TaxAct is a good choice for tax filers looking for a quick and easy-to-use interface. TaxAct’s pricing for federal returns is, for the most part, lower than H&R Block and TurboTax, but state returns are more expensive.

TaxAct makes it easy and affordable to file your federal and state tax returns online.

The simplest federal returns are free to file (state returns cost $39.99 each) with premium options available if you have itemized deductions, capital gains, or self-employment income.

- Easier to use than competitors

- $100k accuracy guarantee

- Optional live tax advice ($59.99)

- State returns are pricey

- Most users can't file via mobile app

If you’re looking for a way to file your federal return more quickly, this might be the right service for you. This TaxAct review will go over everything you need to know about using this platform and help you weigh the pros and cons of choosing this tax software over others.

What is TaxAct?

TaxAct is an online tax software provider you can use to file your state or federal tax return. Depending on the plan you choose, it may be free to use.

Founded in 1998, TaxAct has helped millions of people file their taxes themselves while saving money and time. Products and services available cover a wide range of online tax filing solutions, but the target audience for this service is people who want to file their taxes themselves.

Pros & cons

Pros

- Free plan — TaxAct Free lets you file your federal tax return for free if you use the free online plan.

- Optional professional tax support — For an additional $59.99, you can access live professional support if you need it.

- Lower federal prices — Across the board, TaxAct tends to be the cheapest tax preparation service for federal returns.

Cons

- Extra fees for state returns — For TaxAct online plans, you will pay an additional fee for every state return you need to file.

- No full-service tax preparation — TaxAct no longer offers a service for having a tax professional file your taxes for you.

- Limited mobile app — With some competitors, you can file your taxes entirely on your phone. While TaxAct offers both iOS and Android apps, most users will have to finalize their returns via a browser.

How does TaxAct work?

TaxAct offers a complete tax filing software solution for people who want to file their state and/or federal taxes themselves. You can use as many of these tools and services as you like but all of them are designed for do-it-yourself filing.

You’ll have the option to either prepare your returns and file directly through TaxAct’s online platform or download the software onto your computer and prepare your returns locally on your own device. You may find the download to be more convenient than filing online or even be able to save some money using this instead, but it’s a matter of personal preference. Prices are different between the two options and we’ll go over those later on.

You can also track your IRS refund to find out if it’s been processed yet and when you can expect it to hit your bank account.

TaxAct 2024 pricing

There are four different types of TaxAct online plans. These are:

- Free

- Deluxe

- Premier

- Self-Employed

The right plan for you depends on your unique tax situation, including where your income comes from, your filing status, your expenses, and what investments and assets you have. These factors affect your tax liability and the complexity of your tax return.

And again, this is for online filing. Meaning, you’ll sign up for an account, choose the plan you want to use, and do everything through the TaxAct site.

These plans only include federal filing in the cost, which is typically for online tax preparation services. If you also want to file your state taxes with TaxAct, you’ll need to pay an extra fee for each state tax return.

Let’s break down what kind of tax preparation support, tax deductions and credits, and features are included with each plan as well as how much you’ll pay for each state tax return if you choose to do these.

Free

The free version of TaxAct allows for three different types of income and three different types of tax credits: W-2 income, unemployment income, and retirement income and child tax credit, earned income tax credit, and stimulus credit.

As far as deductions, you’ll only be able to claim dependents and current students as deductions. This plan does not allow for itemized deductions for things like mortgage interest and property taxes. However, it does include a Deduction Maximizer tool to help you make the most of any tax breaks you may qualify for and a ProTips guide to help you identify tax advantages you might not have known to look for.

These two resources are free to use for all other TaxAct plans as well.

The TaxAct Free online plan is ideal for simple filers with straightforward earnings. If you’re eligible for other deductions or credits, own a home, or need to report investment income, you’ll need a more advanced plan.

With this plan, you’ll pay an additional $39.99 for each state tax return. Again, doing these through TaxAct is optional and you can find services that let you file your state taxes for free. However, if you’ve already used TaxAct to prepare your federal return, all relevant information will autofill in your state return so you don’t have to re-enter everything. Just something to consider.

Deluxe

The Deluxe version of TaxAct offers more options for deductions, credits, and income.

If you own a home, have student loans that have yet to be paid off. You can claim credits and deductions for the following:

- Health Savings Account

- Mortgage interest

- Student loan interest

- Real estate taxes

- Child and dependent care

- Adoption credits

This e-filing tax preparation plan is ideal for people who own homes, have childcare expenses they want to claim deductions for, and have outstanding student loans they are paying interest on that may qualify for deductions.

Premier

The TaxAct Premier plan includes all of the options and features already outlined for the Free and Deluxe plans plus provisions for investors and people earning passive income and/or capital gains.

For example, if you have investment income such as rental property income and want to use TaxAct to file, you’ll definitely want to pay for the Premier plan. With this plan, you can report any income from your investments or businesses (except for freelance income) including real-estate investments, stocks, and royalties. You can also report the sale of a home with this plan.

TaxAct Premier is ideal for tax filers who invest, own rental properties and other real estate investments, and have foreign bank accounts.

Self-Employed

The final TaxAct plan, the Self-Employed plan, is specifically for tax filers who work for themselves and/or own a business. This is the only plan that lets you file Form 1099-NEC and claim personalized business deductions. It’s also the only one that includes features to help you calculate depreciation for your property and plan for next year’s taxes.

The Self-Employed plan lets you do everything you could do with the Free, Deluxe, or Premier plan as well as report freelance income and business income and claim personalized business deductions. If you qualify for it, you can claim Earned Income Tax Credit too as long as you’ve deducted all of the expenses you can from running your business.

Whether you work as an independent contractor, sole proprietor, or own a small business, you’ll likely need the TaxAct Self-Employed plan. Unfortunately, this is the most expensive plan and you’ll pay the same fee regardless of which deductions you claim.

Compiling your self-employment income can be a complicated process and you’re likely to have questions along the way, so you’ll want to take advantage of the free professional support from Xpert Assist when you need it.

TaxAct Desktop Edition (downloaded)

Although we suspect most of our readers will be happy using TaxAct on the Web, they do still offer TaxAct Desktop Edition as downloadable software.

Features and benefits

Beyond the online plans and downloads, there are a number of other features included with and benefits of TaxAct. Let’s cover a few of those now.

Importing

TaxAct allows you to import tax returns from the previous year to take some of the work out of filing this year’s taxes. While this isn’t especially unique, we do appreciate that you can do this whether you used TaxAct or another service last year.

With any TaxAct plan, you can upload your 1040 tax returns from last year whether you used TaxAct, another provider, or none at all. For the sake of simplicity, it can be a good idea to stick with the same preparation service, but most software providers allow you to import documents from their competitors. For example, you could import returns from TurboTax, H&R Block, TaxSlayer, or Cash App Taxes to TaxAct for easy filing.

Tools and calculators

TaxAct offers a number of different calculators you can use when planning and filing. Even if you think you’re ready to start, these tools can help you avoid the worst parts of doing your taxes.

- Tax calculator – estimate your refund by plugging in some basic information about your filing status and dependents

- Self-employment calculator – find out how much you’ll need to pay in self-employment taxes

- Tax bracket calculator – see which tax bracket you fall into based on your gross income and filing status (you can also insert childcare expenses, retirement contributions, deductions, and self-employment income here for greater accuracy)

- Tax checklists – find out what information, tax documents, and personal records you’ll need for 1040, 1041, 1065, 1120, 1120S, and 990 forms

- Tax extensions – file a free IRS tax extension if you need more time to file your tax returns with IRS Form 4868

All of these calculators and tools can help you answer your own questions before or while filing your federal return, and the best part is you don’t even have to be a TaxAct customer to access and use them.

To save yourself time, check out these resources before reaching out to the Xpert Assist team about easier questions. They might point you to one of these tools anyway.

Read more: What documents do I need to file taxes?

TaxAct Xpert Assist

With Xpert Assist, you can get support filing taxes at any time. This service is a $59.99 add-on to all TaxAct plans including the free version There is no limit to how many times you can use Xpert Assist.

The Xpert Assist team is made up of experienced tax specialists who can assist with any questions you have about your account or taxes. You won’t have a direct line to a dedicated tax professional like you might have with more expensive services, but you will have unlimited access to professional support. To get help, you need to request a call. Then, an expert will contact you and you’ll share your screen to go over anything you want them to take a look at and clarify.

Note that they are not tax attorneys, so they won’t be able to support you with things like disputes or relief. They also won’t be able to do anything for you but can help you prepare your returns.

Live chat is not available for this service and the Xpert Assist team is not reachable 24/7. Standard support hours (Central Time Zone) include:

- Jan. 2, 2024 – April 7, 2024: Monday – Friday: 8 am – 9 pm; Saturday & Sunday: 9 am – 6 pm

Extended hours are available on:

- Sat & Sun: Jan. 27-28, 2024: 9 am – 8 pm

- Sat & Sun: Feb. 3-4, 2024: 9 am – 8 pm

- Mon-Fri: April 8-12, 2024: 8 am – 10 pm

- Sat & Sun: April 13-14, 2024: 9 am – 8 pm

- Mon: April 15, 2024: 8 am – 12 am

After the tax deadlines, hours are:

- April 16, 2024 – Dec. 31, 2024: Monday – Friday: 8:00am – 5:00pm; Saturday & Sunday: Closed

You can also request that an Xpert Assist representative review your returns before you submit them. But if you do this, know that they can’t see the tax forms you’ve uploaded so they will mostly be checking for completeness and assisting with any specific concerns you have about the different fields.

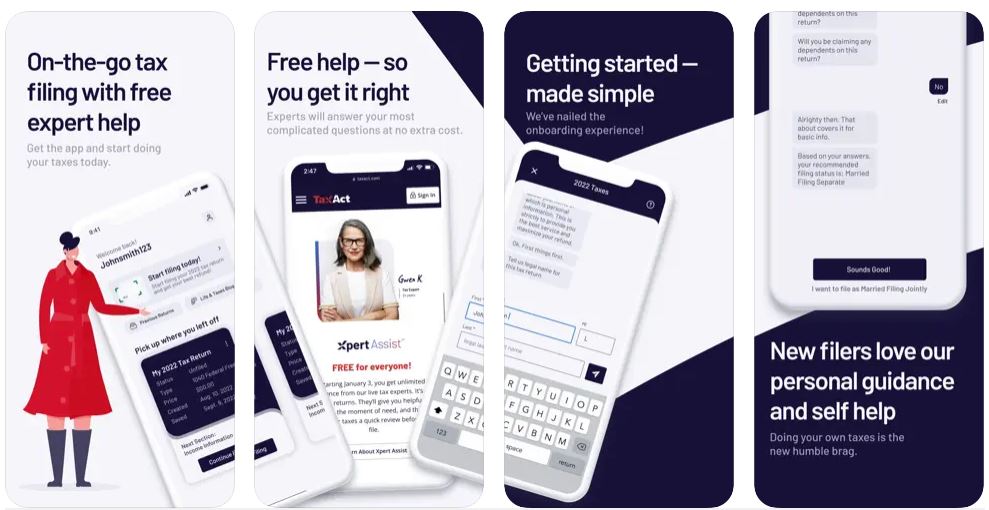

Mobile app

The TaxAct mobile app, called TaxAct Express, is available on both the App Store and Google Play. It has a score of 4.4 out of 5 stars on the App Store and 3.6 out of 5 stars on Google Play. It’s free to download and use regardless of which TaxAct products you use.

This app has almost all of the same features as the online filing platform. You can use TaxAct Express to prep and file your taxes, get support from the Xpert Assist team, calculate your refund, upload your tax forms, and more. But according to users, the app isn’t always entirely reliable and can be prone to crashing, so use it at your own risk.

Who is it best for?

TaxAct is ideal for people with the simplest taxes. This service is a little more basic than others and offers the best value and platform for those who don’t need to claim many deductions, report several different types of income, or itemize.

If you fit any of these descriptions, TaxAct could work well for you.

W2 employees

If all of your money comes from a single direct deposit from your employer, you’re an ideal candidate for TaxAct. This kind of tax return is much easier to file online and you’re less likely to need 24/7 dedicated support.

Renters

You may be a good fit for the TaxAct free plan if you rent an apartment, condo, or house rather than own a home. If you rent, you won’t have to worry about claiming deductions for mortgage interest or property taxes. Consider simpler taxes a perk of renting over buying.

Families

TaxAct is a solid choice for families, but some families will be able to use the Free online plan while others will need to pay for at least Deluxe.

For example, it’s easier to claim deductions for biological children with TaxAct than it is to claim deductions for adopted children. To claim the Child Tax Credit, you can get away with using the Free online plan because this option is included with all levels of service. But to claim adoption credits on your tax return and deductions for things like child and dependent care, you’ll need to pay for the Deluxe online plan. So depending on the needs of your family, you may be able to file for free or need to pay. But either way, TaxAct is an expensive option.

Who is it not ideal for?

If your tax situation is complicated for one reason or another, you may need to choose a different tax software provider. Here are a couple of filers for whom TaxAct’s tools and services might fall flat.

Investors

Whether you consider yourself to be a beginner or intermediate investor, there’s no denying that filing taxes gets more complicated after you start investing. It’s not that you can’t make TaxAct work for you if you’re an investor, but you may find it more difficult to maximize your deductions and report all of your streams of income. It’s possible to do, for sure, but perhaps clunkier with this software than it would be with another.

Freelancers and side-hustlers

If you earn any kind of freelance income, even if it doesn’t make up the majority of your earnings, TaxAct might not be right for you. This tax software provider charges the most for its Self-Employed plan and you might be able to save money by choosing another service. And because self-employed taxes are notoriously complicated, you might want more hands-on support than TaxAct offers with its Xpert Assist service.

How much does TaxAct cost?

TaxAct charges different rates for e-filing through its online platform and software downloads. For e-filing online plans, the prices are as follows:

- Free: $0 for federal filing + $39.99 per state

- Deluxe: $29.99 for federal filing + $39.99 per state

- Premier: $39.99 for federal filing + $39.99 per state

- Self-Employed: $69.99for federal filing + $39.99 per state

You’ll only pay a fee when you file if you choose a paid plan, so you can start preparing your documents for free.

The competition

How does TaxAct compare to other popular tax preparation software you’ve heard of? See how TaxAct stands up to TurboTax and H&R Block to decide which one — if any — to use this tax season.

TaxAct vs TurboTax

TurboTax is one of TaxAct’s biggest competitors. Compared to TaxAct, TurboTax has higher prices in general for its products. TaxAct ends up being slightly cheaper than TurboTax across the board for e-filing federal returns but is very comparable for state tax returns.

If you want to pay someone to file your taxes for you, you’ll need to choose TurboTax. TaxAct used to offer full-service tax preparation services, called Xpert Full Service, but this is no longer available. And for tax preparation software downloads, TurboTax is the more affordable option.

If you need full preparation services or want to download the software, consider using TurboTax. But if you want to e-file your federal return online, TurboTax offers a generally simpler system that lends itself especially well to simple filing. Choosing between the two for more complex filing will depend on what you’re willing to pay for, but TurboTax’s software and system are more robust.

TaxAct vs. H&R Block

Another huge competitor, H&R Block is better than TaxAct in some ways and worse in others. Dollar for dollar, TaxAct is again less expensive but H&R Block offers the option for free state tax returns.

For self-employed filers, H&R Block has a significant edge. This e-filing service is not only less expensive than TaxAct but also more powerful, giving freelancers and small business owners more support with things like expense tracking and bookkeeping and easier systems for reporting income. H&R Block also, like TurboTax, provides the option for expert tax preparation that’s relatively inexpensive and is better equipped for handling investing income and deductions.

To save money on Deluxe or Premium online filing service and get expert help, choose TaxAct. But if you’re a freelancer or want to pay someone to do your taxes for you, choose H&R Block.

Summary

TaxAct is just one of many excellent types of tax filing software you can use, but it may be the best choice for you if you don’t need to claim many tax credits or deductions and you don’t earn money from a lot of different places. The e-filing platform is user-friendly and simpler than others, and for more basic tax returns as well as moderately complex returns, it almost always comes out to be a lower price.

But if you have investments, freelance income, or other items that will lead to a more complicated tax return, you may find a different service to be more suitable. TaxAct is also not a good option if you want to pay someone to file your taxes for you and this provider charges higher prices for downloadable software than other similar providers.

FAQs about TaxAct

Is TaxAct legit?

Yes, TaxAct is a legitimate tax filing platform with legitimate tax professionals.

TaxAct has a $100k Accuracy Guarantee. This is a maximum refund guarantee, meaning TaxAct will do everything possible to make sure you get the highest refund you can and will reimburse you up to $100,000 for any fines or fees you have to pay as a result of errors caused by their system or tax experts.

But if you investigate and find that your tax refund with TaxAct was lower than you could’ve gotten elsewhere, TaxAct will refund you for any fees you paid to file with them.

Is TaxAct really free?

It’s natural to be skeptical when a service is “free,” especially if you’ve ever signed up for something you believed to be free only to end up paying for it later. But TaxAct Free (the free plan) does offer truly free online federal filing. But if you need to file your state tax return as well, you’ll pay an extra $39.99 per state.

Otherwise, it’s free to prep your tax return and file it with TaxAct with the Free plan. And if you do pay for a plan, you won’t owe anything until you actually file.