Today, it’s easier than ever to check your credit score. There are free apps and premium credit monitoring products. Many banks also provide free credit scores to customers. CreditWise from Capital One gives you free access to your credit score and report, even if you’re not a Capital One customer.

Whatever your situation, taking time to understand and monitor your credit is an essential part of financial fitness.

- Starting out? Keep an eye on your credit to learn how your behavior affects your score.

- Preparing to buy a car or home? Check your credit profile often, and apply for financing with confidence.

- Already have top-notch credit? Peek at your report occasionally to ensure there are no surprises.

Anybody can create a free account on the CreditWise website; you don’t have to be a Capital One cardmember. Is CreditWise the right credit monitoring solution for you? Let’s explore.

CreditWise is 100% free for everyone

CreditWise is (really) free.

You shouldn’t have to pay a fee to have access to your own credit information. In fact, the U.S. Government requires that each of the three major credit bureaus—TransUnion®, Experian®, and Equifax®—provide a free credit report once a year to any consumer who requests it. You can (and should) request your credit reports at annualcreditreport.com once a year.

But we recommend you don’t stop there. As great as annualcreditreport.com is, you’re limited to checking your reports for free once a year. CreditWise gives you access to both your TransUnion® credit report and VantageScore® 3.0 credit score, provided by TransUnion. Best of all, you can refresh your information weekly.

CreditWise won’t ask you for your credit card info and there’s no trial period to worry about. CreditWise is 100% free, and, again, you do not have to be a Capital One customer to use it.

Using CreditWise won’t affect your score

Requesting your own credit information through CreditWise will not negatively impact your credit score.

Generally, each time you apply for a new loan or credit card, a lender checks your credit. These inquiries are recorded on your credit report and may have an effect on your credit score. If you apply for credit repeatedly within a short amount of time, however, your credit score may go down noticeably.

However, checking your own credit information through CreditWise or any other service will not have this affect. In credit-speak, checking your own credit is known as a “soft” pull or inquiry. By contrast, a lender checking your credit after you make a credit application is known as a “hard” pull or inquiry. Using CreditWise results in a soft pull.

Access your credit score and TransUnion credit report

With CreditWise, you’ll get access to your VantageScore 3.0 credit score, provided by TransUnion, as well as your TransUnion credit report.

Your credit score is a good way to quickly evaluate your credit health and see how it’s changing over time. Keep in mind that lenders use many different credit scores. If you compare the VantageScore 3.0 credit score you see in CreditWise, it may be different than the score a lender provided. Don’t worry; this is normal! The most important thing is to regularly check up on your overall credit health.

CreditWise breaks down what your score means, how it’s calculated, and how you compare to the average American. You also get personalized suggestions for improving your score (e.g., it may recommend reducing the percentage of available credit that you use, or suggest adding a new line of credit that you pay regularly).

In addition to seeing your credit score, you can review your TransUnion credit report for signs of error, theft, or fraud. If you spot something that doesn’t look right, CreditWise will tell you what to do next.

The only negative to CreditWise is that you only get access to one credit score and a credit report from one bureau (TransUnion) out of three. But, remember, you can always review all three of your credit reports once a year at annualcreditreport.com.

Update your score weekly, not monthly

CreditWise lets you refresh both your credit score and report once a week.

Your credit score can change at any time. Your score may change whenever you make (or miss) a loan or credit card payment, increase or pay down the balance on a loan or credit card, apply for credit, close an existing account, or obtain a credit limit increase on an existing account.

For example, if you have more than one credit card, each card likely has a different due date and billing cycle. Your credit score may change each time one of your credit accounts begins a new billing cycle. Not only is your monthly payment recorded on your credit report—hopefully on-time—but also your new account balance. In general, more on-time payments and lower account balances should cause your score to go up. Larger balances—and certainly late payments—could cause your score to go down.

Although checking your score monthly may be adequate for a consumer in “maintenance mode”, weekly updates are invaluable to consumers who are actively trying to build credit or monitor credit ahead of a major purchase.

CreditWise will also send you an email and/or push notification when your TransUnion credit report changes. This is a great way to stay alert for any potential unauthorized use of your personal information, as well as get confirmations of when other changes post to your TransUnion credit report, such as paying off a loan or opening a new account.

CreditWise offers a credit score simulator

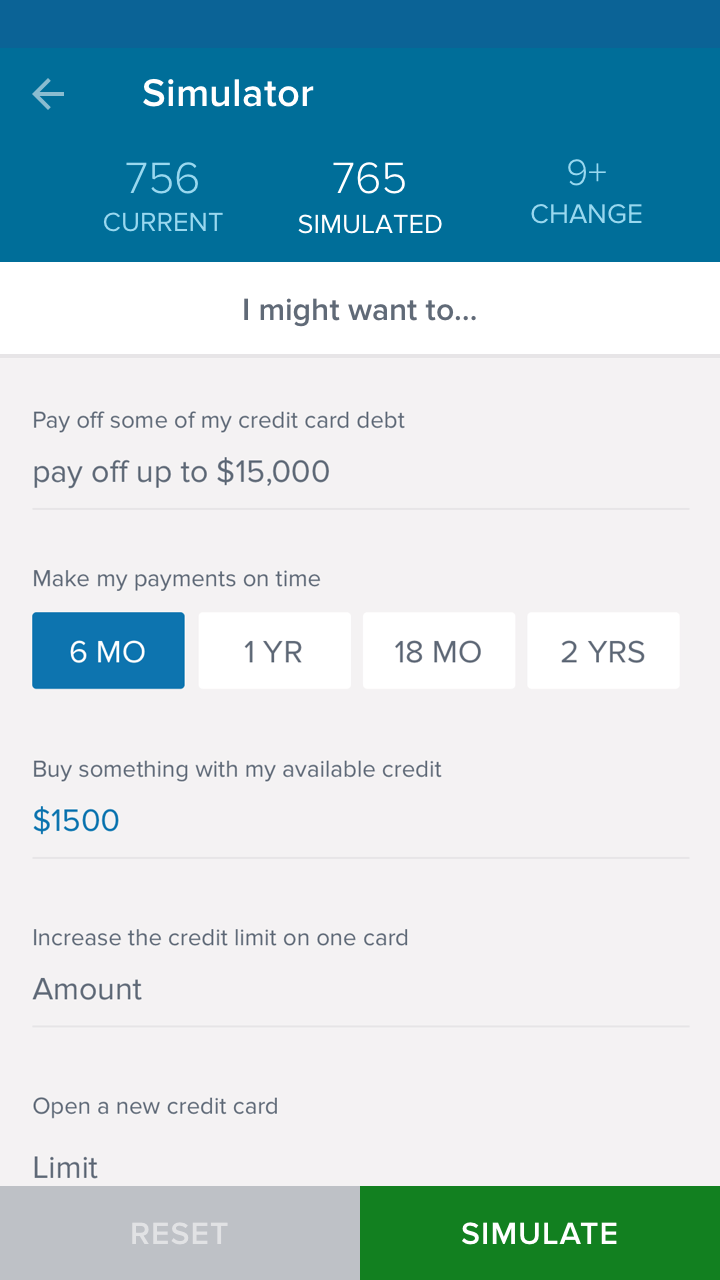

With the CreditWise score simulator, see how decisions like paying off a balance, opening a new credit card, or making a late payment could affect your credit.

Despite what some believe about Millennials, I indulge myself in the dream that I will someday be able to buy a home, so I find the house down payment scenario the most helpful to see how my credit score may affect how much of a down payment I’ll need to come up with in order to buy a home.

You can also use the simulator to see how paying off debt, making payments on-time (or not), increasing your credit limit, and taking out new credit lines may affect your credit score.

Summary

CreditWise provides 100% free credit monitoring to anyone, whether you’re a Capital One customer or not. CreditWise distinguishes itself by providing weekly updates to your credit report and score. We also feel confident in CreditWise, knowing the service is backed by Capital One.

If you’re looking for a truly free way to stay on top of your credit score and report, give CreditWise a try today.