Lively is a health savings account (HSA) provider that’s a good option for anyone wanting to open a HSA either because you’re self-employed or don’t have access to a health savings account through work.

Lively has excellent customer reviews, is incredibly easy-to-use, and earns top grades from industry watchdogs.

Lively is a company devoted to Health Savings Accounts (HSAs) that has flexible, competitive options for savers, spenders, and investors. Lively let individuals set up HSAs on their own. Contributions are pre-tax—you won’t pay taxes on your HSA funds as long as they’re used for qualified medical expenses.

- No individual account fees

- Bank partnership

- Online receipt storage

- Fund transfer lag time

- No pre-selected investments

What is Lively HSA?

Lively is a health savings account provider. Health savings accounts, or HSAs allow you to invest pre-tax dollars that you can later use for qualified medical expenses.

HSAs are good for:

- Reducing your current-year income tax

- Setting aside money for out-of-pocket medical expenses (especially with high-deductible health insurance plans)

- Additional tax-deferred retirement savings — on top of a 401k and IRA

If your employer doesn’t offer an HSA, Lively lets you set up an HSA on your own.

Money you deposit into an HSA directly reduces your taxable income. And you’ll never pay taxes on money you put into an HSA as long as you use those funds for qualifying medical expenses.

Employers or individuals can participate in Lively plans.

With any Lively HSA, you have two options for your money:

- An FDIC-insured interest-bearing cash account

- A self-directed investing account through Charles Schwab

How does Lively HSA work?

When you open an individual HSA with Lively, you’ll answer a few qualifying questions and then need to fund the account–either by transferring (“rolling over”) funds from an existing HSA or setting up automatic contributions from your bank account.

When you open an individual HSA with Lively, you’ll answer a few qualifying questions and then need to fund the account–either by transferring (“rolling over”) funds from an existing HSA or setting up automatic contributions from your bank account.

You’ll then need to choose whether to keep your HSA funds in cash or invest them.

In 2024, you can make tax-free HSA contributions up to $4,150 for an individual and $8,300 for a family. Anyone age 55 or older can make an additional $1,000 catch-up contribution (unchanged from 2023).

You can withdraw funds at any time via electronic transfer. (Keep in mind, you will need to keep receipts showing the funds were used qualifying medical expenses in order to preserve your tax savings). You can also request up to 3 debit cards per account. Lively HSA debit cards can be used to directly pay for qualifying medical expenses.

There are no limits on HSA withdrawals as long as funds are used for qualifying expenses.

Finally, keep in mind that HSA funds can rollover from year to year — you won’t lose your funds or tax savings if you don’t use the money this year. In fact, the best way to use an HSA is to invest your HSA funds for many years. The money grows tax-free and you’ll likely face more (and more expensive) medical expenses when you’re older.

Who is eligible for a Lively HSA?

You are eligible for a Lively HSA if you have a current HSA with funds to roll over to Lively and/or a high-deductible health insurance plan.

In 2024, the IRS defines a high-deductible health insurance plan as any plan with an annual deductible of more than $1,600 for an individual or $3,200 for a family. Annual out-of-pocket expenses limits cannot exceed $8,050 for individual or $16,100 for family coverage.

HSAs are meant to supplement high-deductible insurance plans, not replace them. Insurance policyholders usually have to pay a certain amount called a deductible before their coverage kicks in, and HSA money covers these expenses.

You don’t need employer-sponsored health insurance to use an HSA. People in diverse financial situations, including the self-employed, can open a Lively HSA as long as their insurance meets the criteria.

Lively does not require minimum balance, either.

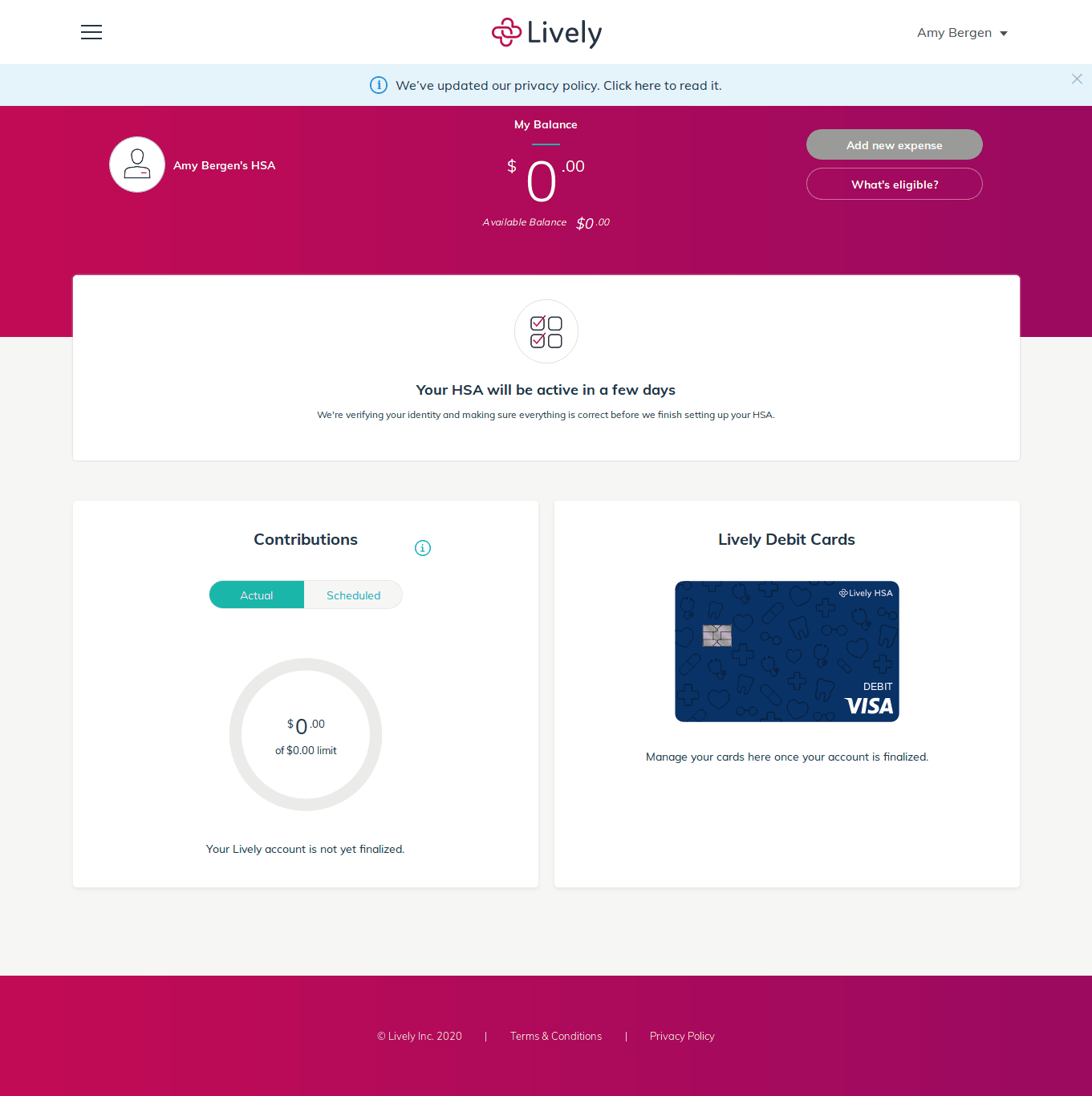

The enrollment process is quick for an individual account, and I could set up a fund transfer from my bank. Lively HSAs are FDIC insured up to $250,000 for extra peace of mind.

I specified how I’d contribute funds — individually rather than through an employer payroll. Then I set up initial and ongoing contribution amounts.

How much does a Lively HSA cost?

Individual and family Lively HSAs are free.

Lively’s fee-free structure plus the absence of a minimum balance requirement make Lively the most affordable option for a solo HSA.

Employers who want Lively HSA coverage for their employees pay a fee of $2.95 per employee per month with a $50 minimum.

Lively HSA investment options

Lively offers two investment options for both individuals and employers (and their employees):

- A self-directed Charles Schwab brokerage account

- A guided portfolio powered by Devenir

Charlse Schwab HSA brokerage account

You can choose to invest your Lively HSA funds via a self-directed Charles Schwab brokerage account. You’ll choose how to invest your HSA funds in any stock, ETF or mutual fund available through Charles Schwab. There’s no minimum balance to choose this option, but brokerage accounts of less than $3,000 are subject to a $24 annual fee.

Guided HSA portfolio by Devenir

If you prefer a hands-off investment approach, Devenir’s guided portfolio is like an HSA robo-advisor. Answer a few questions, and Devenir will invest your money based upon your risk tolerance and time horizon. Your investments will be automatically rebalanced every so often to keep you on track. The fee for the guided HSA portfolio is 0.50% of your account balance per year.

Cash account

If you do not want to invest your HSA funds, you can leave them in an interest-bearing cash account. Your money is FDIC-insured up to $250,000 through Lively’s partner banks.

The cash account is best if you plan to spend your HSA funds soon on qualifying medical expenses. Unfortunately, the interest paid on the Lively cash account is much too low to justify keeping it there for more than a few months. Interest rates are a tiny fraction of what you can earn with the best high-yield savings accounts.

Lively HSA features

Automatic deposits

You can easily set up a regular contribution amount and have it move seamlessly from your bank to your HSA.

Investment account

You can keep your HSA money for saving or spending, or you can take the extra step of investment. Lively partners with Charles Schwab, an original investment broker that caters to beginner and expert investors alike.

Though you can automate transfers from an HSA to an investment account, you do the work of investing on your own.

Self-directed brokerage

Ready to invest? Lively HSA holders get to direct their own investments through Charles Schwab. You’ll have multiple options, including mutual funds, individual stocks, brokered Certificates of Deposit (CDs), and commission-free ETFs with the Money Under 30 stamp of approval.

‘First dollar’ investing

This is a rare but crucial perk of the Lively HSA investment account. You don’t have to meet a minimum threshold to invest—you’ll start earning interest with your first dollar, hence the phrase “first dollar investing.”

Tax deductions

Besides a health fund cushion and an investment performer, the HSA can be a major tax saver. The Lively resource guide describes an HSA as a “supercharged IRA” come tax time. Not only are contributions tax-free, but interest is also tax-free too. So are withdrawals as long as you use the money for a qualified medical expense.

This kind of account is ideal for anyone who has an ACA (Affordable Care Act) health plan. I pay my own ACA premiums with post-tax income, so it’s nice to have some pre-tax money in the bank to help out with my ongoing—significant but not excessive—medical expenses.

Note any contribution you make above the annual limit ($3,550 for individuals) will be taxed. If you accidentally contribute too much you can withdraw it before the tax deadline.

User dashboard

Lively’s dashboard makes everything simple. You see your HSA balance when you log in, and each transaction is broken down by type so you can track your health spending. Investors can check out their investment performance and transaction info.

There’s also a handy mobile app for iOS or Android.

Links to other apps

Lively HSAs integrate with Empower, the free budgeting and paid wealth management app that stands out for its investment analysis. Link the two apps to keep all your financial info in one place.

Personal finance apps are helpful in so many ways, and this connection is an extra Lively perk.

Rollovers and transfers

Lively lets you “rollover” your HSA funds, or personally transfer them from one HSA provider to another, when you enroll or any time afterward. Rollovers are tax-free and limited to one per year.

You can make unlimited trustee-to-trustee transfers where the money goes straight from one HSA holder to another (you can’t personally access the funds during the transfer).

Employer accounts

Small business owners and other employers can add HSAs for their employees. There’s an easy onboarding process and a way to automate company contributions by linking payroll info to Lively. You can streamline employee pre-tax deductions too. Larger corporations may be able to deduct employee HSA expenses from their own taxes.

My experience with Lively HSA

Lively HSA had my attention at first dollar investing. Every cent gets invested towards my goals—with interest!—and I don’t have to start with hundreds of dollars if I’m not ready for that commitment.

My main priority is health care spending. After years of four-digit medical bills for a chronic condition and high insurance deductibles, I assume I’ll be spending my HSA cash before investment returns roll in. If I’m lucky enough not to, I’ll earn more interest and keep the balance into the next year!

Lively is a great account for spenders (you even get a debit card to use at the pharmacy), and withdrawals are tax-free, so I can deduct HSA money even after it’s spent. Health care deductions are some of my biggest tax savings as a self-employed worker.

The site is easy to navigate and transparent about fees — both big pluses. Low fees are a priority for me in any investment-based account since this indicates the company understands users’ need to minimize costs. Even for a savings account, I’m less likely to go with a competitor, like Health Equity, who charges fees for low balances.

As a personal preference, I wouldn’t use a self-directed investment brokerage right now. I like the experts to narrow down some options ahead of time so I don’t get overwhelmed. If you’re a hands-on investor, though, I’d encourage you to go for it.

Who is Lively HSA best for?

Health care spenders

For those planning to spend their HSA funds on qualified expenses, an easy feat if you have regular medical appointments, Lively is a standout option.

You can access cash at any time. I like to have plenty of money set aside for health care spending — it’s getting trickier to find an insurance plan without a high deductible!

Self-directed investors

If you’re thinking more long term, Lively’s partnership with Charles Schwab sets investors up to earn returns down the line. Charles Schwab investors have a dizzying array of choices, and the direction is up to you, which experienced or independently-minded investors will enjoy.

Self-employed workers

A Lively HSA will maximize your savings and account growth even without employer contributions.

Who shouldn’t use Lively HSA?

Investors who want guidance

Newer investors may prefer some additional hand-holding to make smart choices with their first investments (I know I did). Lively investors are largely on their own.

People with lower-deductible insurance plans

If your insurance deductible isn’t at least $1,400 for an individual it’s not high enough to qualify for a Lively HSA. Unsure if this applies to you? Look at the fine print on your health insurance policy.

Pros & cons

Pros

- No individual account fees — For many people, their HSA doubles as a long-term savings account that augments other savings goals like retirement. Fees add up over longer periods, and even if you’re planning on spending most of the money, the fee-free structure is a great bonus.

- Bank partnership — Since Lively HSA works with Charles Schwab, a broker that offers other banking and lending products, investors get bank-level customer service. That can come in handy.

- Online receipt storage — Lively tracks your health care expenses and receipts, which can be essential to have in one place when you need them.

- First dollar investing — Get started investing and building towards returns right away with a $1 minimum.

Cons

- Fund transfer lag time — Funds take a few days to transfer between Lively HSA savings and investment accounts. If you’re in a time crunch (for instance, if you need investment funds to pay for health care expenses) this wait time isn’t ideal.

- No pre-selected investments — Lively HSA doesn’t give you a vetted investment lineup of mutual funds, a service many other providers offer.

The competition

Here’s how Lively measures up alongside some other HSAs.

HealthEquity

HealthEquity also has different investment options based on your preferences. A self-directed account comes with lower administrative fees. If you enroll in AutoPilot or GPS — two advisor programs that manage your portfolio for you — the fees will be slightly higher.

HealthEquity also has different investment options based on your preferences. A self-directed account comes with lower administrative fees. If you enroll in AutoPilot or GPS — two advisor programs that manage your portfolio for you — the fees will be slightly higher.

There’s a substantial investment threshold of $2,000. Even if you don’t choose to invest, HealthEquity waives the account fee once you hit a $2,000 balance.

eHealth

If you need insurance coverage before saving up for an HSA, want to switch health insurance providers, or just want to look at your options before putting money down, eHealth is a gateway to plans for every budget.

If you need insurance coverage before saving up for an HSA, want to switch health insurance providers, or just want to look at your options before putting money down, eHealth is a gateway to plans for every budget.

The site partners with multiple health insurance carriers, including several that offer short-term or “gap” insurance to cover brief uninsured periods. After you enter some basic info about yourself and what you’re looking for, eHealth’s search engine matches you with providers, and they indicate which plans are HSA-compatible.

eHealth also partners with HSA administrators who set their own fees and interest rates. Visit the HSA section of their site to get a quote and compare plans with no obligation to buy.

Summary

HSA newbies, people with ongoing health expenses, and seasoned investors can all benefit from a Lively HSA. Keep Lively on the list if you’re shopping for health savings!