Online banking has taken off in recent years. Now, banks battle to offer the best rewards program with the fewest fees. You’ll find that many of these online banks end up looking very similar, and you may be wondering if there’s someone more competitive out there.

The answer is a resounding yes. Aspiration is focusing on making an environmental impact, while still offering you a solid financial option. Think of it as “banking with a heart.”

Aspiration gives you a wide variety of benefits, from cash back on purchases with purpose-driven merchants to fee-free Spend & Save accounts. You’ll also earn up to 5.00% APY with Aspiration. The result is an account that’s good for you and the many causes you believe in.

What is Aspiration?

Founded in 2013, Aspiration the leading fintech “neobank” focusing on socially conscious and sustainable money. With more than 1.8 million fans, Aspiration isn’t just making a social impact, it’s making an impact in the financial industry.

Two plans: Standard and Aspiration Plus

There are two plans to choose from, with the Standard plan allowing you to pay whatever you think is fair, even if that’s $0 per month!

If you opt for Aspiration Plus, the Plus plan requires a $7.99/month fee (or $5.99/month when you pay annually), but the perks you get may more than make up for this fee.

What are the perks for Aspiration Plus?

- Earn up to 5.00% APY (Variable).

- Earn up to 10% cash-back with purchases you make with Conscience Coalition retailers (companies doing the ‘right thing’ as part of their business model)

- Unlimited fee-free withdrawals at Aspiration’s network of over $55,000 ATMs.

- One out-of-network ATM reimbursement monthly

- Aspiration Planet Protection feature which carbon-offsets your gas purchases

- A recycled ocean plastic debit card with Aspiration Plus

- *Bonus perk – knowledge that Aspiration has committed to donating 10% of every earned dollar to charity and options to plant trees

Arguably so, the second year, you’ll have to consider whether paying the monthly fee is still worthwhile for you. For many users who are committed to Aspiration as a company and eager to support them and get cash back while all while supporting merchants who are working to make a positive change in the world, it may still be a for sure ‘yes’ to continue on with Aspiration Plus. For others, the monthly/annual total cost may become a deal-breaker.

How does Aspiration work?

To get started, go to the Aspiration website and click “Get Started”. You can alternately input your email address on that page and choose “Get Started.”

If you choose “Get Started” without inputting your email address, you’ll be prompted for an email address in the next step.

Next, you’ll be asked to set up a password. It needs to have at least eight characters and include a number.

Aspiration will then gather some personal information on you, including your date of birth.

You’ll need to input your Social Security number. To make things easier, click “Show” while you’re inputting it, then “Hide” to disguise it before you click “Next.”

In the next step, you can opt into Aspiration’s Plant Your Change program. If you leave it enabled, all purchases made with your debit card will be rounded up to the nearest dollar. Aspiration will use that extra change to plant trees to offset deforestation. You can opt-out by clicking on the button and toggling it to the disabled position.

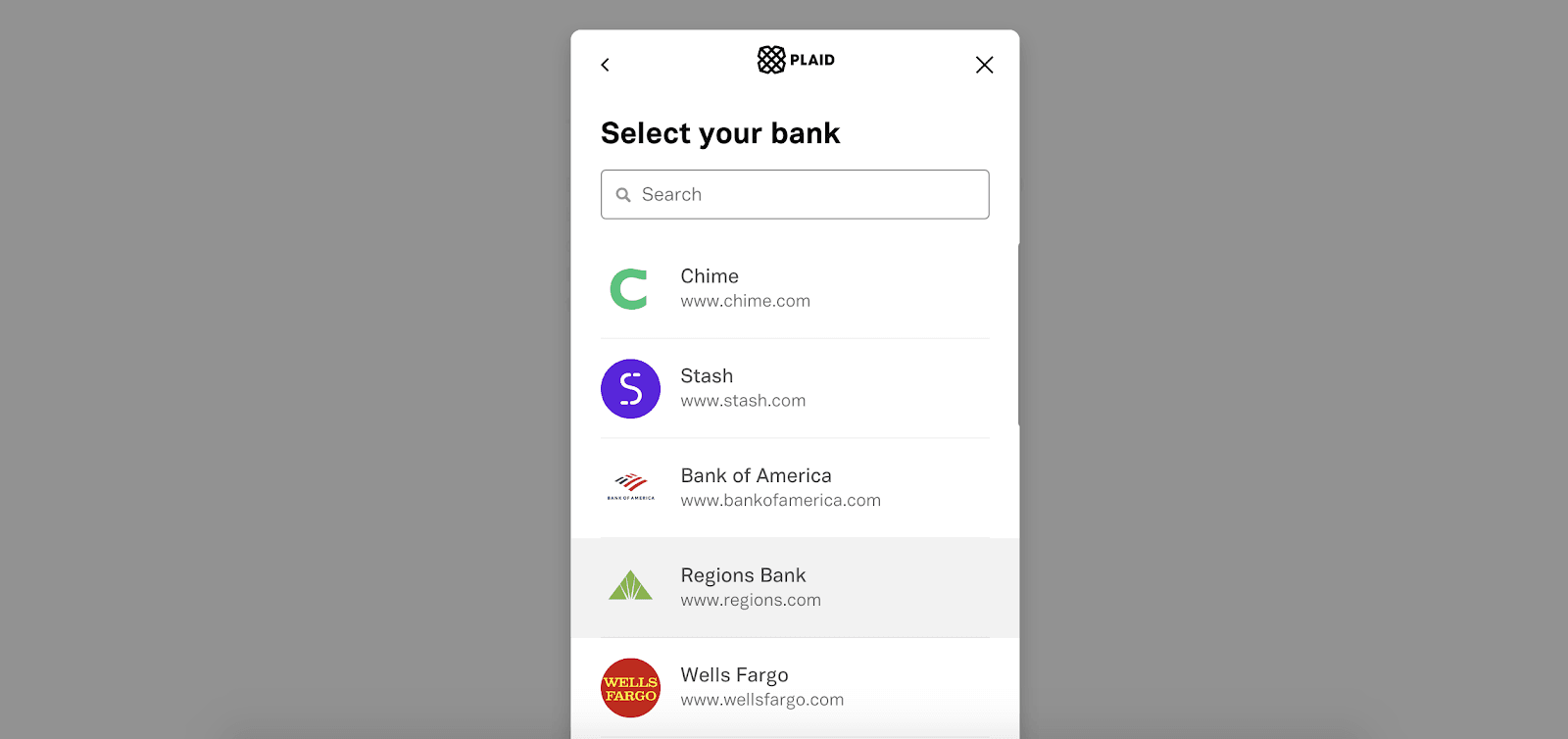

Next up, you’ll be prompted to link to your bank account. This will make it easy to transfer funds in and out of your Aspiration account. You can leave the other account active or move all your money to Aspiration and later close your other account.

You’ll be presented with a list of some of the most popular banks. Mine was listed, so all I had to do was click, but you can enter the name of your bank in the search box to link it.

Once you’ve clicked on your bank, you’ll be prompted to input your banking ID and password. Aspiration will take care of the rest.

Once you’ve completed the application process, you can sign in on the main page and go directly to your dashboard, where you can view your account balances and manage your funds.

Pricing for Aspiration

Aspiration has two options, Standard and Plus. The Standard account empowers you to choose your own fees, is fossil-fuel free, and will give you plenty of perks, including free access to more than 55,000 ATMs worldwide and the option to plant a tree with every purchase.

You’ll get up 3% to 5% cash back on purchases from merchants who are part of the Conscience Coalition program. This also includes access to your personal impact score, which can help you see how your own purchases are making a difference. Although you can get this account for free, Aspiration does invite members to pay a little something if they feel compelled to.

If you don’t mind a monthly fee, there’s Aspiration Plus, which costs $7.99 a month, or $5.99 a month if you pay annually. This gives you all the benefits in the basic plan plus the opportunity to earn up to 10% cash back on Conscience Coalition purchases. On the Plus plan, you’ll earn up to 5.00% APY (Variable) on your savings account balance.

In addition to free transactions at in-network ATMs, Plus members can use their card at one out-of-network ATM each month and have the fees reimbursed.

Aspiration features

Aspiration has plenty of features that set it apart from other lenders. Here are a few that stand out.

Choose the plan that works for you

Aspiration offers two competitive plans – one allows you to pay whatever fee you think is fair, the Plus account costs $7.99 a month, or $5.99 a month if you pay annually. You can choose whichever plan works for your budget. To give you a better sense of which may work for you, here’s a quick comparison:

| Aspiration’s fee-free, no interest Spend and Save account | Aspiration Plus | |

|---|---|---|

| Cost | You’ll pay whatever you this is fair (even if that’s $0) | $7.99/month (or $5.99/month if you pay annually) |

| Cash back | 3-5% cash back on Conscience Coalition purchases | Up to 10% cash back on Conscience Coalition purchases |

| ATMs | 55,000 free in-network ATMs | 55,000 free in-network ATMs; one out-of-network ATM reimbursement monthly |

| APY | None | Up to 5.00% |

Mission-focused pricing

Yes, you can use your Aspiration account for free. But what’s unique about this company is that they invite you to “pay what is fair.” That means if you want to pay $1 a month, you can. This pricing model matches the rest of the company’s mission-centered approach to banking.

You can upgrade to Aspiration Plus for $7.99 a month, or $5.99 a month if you pay annually.

Cash back

With the Conscience Coalition, Aspiration seeks out companies that are mission-based for their cash back rewards. With the free plan, you’ll earn up to 3% to 5% when you buy from purpose-driven partners like Warby Parker and Blue Apron.

Aspiration Plus members can earn up to 10% with select Conscious Coalition members. Every Aspiration account earns everyday cashback of up to 0.5% at some of the most popular merchants, including Walmart, Target, and CVS.

No additional fees

Whether you’re on the free or Plus plan, you won’t run into any surprise fees. You can withdraw cash at any AllPoint ATM, with 55,000 locations across the world. AllPoint ATMs can be found inside retailers like Target, CVS, Walgreens, Kroger, and Safeway.

Just for comparison’s sake, Aspiration’s ATM network is over three times as large as those owned by Chase, Bank of America, and Wells Fargo combined.

Plus members can also use one out-of-network ATM per month with fees fully reimbursed.

Reforestation efforts

Aspiration enables its customers to plant trees for every purchase made using one of their debit cards. If you want to participate in this program, you’ll opt-in and every time you make a purchase, that spare change will go toward Aspiration’s reforestation efforts.

Philanthropic mindset

What sets Aspiration apart overall is its eye toward philanthropy. Aspiration pledges to give 10% of its earnings to causes it believes in. But the company’s setup encourages members to purchase with a purpose. You’ll be able to log in at any time and see your personal impact score, which shows how you’re doing toward your goal of making an impact.

FDIC-insured

No matter which plan you have with Aspiration, your money is FDIC-insured up to $2.46 million per depositor by being swept to partner banks. Visit fdic.gov and aspiration.com/program-banks for more info.

Other financial products

In addition to the Spend & Save accounts Aspiration offers, they also provide retirement and investing products.

Their investing option requires a $10 minimum opening deposit and comes with professionally managed funds that are 100% fossil fuel-free.

Aspiration also offers IRAs that require a $10 minimum opening deposit. Like everything else Aspiration does, they want to help you save, while also saving the planet. That’s why they invest your traditional IRA in sustainable companies.

My experience researching Aspiration

I make every effort I can to go green. I reduce, reuse, and recycle as much as possible, trying to keep single-use plastics off my grocery list each week. But it still feels like no matter what I do, it’s not quite enough.

That’s why I love Aspiration, though. When combined with all the efforts I’m making toward reducing my carbon footprint, their mission-focused features could make me far more aware of the purchases I’m making each day. Over time, I could see adjusting my spending habits so that I’m supporting businesses that are philanthropic in nature. Not only does Aspiration plant trees with each swipe, but they also invest in carbon offsets for all fuel purchases.

But what I really love is the extra cash back they offer when you buy from members of their Conscience Coalition. Some of these are brands that I’d patronize anyway, so it’s comforting to know they’re mission-focused.

All of those things are great, but it comes down to fees and rewards. I don’t think I’d get enough out of the Plus plan to merit $7.99 a month, so I love that the Standard, no interest Spend and Save account is free. It also says a lot about Aspiration that they let you pay what you want. Aspiration’s cash back, welcome bonuses, and focus on making a difference are all compelling reasons to switch.

Who is Aspiration best for?

Mission-focused consumers

Those who are concerned about the environment or are charitable in general will benefit most from Aspiration. First, there’s the fact that every enabled swipe means another tree is planted. Second, Aspiration Plus’ Planet Protection™ feature tallies up the carbon output of all of your gas purchases, and then automatically buys offsets to help counter the climate impact.

And finally, there’s the fact that your purchases from mission-purpose brands earn you cash back.

But Aspiration also maintains a personal impact score to help motivate you to steer your purchases toward purpose-driven businesses.

Frequent debit users

Many of Aspiration’s benefits come from using your debit card. This includes the cash back rewards and round-ups to fight deforestation efforts. If most of your purchases are by debit, you’ll maximize your perks.

Flexible spenders

Although Aspiration gives you everyday 0.5% cash back at popular retailers like Target and Walmart, for the bigger rewards, you’ll need to shop merchants in the Conscience Coalition. If you’re flexible on your purchases, you can save while also making an impact.

Heavy savers

If you’re an Aspiration Plus member, you’ll get up to 5.00% APY (Variable) on your savings account balance. Those who tend to keep most of their money in savings will benefit more from this perk.

Who shouldn’t use Aspiration?

Frequent cash users

If you tend to drop by an ATM on the regular, you may do better with an account that allows unlimited fee-free out-of-network ATM uses. It may help to check the ATM locator on Allpoint’s site to see if there’s an in-network ATM located near you.

Those wanting unlimited cash back

Aspiration offers cash back at select merchants. If you’re looking for an account that issues cash back on every purchase, there are other accounts that will give you those benefits. You just won’t get the benefits of making an impact that Aspiration gives you.

Pros & cons

Pros

- Fee-free option — You can pay what you think is fair for the Standard, no interest Spend and Save account.

- Cash back on purchases — You’ll earn 0.5% back at retailers like Walmart and Target and as much as 10% back with merchants that are part of the Conscience Coalition.

- Dedication to philanthropy — Not only does Aspiration encourage you to purchase from purpose-driven brands, but the company also pledges to donate 10% of its earnings to charitable causes.

- High APY option — With the Aspiration Plus plan, you’ll earn a high Annual Percentage Yield (APY), earning money just for keeping your money with Aspiration.

Cons

- Some perks aren’t free — To get higher cash back rates and a high APY, you’ll need to upgrade to the paid plan, Aspiration Plus.

- No local branches — As with many online lenders, your transactions will be limited to your online account and what you can do at an ATM.

The competition

If you are looking for an alternative to Aspiration, here are two others to consider.

Aspiration vs Chime®

If financial health is your goal, Chime® is a great option to consider. You’ll earn a 2.00% APY on your savings balance.

Chime has many of the features typically found with online accounts.

» MORE: Read our full Chime review

Aspiration vs LendingClub Bank

Frequent cash users will love LendingClub’s unlimited ATM rebates. You can use any ATM at any time and LendingClub will cover any third-party fees you incur. For a limited time, you’ll earn an unlimited 1% cash back on all debit card purchases regardless of the merchant.

Another great benefit you’ll get with LendingClub is interest on your checking account. With a Rewards Checking account, you’ll earn on savings. This is in addition to no monthly maintenance fees.

» MORE: Read our full LendingClub Bank review

Summary

Aspiration gives you the services you need while also helping you make a strong social impact. With cash back at purpose-driven merchants and fee-free services, you’ll get everything you need to pay bills, save money, and make the world a little better.