in your basic quote and displays optional add ons.

Scrolling down, I see that the preventative care-focused wellness package mentioned above is just a $10 per month add-on (for a cat in Atlanta). I recommend this since it includes the annual checkup, rarely less than $120 anyway.

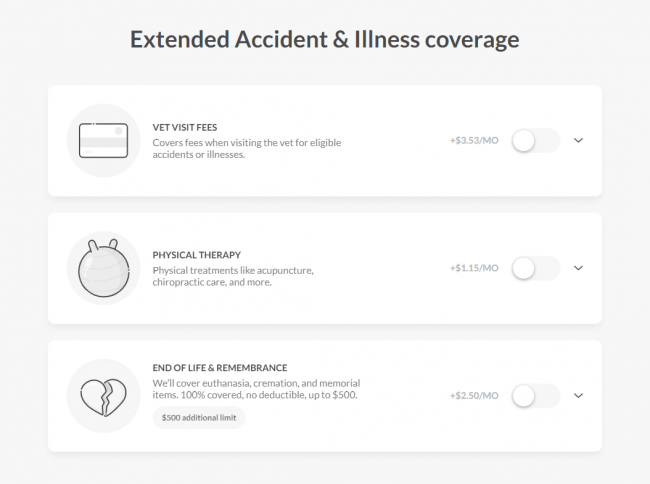

And finally, for less than the cost of a large fry, you can get vet visit fees, physical therapy, dental illness, behavioral conditions, and end-of-life and remembrance covered.

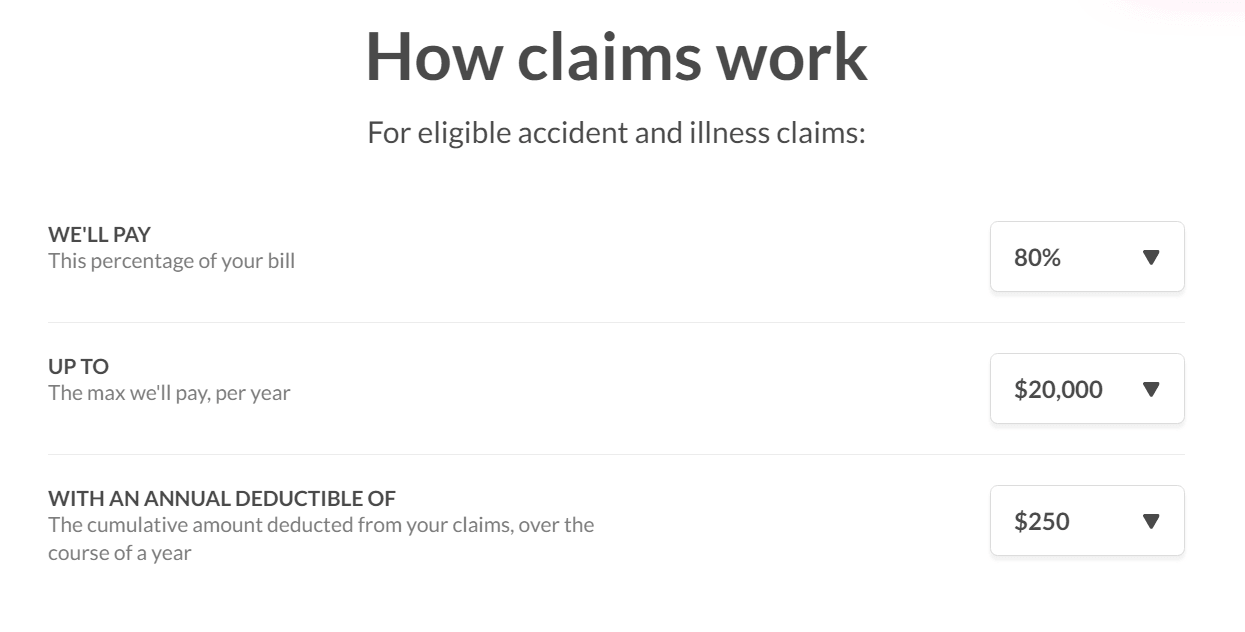

For $10 a month, is your deductible like $7,000? Nope! Lemonade defaults you to a midrange option, with 80% reimbursement, a $20,000 annual limit, and a $250 annual deductible.

Playing with the dropdown menus, I created a barebones pet insurance policy with 70% reimbursement, a $5,000 annual limit, and a $500 deductible. This brought the monthly premiums down $0.83 to $10 flat.

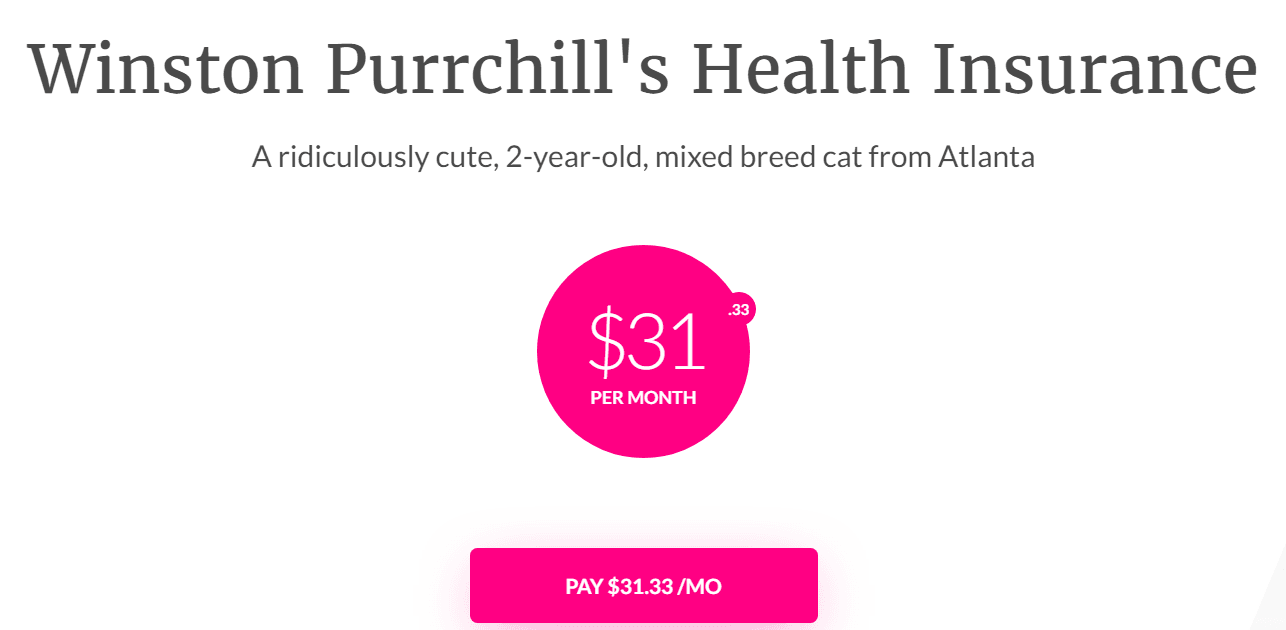

That covers a “silver” and “bronze” plan, if you will, so what does a “platinum” plan look like? I maxed out everything and made it rain pet insurance coverage to find out. My “platinum plan” for Winston Purrchill included:

- Base coverage

- Preventative Care Package

- Extended Accident and Illness coverage

- $100 deductible

- 90% reimbursement

- An eye-watering, unheard-of $100,000 annual limit

The price increased to just $31.33 per month for all that jazz. Considering most competitors start their policies at $30 per month, this rate is extraordinary.

When you’re ready to purchase, enter your payment information, and presto! Download the app via the App or Play Store, upload your documents and bills to get paid, and that’s it.

Lemonade Pet Insurance waiting period

Keep in mind that you’re not immediately covered as soon as you pay. As with many forms of medical insurance, there’s a brief waiting period before coverage activates. Here’s how this breaks down:

- No accident waiting times*

- 14 days for illness*

- 30 days for orthopedic conditions*

Lemonade’s waiting period page does a great job of explaining why waiting periods, in general, are essential for insurance companies. Without waiting periods, somebody could take their dog to the ER, buy insurance in the waiting room for $10, and then bill Lemonade for $10,000 when their dog comes out. Then, if they’re malevolent, they can cancel their policy.

If waiting periods didn’t exist, insurance companies wouldn’t either.

Waiting periods do not apply to Preventative Care.

How to file a claim with Lemonade Pet Insurance

Filing claims with Lemonade works a little differently, too. Because so much of Lemonade’s business practice is AI-driven, you often don’t always need to wait for a human to review your claim before getting paid. About 40 percent of Lemonade Pet claims are handled instantly after you upload your vet bill. It’s not surprising, then, that Lemonade’s app scores 4.9 out of 5 stars in both the App Store and Google Play Store.

Lemonade Pet Insurance cost

For a healthy young pet, Lemonade can cost as little as $10 for good coverage and $30ish for excellent coverage, including preventative care.

How about a sick pet?

I went through the quote process for an unhealthy eight-year-old mixed-breed dog weighing 60 pounds to investigate. Maya asked me a lot of questions about my dog’s health.

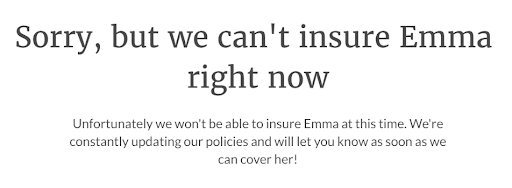

If you’re wondering why Lemonade is so inexpensive, here’s a clue:

My imaginary pup Emma is too old/unhealthy/overweight to be insured. Even though Lemonade wouldn’t cover any of her preexisting conditions, they still couldn’t write her a policy for any price.

I get it. It’s the same reason some auto insurance companies won’t insure reckless drivers; they file too many claims and are too expensive. In the pet world, it may seem indelicate, but by excluding older, less healthy pets, Lemonade can afford to keep rates extremely low for everyone else who’s less likely to submit regular claims.

So, in summary, Lemonade costs the following:

- Between $10 and $30 for a healthy, young pet.

- Between $30 and $50 for an unhealthy, middle-aged pet.

Lemonade may not insure older pets, but it’s worth grabbing a quote to be sure.

What are Lemonade’s best features?

Don’t mistake “affordable” for “barebones.” Lemonade’s pet insurance policies have plenty of tech and conveniences to offer the modern pet owner, such as:

The Lemonade app

How can an insurance app rate higher than Google Maps?

Lemonade scores an impressive 4.9 stars out of 5 from tens of thousands of ratings in both the Google Play store and the App Store.

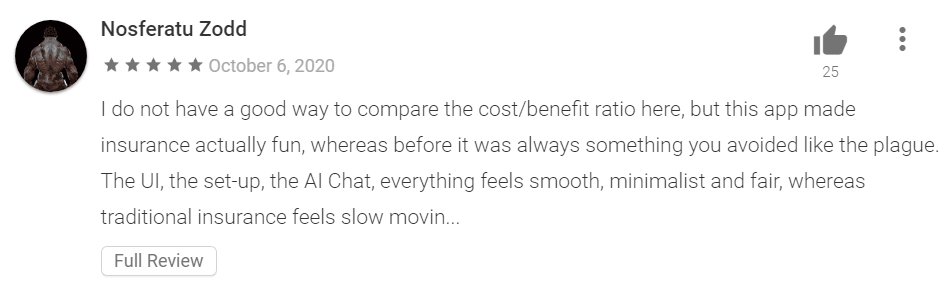

One user called…umm…Nosferatu Zodd gave the Lemonade app five stars, praising its minimalism, UI design, and ease of use. According to Nosferatu, the app is so easy to use that it “makes insurance fun.”

I’m usually pretty skeptical when apps rate higher than 4.7 stars since it often means that the company has manipulated the scores. But Lemonade’s high scores seem warranted. Users report deep satisfaction with the app’s ability to adjust coverage, upload files, and receive instant reimbursement for claims.

Breadth of coverage

Lemonade’s coverage is affordable yet comprehensive. For as little as $30 a month, you can get 90% reimbursement, up to $100,000 per year, with a $100 annual deductible. These can include additional packages and add-ons to cover everything from regular checkups to aquatic therapy and medications, vaccines, and more.

Bundle discount

This feature is relatively common among pet insurance companies, but it’s worth mentioning nonetheless. Lemonade offers a discount if you insure your home or car with Lemonade.

High annual reimbursement limits

If you’re worried that your pet will one day bankrupt you (and it’s possible, since vet procedures can cost $15,000) with vet fees, you can opt for Lemonade’s maximum annual payout limit of $100,000.

It doesn’t cost that much extra, either; the jump from $5,000 to $100,000 costs less than $10 per month for most pets. Depending on your situation and personality, that extra $120 annually might be worth the peace of mind that your furball won’t cost you as much as a new Mercedes.

Award-winning service

Lemonade has fantastic service. Period. And this includes zero-hassle, super-fast claim payment, and simple, jargon-free, and intuitive policies.

Charitable donations

At the end of your policy term, Lemonade doesn’t just pocket all of your premiums. They donate unclaimed premiums and donate it to the nonprofit(s) chosen by the Lemonade community.

My experience researching Lemonade Pet Insurance

I highlighted Lemonade’s charitable donations above and in the intro because I admire how an insurance provider creates such value for all of its stakeholders.

- They benefit pet owners by providing affordable insurance and peace of mind.

- They benefit pets by encouraging higher-quality, higher-frequency care.

- Finally, they benefit charities through cash donations.

I think Lemonade’s trifecta of minimalism, mindfulness, and technology sets a strong example for others in the industry to follow. Sure, their low rates are undeniably impressive, but I think this aspect of Lemonade’s practice deserves praise also.

The only disappointing part I found in my research is that owners of aging and exotic pets can’t take advantage of Lemonade’s offerings.

However, Lemonade is still a superb choice for many pet owners for the time being. In writing this review, I’ve recommended them to several people who’d previously considered pet insurance companies to be too expensive — $10 a month is pretty affordable for peace of mind. For that reason, purchasing pet insurance through Lemonade is practically a no-brainer.

One other thing to remember is that Lemonade also offers different types of insurance, such as Lemonade Renters Insurance. For example, if you end up getting renters insurance through Lemonade, you can likely get a discount on a pet insurance policy (bundling them).

Who should get Lemonade?

Lemonade is the right choice for most cat and dog owners, but exceptions exist. Here’s who should consider getting a quote:

Owners of recently adopted pets

The first year of dog or cat ownership can be expensive, and much of that can potentially be offset by a policy with Lemonade for as low as $10 a month.

Owners of younger cats and dogs

Lemonade’s rates are pretty unbeatable, so if they can offer you a quote, it’s probably the best you’ll see.

However, that’s a big “if.” Lemonade doesn’t seem ready to cover pets in their golden years, which is fair since it keeps rates low for everyone else.

Pet owners on a budget

Lemonade’s rates are almost unbelievably low for the amount of coverage. For less than the cost of Netflix, you can get most of your vet bills covered, planned or unplanned, saving hundreds and sleeping better at night.

Who should skip Lemonade?

Objectively speaking, Lemonade isn’t a fit for all situations.

Pets with preexisting conditions

Lemonade will still cover pets with preexisting conditions, but not any expenses arising out of those preexisting conditions (this is the industry standard). Does that make sense?

For example, any provider (not just Lemonade) may reject your claim for a sprained ankle if your pet has orthopedic issues or obesity listed as a preexisting condition.

Owners of exotic pets

Currently, Lemonade only covers cats and dogs. Owners of more exotic animals will need to look elsewhere for coverage.

The pet insurance competition

| Lemonade Pet Insurance | Embrace Pet Insurance | Pumpkin Pet Insurance | |

|---|---|---|---|

| Animals covered | Cats and dogs | Cats and dogs | Cats and dogs |

| Coverage options | Diagnostics, medications, accidents, illnesses, annual checkups, heartworm tests, fecal tests, bloodwork, vaccines, etc. | Accidents, illnesses, breed-specific conditions, alternative therapies, diagnostic testing, ER & specialist care, prescription drugs, cancer treatment, behavioral therapy, chronic conditions, consultations/exam fees | Exam fees for accidents & illnesses, dental illnesses, behavioral illnesses, alternative therapies, microchipping |

| Preexisting conditions covered? | Yes, for curable conditions | Yes, for “curable” conditions | No. However, this doesn’t mean the condition can’t be covered in the future if the condition is curable. An injury or illness that is curable, cured, and free of treatment and symptoms for 180 days will no longer be regarded as preexisting, with the exception of knee and ligament conditions. |

Lemonade Pet Insurance vs Embrace

As its name implies, Embrace is one of the pet insurance providers that welcomes pets with preexisting conditions.

Now, it’s worth reiterating that most insurance companies (including Lemonade) will insure pets with preexisting conditions; they won’t cover any expenses arising out of those preexisting conditions.

Embrace works a little differently. In its own words, “Embrace is one of the few companies that distinguish between curable and incurable preexisting conditions.” “Curable” preexisting conditions include, but are not limited to, respiratory infections, urinary tract/bladder infections, vomiting, diarrhea, and other gastrointestinal disorders.

If your pet has one of these preexisting conditions but goes 12 months without a symptom, Embrace will cover it moving forward. This can be a massive money-saver for pet parents worried that their fur baby will have one of these preexisting conditions as they age.

Speaking of, another perk to Embrace is lifetime coverage. As your pet ages, their vet bills will increase exponentially. That’s when most insurance companies will not let you renew, but Embrace won’t give you the boot. So if you have a pet beginning to age, purchasing insurance with Embrace could be seen as an investment as they reach their twilight years.

Lemonade Pet Insurance vs Pumpkin

Pumpkin is one of the newer pet insurance providers on the scene. Although the company launched early in 2020, it has made a great impression.

Pumpkin offers top of the line pet insurance for pet owners that want the very best for their pets. The goal of the company is to provide pet insurance with a holistic approach. Instead of only waiting for the worst to happen, Pumpkin takes preventative measures to help your pet stay healthy at all times.

- Affordable preventative care

- Digital reminders

- Another monthly bill

- Not available in every state

The agency’s core value is to provide affordable preventative care options for pets and extensive coverage for accidents and illnesses. With Pumpkin’s optional, add-on preventative care pack, you’ll find coverage for an annual wellness exam, vaccines, and key lab tests to keep your pet healthy. These benefits are covered with a 100% reimbursement rate, meaning you won’t be out a single penny for those preventative care benefits.

Toss in great coverage, technology, and customer service, and Pumpkin offers a lot of value to the pet owner who can’t get coverage anywhere else.

» MORE: Read our Pumpkin Pet Insurance review

Summary: Is Lemonade Pet Insurance good?

My final thoughts on Lemonade Pet Insurance are: If they offer coverage for your pet, get it.

A good pet parent should be paying around $300 annually for preventative care anyway, so you might as well purchase a Lemonade policy for $10 to $30 a month that covers most of those routine expenses (and protects you from the big ones).

» Get a quote from Lemonade Pet Insurance

FAQs about Lemonade Pet Insurance

Where is Lemonade Pet Insurance accepted?

Lemonade pet insurance is accepted at any vet in the United States, provided the vet is licensed in its operating state.

What states does Lemonade Pet Insurance cover?

Lemonade pet insurance is available in the following 37 states + Washington, D.C.:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Illinois, Indiana, Iowa, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Tennessee, Texas, Utah, Virginia, Washington, and Wisconsin.

Does Lemonade Pet Insurance cover dental?

Dental x-rays, anesthesia, polishing, and other routine dental care is available via Lemonade’s Preventative+ package. Dental accidents are covered by a base accident and illness policy, and there is also a dental illness add-on for even more coverage.

Does Lemonade Pet Insurance cover neutering?

Lemonade offers a preventative policy for puppies and kittens under two years old. It includes coverage for neutering and spaying.