If you’re saving up for a new car, will an automaker’s bespoke rewards card help you get there faster?

It certainly seems that way; the My GM Rewards Card™ offers a whopping 4x back on all purchases, plus 7x back on GM services, parts, and accessories.

Even if you don’t have a Camaro or a Cadillac to service yet, 4x is still a heckuva whole lot. Plus, the card has no annual fee, a $150 sign-up bonus, and up to $150 worth of annual statement credits.

So what’s the catch? Let’s investigate.

Key Features

- Earn rates: 7x points per $1 spent on select GM purchases; 4x points per $1 spent on everything else

- Welcome offer: Earn 15,000 bonus points after you spend $1,000 in your first three months – that’s $150 in value when you redeem with GM

- Redemption value: Points worth $0.01 each when applied to GM products, vehicles, and services; $0.0025 each when redeemed for gift cards

- Statement credits and extra discounts: Up to $150 in annual statement credits and discounts for fuel and vehicle detailing

- Extra benefits: Cardholders automatically qualify for My GM Rewards Gold Tier status and World Elite Mastercard benefits

- Intro APR: .

- Annual fee:

In-Depth Analysis

Earn Rates

Easily the most eye-popping feature of the My GM Rewards Card™ is the ability to earn at least 4x points on everything you buy.

Yep; whether it’s gas, groceries, even a Ford Mustang keychain — doesn’t matter, you’ll earn 4x points on it.

On top of that, you’ll earn an impressive 7x points on all eligible GM purchases, including services, parts and accessories purchased at participating My GM Rewards Card™ dealerships or online.

I couldn’t find a list of “participating” dealerships online, but not to fear — I called around, and three separate GM sales managers told me they’ve never heard of a GM dealer not participating in My GM Rewards.

Redemptions

My GM Rewards points can only be redeemed for their full value ($0.01 each) when applied to a GM purchase. That list includes:

- Purchase or lease of an eligible new GM vehicle

- Purchase of an eligible Certified Pre-Owned GM vehicle

- GM Certified Service, GM Accessories, or GM Genuine Parts and ACDelco parts sold at a participating GM dealership

- Select OnStar®, SiriusXM, and GM Connected Services Plans

- GM Vehicle Protection Plans

There are also limits on how many points you can convert within each category in a single calendar year.

Lastly, outside of GM products, you can convert points to gift cards — but at a loss of 75% of their maximum value ($0.025 each).

Here’s’ a full breakdown:

| Redemption option | Redemption value | Maximum redemption amount | Exceptions |

|---|---|---|---|

| Purchase or lease of an eligible new GM vehicle | $0.01 | Unlimited | Fleet vehicles, GM Employee Discounts, GM Company-Owned Vehicle Discount, Supplier Discount, some other offers |

| Purchase of an eligible Certified Pre-Owned GM vehicle | $0.01 | $1,000 per calendar year | Fleet vehicles, GM Employee Discounts, GM Company-Owned Vehicle Discount, Supplier Discount, some other offers |

| Certified GM services, parts, and accessories; OnStar and Connected Service plans and SiriusXM subscriptions; Vehicle Protection Plans | $0.01 | $250 per calendar year | None listed |

| Gift cards to various stores, restaurants, and merchants | $0.0025 | $250 per calendar year | None listed |

If you want to get any meaningful value out of your My GM Rewards points, you can essentially only redeem them for GM products. Even then, there are low ceilings on how much you can redeem at once.

Fuel/EV Statement Credits and Vehicle Detailing Discount

The card starts to look a lot better when you factor in some bonus statement credits.

For starters, there are two ways you can get the $100 “fuel” statement credit:

- Spend $1,500 on gas in a calendar year, or

- As the owner of a GM electric vehicle, use your My GM Rewards Card™ to pay for six months of electric bills.

A $100 fuel credit is quite a substantial draw for those who meet either of the above conditions. If you spend $1,500 on gas in a given year, the fuel credit is equivalent to nearly 7% cash back on that spending. That’s very competitive with the best gas cards out there.

The My GM Rewards Card™ also includes a $50 “allowance” toward a vehicle detailing service at a participating GM dealer. For reference, basic washes and details tend to start at $25 and $125, respectively.

Fees and Interest Rates

My GM Rewards Card™ offers and charges no annual fee.

It also charges no fees for transfers, balance transfers, foreign transactions, or cash advances.

In fact, about the only fee this card charges beyond its regular, variable APR is a late payment fee of up to $40.

For more cards that help you avoid fees, check out our lists of the Best No Annual Fee Credit Cards and the Best Credit Cards For International Travel.

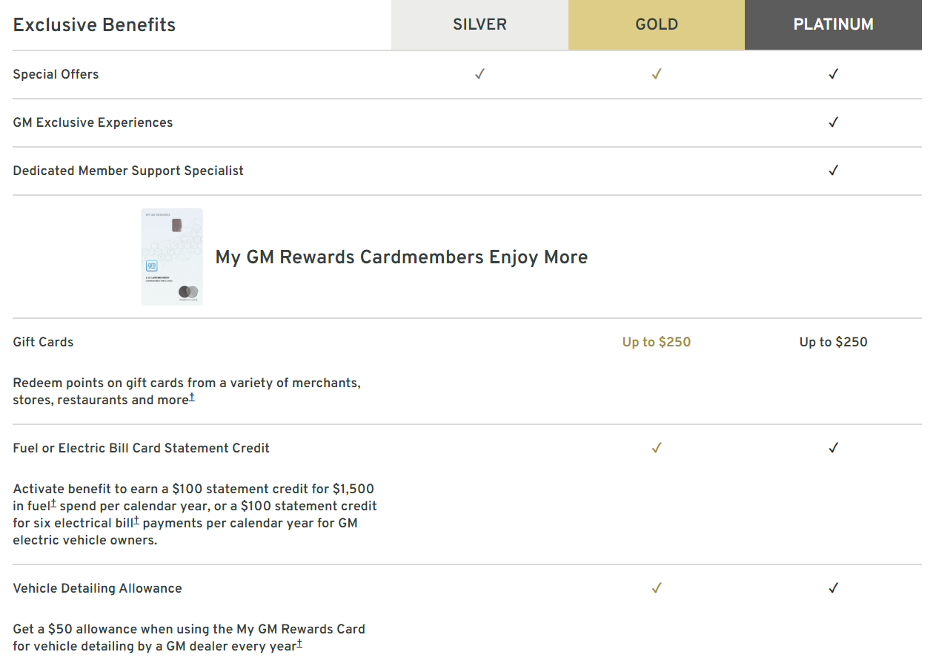

My GM Rewards Gold Tier Benefits

Once you receive your My GM Rewards Card™ and enroll in My GM Rewards, you’re automatically elevated to Gold Tier status.

Curiously, while this is touted as a perk, My GM Rewards Cardholders already have all the bonuses of Gold Tier status — and more. Enrolling doesn’t seem to get you anything extra, except one step closer to Platinum status which adds GM Exclusive Experiences and a Dedicated Member Support Specialist.

World Elite Mastercard benefits

Since My GM Rewards Card™ is a World Elite Mastercard, you’ll gain instant access to a suite of money-saving benefits like:

- $5 in Lyft credit for every three rides taken per month

- Three months of free DoorDash DashPass plus $5 discount on your first two orders each month

- Complimentary ShopRunner membership

- Complimentary grounds passes for PGA Tournaments

And more. You can check out the full list of World Elite Mastercard benefits here.

Pros and Cons

Pros

- Rewards rates — Earn up to 7x points to apply toward your next GM purchase.

- Welcome offer — Earn 15,000 bonus points after you spend $1,000 in your first three months – that’s $150 in value when you redeem with GM.

- Statement credits — Earn $100 back on $1,500 of fuel purchases or six months of electric bills for GM EV owners, plus $50 toward an auto detail at the dealer.

- World Elite Mastercard benefits — Includes a free DashPass for three months, PGA Tournament passes, and more.

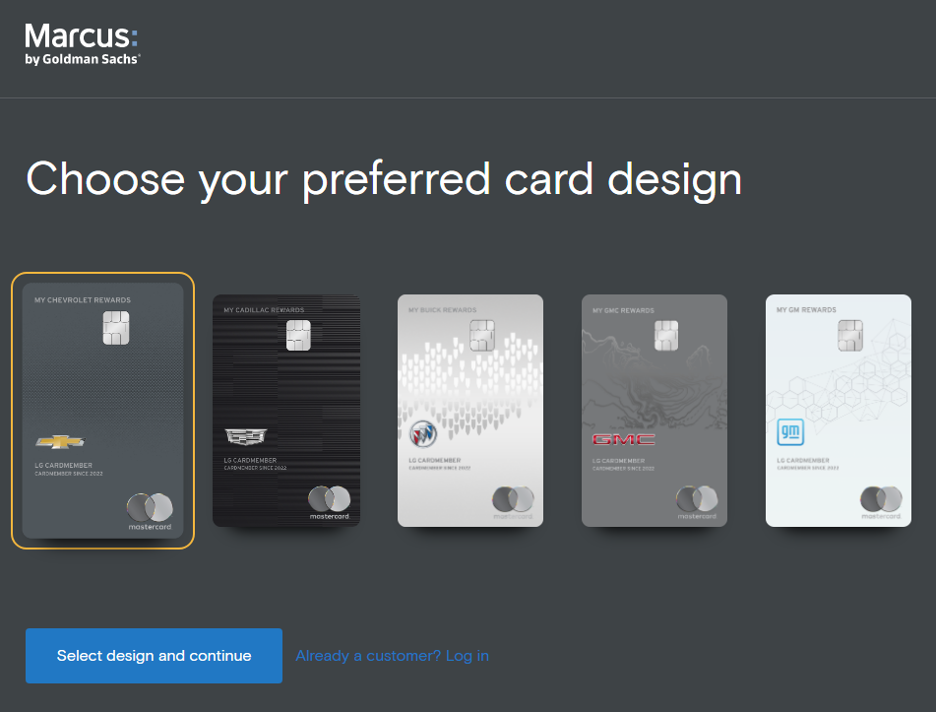

- Slick GM-themed card design — You can choose from GM, Chevy, Buick, Cadillac, or GMC-themed card designs.

Cons

- Limited redemption options — GM purchases are basically your only redemption option if you want reasonable value for your points.

- Can’t combine points with GM incentives — My GM Rewards points cannot be combined with an employee discount, supplier discount, or other purchase incentives.

- Low redemption caps — You can only redeem $1,000 worth of points toward a Certified Pre-Owned Vehicle and $250 toward other GM products or services every calendar year.

My GM Rewards Card™ Compared

Let’s say you’re saving up to buy a Chevy Silverado next year.

Which card will help you earn the most cash back to apply toward your truck purchase?

| My GM Rewards Card™ | Citi Custom Cash℠ Card | Chase Sapphire Preferred® Card | |

|---|---|---|---|

| Annual fee | $0 | $95 | |

| Rewards rates | 7x on eligible GM purchases; 4x all other purchases | 5% in top eligible spend category; 1% everywhere else | 5x on travel purchased through Chase; 3x on dining, online grocery purchases, and streaming services; 2x on non-Chase travel; 1x on all other purchases |

| Sign-up bonus | Earn 15,000 bonus points after you spend $1,000 in your first three months – that’s $150 in value when you redeem with GM | $200 cash back after making $1,500 in purchases in the first 6 months | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards®. |

| Statement credits and other bonuses | $100 after spending $1,500 on fuel or paying 6 electricity bills; $50 toward detailing service at GM dealer | N/A | $50 annual Hotel Credit; 10% anniversary points boost at year’s end |

| Other notable perks | World Elite Mastercard benefits | Add Authorized Users free and earn points on purchases they make | Break up big purchases into zero-interest monthly payments |

My GM Rewards Card™ vs. Citi Custom Cash℠ Card

It’s hard to beat the My GM Rewards Card’s 4x points ‘flat’ earn rate, i.e. the minimum number of points it earns for any purchase. But the Citi Custom Cash℠ Card is definitely competitive with its unique accelerated earn rate: The card dishes out 5% cash back in your top spending category each month, which might be groceries, gas, travel, etc. in a given month depending on your spending habits.

Granted, the 5% rate only applies to the first $500 spent in that category each billing cycle ($25 in cash back). Given that the Citi Custom Cash℠ Card doesn’t have an annual fee, you might actually choose to use it in combination with the GM Rewards Card™, putting the first $500 spent in a given category on the Citi card and then shifting your spending to the GM Rewards Card™ until a new month begins.

My GM Rewards Card™ vs. Chase Sapphire Preferred® Card

How does the My GM Rewards Card™ compare to a card with an annual fee, but a much higher sign-up bonus?

The Chase Sapphire Preferred® Card awards you with 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards®.

By comparison, the My GM Rewards Card™ has a more modest $150 sign-up bonus — but it accumulates points much faster. To make up the difference in the sign-up bonus values, you’d need to make about $9,000 in purchases in the My GM Rewards Card’s 4x points category (non-GM purchases).

So, provided you have excellent credit and qualify, in the short term you might actually pocket more money toward the purchase of a new vehicle by using a paid, top-tier rewards card with a big sign-up bonus, like the Chase Sapphire Preferred® Card.

Who Should Apply for the My GM Rewards Card™?

The My GM Rewards Card™’s unique limitations and restrictions make it appealing to a very narrow niche.

If you’re already spending thousands annually on eligible GM purchases and plan to purchase a GM new or Certified Pre-owned vehicle in the near future, the card makes sense. At that point, you’d be earning points faster than you would with a leading, general purpose rewards card.

It might also make sense as a backup/emergency credit card that you only use when servicing your existing GM vehicle. Just keep in mind that your My GM Rewards points are only redeemable for $0.01 when applied to future GM purchases.

How to Apply for the My GM Rewards Card™

Your first step in applying for the My GM Rewards Card™ is to ensure you have a high enough credit score — around 700 or so.

To its immense credit, the My GM Rewards Card™ actually lets you view your eligibility without making a hard credit check — also known as a soft pull.

Even still, you can save time by checking your score first. You can get a free credit report from our friends at Credit Karma and if you need help getting your numbers up, check out our article: How To Improve Your Credit Score, Step By Step.

Your next step is a fun one — pick a design:

Next, you’ll fill out a standard credit card app. You’ll share your basic contact info, SSN, income, and more.

If you’d like help or are just curious why credit card companies have to ask this stuff, check out our guides on How to Apply for a Credit Card and What You Need to Know About Applying for a Credit Card with a Limited Income.

While your card is in the mail for between five and ten business days, go ahead and enroll in My GM Rewards, too. You’ll need it to maximize your benefits.

Lastly, if you’re treating your My GM Rewards Card™ as a spare/backup card, just be sure you put $1,000 on it within three months to trigger your $150 bonus!

Summary

The My GM Rewards Card™ makes the most sense if you’re already spending thousands a year on GM vehicles, services, and accessories — and plan to buy additional GM vehicles in the future. Despite the mass appeal of 4x back on every purchase, it’s really just a niche card for GM loyalists.