The days of researching personal loan quotes company by company are no more. It’s gotten easier to find all of your loan options in one place. Aggregators have popped up left and right, and now there’s a competition to see who can make the process easiest.

That’s great news for borrowers!

Today, I’ll be reviewing Fiona, an aggregator that lets you compare personal loans, credit cards, savings accounts, insurance, and student loan refinancing offers. This company offers a free quote process that can be done in 60 seconds, but is it really as easy as it claims?

Find out if Fiona is the right platform to help you find a loan here.

Fiona is an aggregator that offers free quotes for personal loans with an application that takes less than 60 seconds to complete and does not require a hard credit pull.

- Fast quote process

- Reputable companies

- Free to use

- Helpful education tools

- No hard credit pull

- Limited quote options

- Not a direct lender

What Is Fiona?

Fiona is an aggregator that can help you find quotes for personal loans and student loan refinances. They can also help you find the best credit cards for your needs and the perfect savings account for your budget.

Once you pick one of the choices Fiona gives you, they’ll help you through the application process and, if you’re approved, you may be able to get the money in your account right away (for personal loans, of course).

In 2021, we gave Fiona the award for the Most Disruptive Personal Loan because it takes a lot of the stress out of finding and comparing different loans. At no cost to you and with no effect on your credit score, Fiona can help you find the best rates online in a fraction of the time you’d spend browsing offers yourself.

How Does Fiona Work?

I have to say, I was genuinely surprised at how simple Fiona was to use. I decided to start out by looking at what personal loan rates I could qualify for.

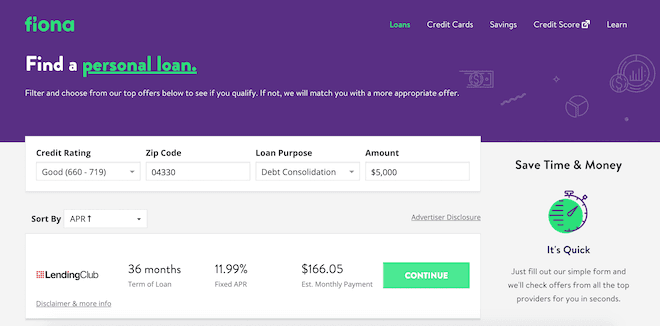

After clicking on the continue button shown above, I was immediately led to the following page:

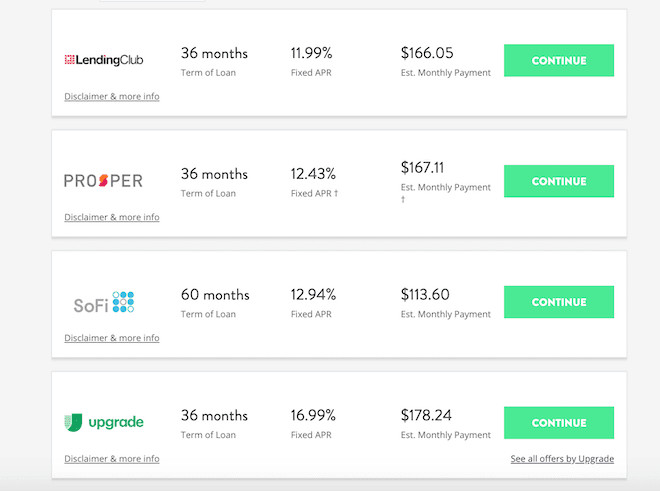

To my surprise, all my information (minus the loan amount) was auto-filled and my loan options appeared right away.

Fiona can show you personal loans up to $250,000 with terms between six and 144 months and a range of APRs. I looked at multiple different loan amount options from many of the same companies with different payment options and interest rates. The platform shows the estimated monthly payment for each loan.

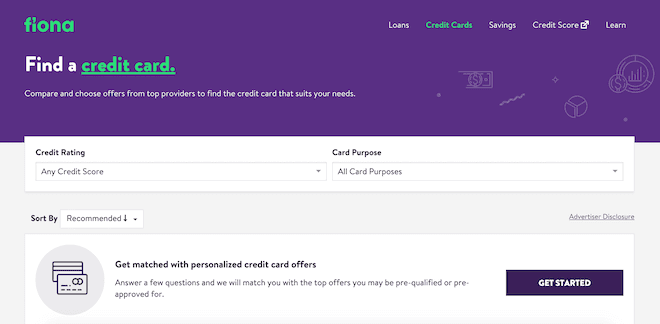

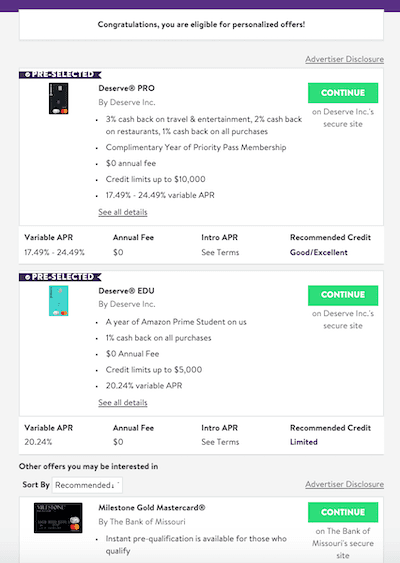

Then, I decided to check out credit cards.

I was led to the page pictured above. I was able to search cards by purpose or credit scores or get personalized results. To get personalized results, you have to answer a few basic questions about yourself and provide your name, address, and email address).

Unfortunately, I was only given a couple of personalized options to choose from, so I went back to the homepage and sorted the list by card purpose instead.

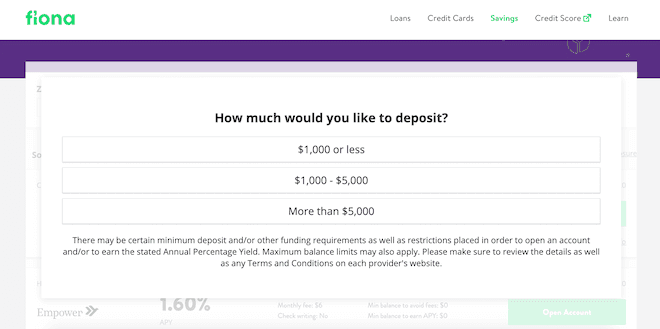

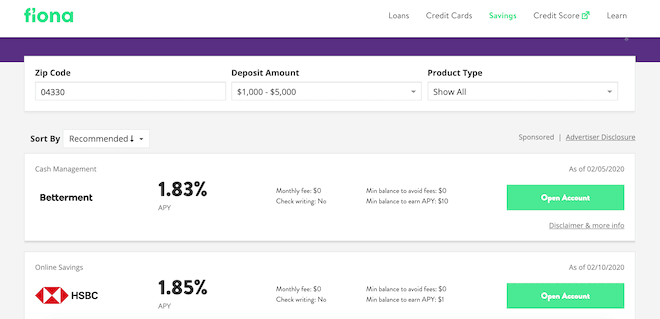

Next, I moved on to savings accounts.

The savings accounts quote process was equally as simple as the personal loan quote process. When I visited the savings page, I was given the option to choose how much I want to deposit (ranging from under $1,000 – more than $5,000). I clicked $1,000 – $5,000 and was led to the following offers (not all are shown):

As you can see, Fiona breaks down the accounts by monthly fees, APY, and minimum balance needed to reach the highest interest rate.

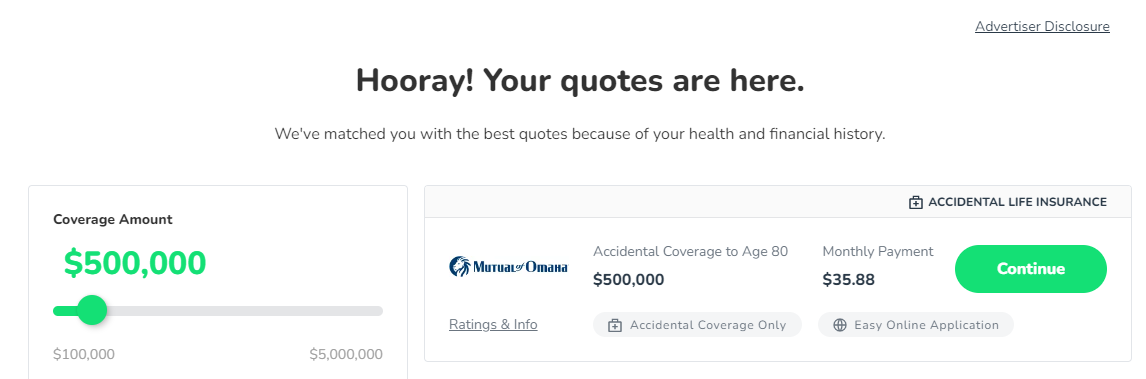

Finally, I decided to get a quote for life insurance.

It took me less than a minute to fill out the application. Then, I received one quote from Mutual of Omaha for Accidental Life Insurance. I was disappointed there weren’t more options to compare or term life insurance offers, but no-exam life insurance can be difficult to qualify for if you’re not in perfect health. Still, the process was easy and didn’t even require an email.

You can also search offers for auto insurance through Fiona in partnership with Jerry to find a new policy or switch.

Related: When Do You Need To Buy Life Insurance?

How Much Does Fiona Cost?

One of the biggest perks of Fiona is the fact that they’re completely free to use.

You won’t pay anything to use the platform, but there may be an origination fee when you apply for a loan. These are charged by partner lenders and calculated as a percentage of the loan amount you’ve chosen.

Fiona Features

Fast Quote Process

I honestly expected to spend at least five minutes answering a bunch of questions to get quotes, but I was happy to see that Fiona shows your options after just a simple half-page form.

This rang true for all the different types of applications. The credit card page required a few more questions than the personal loan quote process but only took me a little bit longer to fill it out.

Personal Loan Offerings

Fiona partners with tons of personal loan companies to give you a wide range of offers.

Some of Fiona’s lending partners include Prosper, SoFi, LendingClub, and Best Egg.

Related: How To Apply for Personal Loans (and the Differences Between Each Type)

Credit Card Comparison

Fiona allows you to compare cards in a couple of different ways. If you don’t want to give your personal information, you can simply go to their main page and browse by credit score or card purpose. This is a perfect solution for conspiracy theorists (like myself) that don’t like having to use their personal info to get recommendations.

If you do want a more personalized experience, you can click the “Get Started” button underneath “Get matched with personalized credit card offers.” You’ll need to fill out the usual information you give for any type of card application:

- Name

- Address

- Date of birth

- Email address

After that, you’ll be led to your personalized list, like the one below:

As I mentioned, this really wasn’t as many choices as I was hoping for, so I went back to the main page.

Savings Accounts Comparison

Fiona sorts their savings account options by asking you how much you’d like to deposit, which I love.

Many accounts have different APYs depending on your balance. Fiona takes that into consideration and pushes the best picks to the top of your list.

Related: Best Online Savings Accounts

Student Loan Refinance Quotes

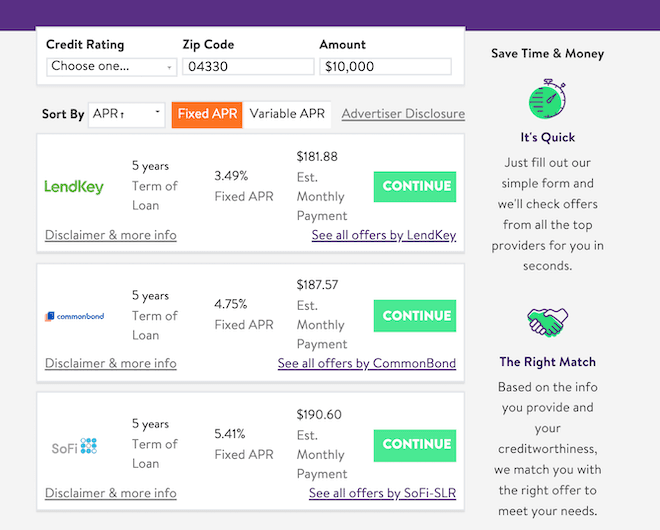

The process for getting a quote to refinance your student loans is the same as the personal loan process. All you’ll need to fill out (assuming it’s not auto-filled for you if you have your location services turned on) is your credit rating, zip code, and the amount you want to refinance.

You’ll then be brought to a page like the one below:

From there, you can choose the lender that you think will work best, and go through their application process.

Life and Auto Insurance

Fiona partners with LeapLife to provide online life insurance offers from a variety of companies including Pacific Life, Transamerica, and more.

Fiona also partners with Jerry to provide auto insurance quotes from top companies like Progressive, Allstate, Nationwide, and several others. Choose from car insurance, car and home insurance bundles, and car and renters insurance bundles.

If you’re looking for a fast and easy way to apply for insurance, Fiona is perfect. Just keep in mind that you may not qualify for no-exam term life insurance or see as many auto offers as you want.

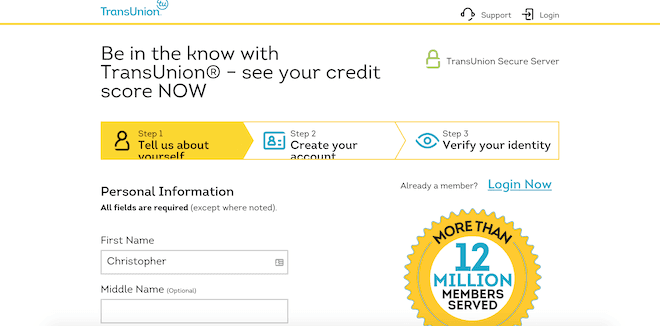

TransUnion Credit Score

Fiona knows that your credit score is important when considering any financial product. That’s why they’ve partnered with TransUnion to offer you a look at your score.

When you hit the “Credit Score” button on Fiona’s website, you’ll go to the following page:

From there, you can sign-up to get your score. I opted not to go through this sign-up process because I love using Creditwise to track my score (I’m a Capital One customer, so it’s much easier to use).

Also, using Fiona won’t affect your credit score since the application only uses a soft credit pull.

Learn Portal

The Learn Portal leads you to a ton of educational articles that are featured on the Fiona blog about credit, loans, and savings accounts. They also provide a bunch of information on their lending partners so you can research all of your options before you decide to go with a specific lender.

High-Powered Security

Fiona uses 256-bit encryption to secure your information. They claim that this is a higher security standard than most banks have. If that’s true, your personal info is sure to be safe in Fiona’s hands.

Customer Service

You can contact Fiona in a number of ways. They offer a phone number you can call as well as an email address for customer support. As someone who has called customer support many times in my life, I appreciate the fact that Fiona promises to get back to you within 24-48 hours. If you have an urgent question, your best bet is to call their hotline.

Finally, you can also use their contact form on the “Contact Us” page. You’ll fill in your name, email, and your question or concern.

Who Is Fiona Best for?

Those Looking for Quick Quotes

If you want the fastest loan quote experience out there, use Fiona. I’ve yet to find an aggregator that can generate quotes faster. Plus, Fiona makes the application process easier once you’ve chosen a lender.

Those Looking for More Than Personal Loans

Fiona isn’t just for finding personal loan quotes. You can also compare a handful of credit cards, savings accounts, and insurance offers. Fiona makes it easy to sort these by your financial need. Each application takes a couple of minutes at most.

Who Shouldn’t Use Fiona?

Unfortunately, Fiona doesn’t offer quote comparisons for new auto loans, so this isn’t the right marketplace for you if you need to take out a loan to buy a car. Fiona also doesn’t let you shop for other types of insurance besides auto and life.

Pros and Cons

Pros

- Fast quote process — Fiona asks a few questions and takes just 60 seconds to get your quotes.

- Reputable companies — Fiona only works with reputable loan companies, so you can be sure you’re getting quoted a fair price.

- Free to use — Fiona is completely free to use and will never affect your credit score.

- Helpful education tools — Fiona offers the Learn Portal, which has educational material for savings accounts, credit cards, and loans.

- No hard credit pull — I liked that there was no hard pull on my credit so my score wasn’t affected. This isn’t always true when you apply directly through multiple lenders to get quotes.

Cons

- Limited quote options — Fiona only works with certain lenders and providers, so options can be limited.

- Not a direct lender — Using Fiona is just the first step to getting a loan. After Fiona gives you options, you will still need to apply directly through the lender of your choice.

The competition

Fiona isn’t the only aggregator on the market. Here’s how this product stacks up against popular competitors Policygenius and Credible.

Fiona vs Credible

Credible is another free loan portal you can use to find the best rates on loans, whether you’re looking for personal loans, mortgages, or student loans. Credible can help you save money like Fiona by letting you easily compare offers from multiple lenders. But unlike Fiona, this marketplace also gives suggestions for home insurance and auto insurance.

Credible is one of the most popular loan portals online today. It is a free tool that specializes in finding borrowers personal loans for the most competitive rates.

Loan amounts range from $600-$100,000 and offer interest rates starting at 6.4% fixed APR (with autopay) See Terms*.

- Single application form

- 100% free to use

- Credible Personal Loan Best Rate Guarantee (Terms Apply)

- Limited lending opportunities

- Lender fees may apply

Credible could be the better option if you’re looking to avoid paying an origination fee as more of their partners don’t charge one. But Credible personal loans only go up to $200,000, so choose Fiona if you need to borrow more than this.

Fiona and Credible work with some of the same and some different lending partners, so it doesn’t hurt to use both to compare more loans.

» MORE: Read our full Credible review

Fiona vs Policygenius

Policygenius works in much the same way Fiona does. But, rather than focusing on loans, credit cards, and savings accounts, Policygenius offers insurance quotes.

So you can use Fiona and Policygenius alongside one another, depending on the financial product you’re looking for. But know that Policygenius doesn’t have as quick of a quote process as Fiona. Fiona takes just a few seconds, while Policygenius takes a few more minutes.

You’ll also need to be willing to give a few more personal details about yourself to get a quote from Policygenius.

» MORE: Read our full Policygenius review

My Experience Using Fiona

I’ll Definitely Look Again If I Need a Personal Loan

I’ve looked for personal loans in the past and usually I just research company by company, writing down the rates as I go. Fiona eliminated that entire process. I got over a dozen loan options in no time. And really, it doesn’t get much easier than that.

I Wasn’t the Biggest Fan of Their Credit Card Options

After filling out the personalized credit card page, I was only offered a handful of cards – one of which was a student card (which I don’t qualify for). This may be because Fiona simply doesn’t have as many partnerships with credit card companies as they do personal loans. But, overall, I wasn’t impressed with their suggestions.

It Was the Easiest Quote-Comparing Experience I’ve Ever Had

Using Fiona was the easiest experience finding quotes I’ve ever had – and I’ve tried most of the other aggregator options.

While I wouldn’t be able to find mortgage quotes or auto loan quotes, I’ll happily use Fiona again if I need to find a personal loan or want to open a savings account and need recommendations.

Summary

Fiona helps borrowers look for personal loans and student loan refinancing options. But that’s not all. You can also compare different credit cards and savings accounts.

The quote process was so unbelievably quick, and you barely have to give any personal information – which is great in today’s easily hackable world.