So you’ve decided to invest in a little gold, eh?

Maybe you’re looking for a hedge against inflation. Or a low-risk way to capitalize off of the demand for gold due to inflation. Or maybe, you heard Ray Dalio say he thinks gold is a better buy than crypto.

Whatever your reasoning, there are many ways to invest in gold that don’t necessarily involve buying fun-sized ingots from a vending machine.

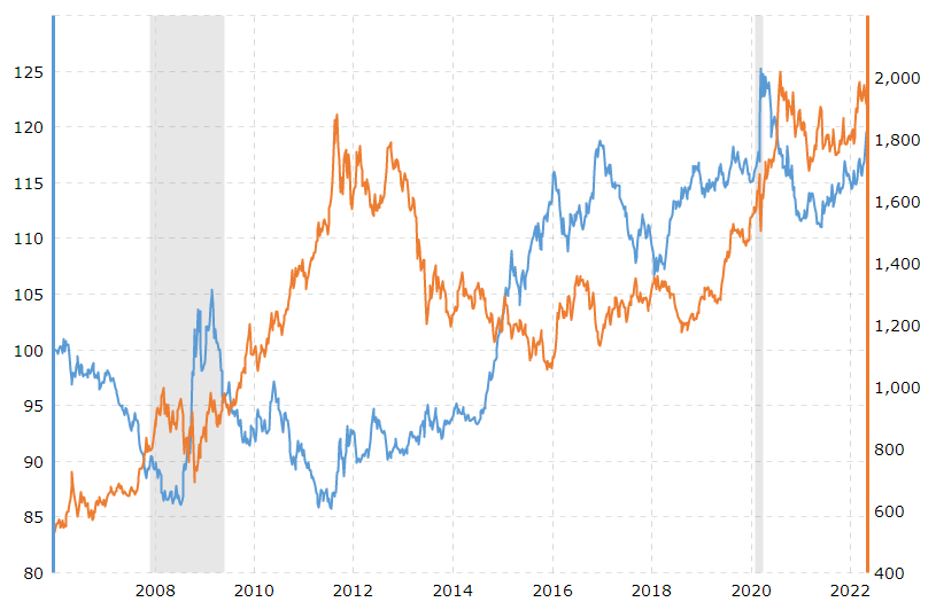

Image source: Ex Oriente Lux, as published in WSJ

You can buy stock in mining companies, shares of a bullion-backed ETF, and more — and with inflation rising, now might be an opportune time to buy your first gold asset.

But which assets should you buy? Which asset is best for long-term investing, and which has the best short-term upside potential? Should you invest directly or indirectly in gold?

And what the heck is bullion?

Let’s investigate the best gold stocks and ETFs to buy – and cover some FAQs below that!

Overview of the 5 best gold stocks

| Stock or ETF | Best for |

|---|---|

| Barrick Gold (NYSE: GOLD) | Investing in a single gold company with healthy growth |

| VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) | Investing in the gold mining industry as a whole |

| SPDR Gold Shares (NYSE: GLD) | Direct exposure to the value of gold bullion |

| GraniteShares Gold Trust (NYSE: BAR) | Low expense ratio/long-term investing |

| Kinross Gold (NYSE: KGC) | Upside potential/short-term investing |

Barrick Gold (NYSE: GOLD)

Canada-based mining giant Barrick Gold has become an investor darling in recent years due to its knack for smashing revenue targets while simultaneously lowering its operating costs. Traders are especially bullish on the stock because the company is more than a decade away from exhausting its current mines and they recently stocked up on cyanide and explosives.

VanEck Vectors Gold Miners ETF (NYSE: GDX)

The VanEck Gold Miners ETF contains holdings in 56 different gold mining companies — including Barrick Gold Corporation — and gives investors a convenient way to capitalize upon the success of the gold industry without a direct investment in the shiny stuff itself.

So, why would you want indirect exposure to gold?

Well, when demand for gold bullion rises, you may just want a stake in the companies swinging the pickaxes (so to speak). Case in point, between 2008 and 2011 when the value of gold rose 300%, shares of GDX rose nearly 400%.

Copyright: Village Roadshow, VH1 Films

GLD is the largest physically-backed gold ETF in the world, and is therefore considered the [you-know-what] standard of the industry. As SPDR themselves put it, “Gold Shares represent fractional, undivided beneficial ownership interests in the Trust, the sole assets of which are gold bullion, and from time to time, cash.”

In other words: Shares of GLD are the closest darn thing you can get to buying gold without buying literal bars of gold. So if you’re looking to diversify your portfolio with precious metals, GLD is a top-shelf pick.

GraniteShares Gold Trust is a popular alternative to GLD since it features a nearly identical operational setup — a big ol’ pile of gold — but charges a much lower expense ratio to buy in: 0.17% versus GLD’s 0.40%.

As you might recall, expense ratios are like ETF “subscription fees” paid annually based on how much you have invested in the fund. So BAR will be $23 cheaper than GLD for a $10,000 investment.

$23 on a $10k investment isn’t much in the short term, but over 30 years in an IRA — especially as your initial $10,000 investment grows to $20,000 and $40,000 — a high expense ratio can make a four-figure difference.

Therefore, BAR might be a better choice if you’re looking to retire on a (figurative) pile of gold :).

Kinross Gold (NYSE: KGC)

Finally, if you’re looking for a gold stock with higher upside potential than raw bullion or an ETF in the short term, Canadian mining outfit Kinross Gold may fit the bill.

Shares of KCG took a dive in Q2 due to uncertainty surrounding the company’s Russian mines (yikes), but the company managed to sign a deal on April 5 to sell 100% of its Russian assets and 90% of its Ghanan assets for a combined $905 million.

That means the company will now do the majority of its mining in North America, where geopolitical instability is less likely to throw a wrench in operations. This gives the Canadian mining underdog a serious advantage over competitors with mines in turbulent areas — and has led to some eyebrow-raising in the short-term gold trading community.

Summary of the 5 best gold stocks

| Stock or ETF | Overview | Market cap | 5-year performance |

|---|---|---|---|

| Barrick Gold Corporation (NYSE: GOLD) | One of the world’s largest, most successful mining companies | $40.1b | +33.73% |

| VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) | Basket of mining stocks for indirect exposure | N/A | +52.52% |

| SPDR Gold Shares (NYSE: GLD) | Largest physically-backed gold ETF in the world | $66.0b | +49.90% |

| GraniteShares Gold Trust (NYSE: BAR) | Lower-cap alternative to GLD with a lower expense ratio | $1.03b | +40.39% |

| Kinross Gold (NYSE: KGC) | U.S.-focused mining company with high upside potential | $6.48b | +20.77% |

How we came up with the list of the best gold stocks

To come up with this list, we considered the five most popular categories of gold investments — indirect exposure, long-term upside, etc.

(As you probably figured out, these “categories” became the Best For column in the first chart above).

Anyways, to pick the assets within each category, we carefully considered factors like:

- Investor sentiment (lots of chatter out there on gold vs. USD given 8.5% inflation)

- P/E ratios

- Expense ratios (greater than 0.60% is no bueno in my book)

- Proximity to bullion value, where applicable

- Geopolitical insulation from the war in Ukraine, inflation in sub-Saharan Africa, etc.

- 5-year returns

- Sustainability and ESG stuff

And more. There were at least four worthy contenders in each category, but the pantheon above represents the best a young investor can buy in Q2.

What is a gold stock?

A gold stock is a stock or ETF whose value is tied to the current market value of gold.

Some examples may include:

- Companies that mine and process gold

- Companies involved in gold exploration (i.e., finding it in the first place)

- ETFs that contain companies that explore, mine, and process gold

- ETFs that are backed by physical gold assets

As the value of gold goes up, the value of these assets tends to follow. That’s why investing in gold stocks is considered a safer, more convenient alternative to buying actual, physical gold yourself and stacking it in a safety deposit box.

Gold vs. bullion

You’ll often hear economists, investors, or Austin Powers’ nemesis Goldmember refer to something called “gold bullion.”

So what the heck is “bullion”? Sounds tasty.

In reality, bullion is just the term for pure gold in its physical form as legal tender. The term can also apply to other precious metals, such as silver or rhodium.

Gold coins and gold bars are considered bullion because they’re basically like the gold equivalent of dollar bills and cents. Meanwhile, gold rings and silver forks are not considered bullion because they’re not in the right form; they’re not coins or bars that one bank can easily send to another.

Why do folks invest in gold?

We have a whole feature on buying gold — is it time to add some to your portfolio? Which takes a deeper dive into the “why” behind it all, but here’s a TL;DR.

For thousands of years, humans have universally agreed that gold has monetary value. Whether you brought a sack of gold to Tokyo or Timbuktu, you’d probably be able to buy nice stuff with it.

As a result, gold tends to hold its value pretty steadily in the long term. So when folks lose faith in the value of their national currency or the economy overall, they stash money in gold until their concerns blow over.

What should you look for in a gold stock?

Market cap

If you’re investing in gold, it’s probably as a long-term hedge against inflation — not as a risky, short-term play.

Therefore, you might want to focus on gold stocks and ETFs with a large market cap, i.e. major, well-established players and funds in the gold space.

Expense ratio

With an ETF, the expense ratio is how much the creators of the ETF charge shareholders as a “management fee.” Therefore, an expense ratio of 0.30 means you’ll pay $30 a year for every $10,000 you have invested.

A gold ETF with an expense ratio below 0.5% is ideal, and any ETF with an expense ratio above 1% should be avoided.

Whether it’s backed by actual gold

Not all gold stocks and ETFs are backed by actual gold, meaning you’re buying part ownership in a literal pile of gold somewhere. Some, like the Global X Gold Explorers ETF (GOEX), are baskets of stocks that mine gold.

Neither backed or unbacked is objectively better; it just depends on whether you’d like to invest in the gold industry or actual gold bullion itself.

Sustainability

If you’re an ESG investor who likes to have your investments line up with your environmental/social/governance principles, you might want to do some extra research before investing in certain gold companies.

Needless to say, some international mining companies — especially those with mines in developing nations — may not be digging for what humanitarian groups call “ethical gold.”

Gold stocks vs. ETFs

Finally and more fundamentally, it’s worth considering whether you want to invest in a gold stock or an ETF (or both).

The same differences between regular ol’ stocks and ETFs apply here; ETFs are generally safer and less volatile due to their inherent diversity, but an individual gold stock may have higher upside potential – especially in the short term.

How to invest in gold stocks

Thankfully, you can buy gold stocks and ETFs pretty much anywhere you can buy regular stock. If you’re new to the stock market game, here are some options to start trading gold stocks:

Robinhood

Robinhood keeps things extremely simple. On each asset page, you get a quick pricing chart, a list of holdings for ETFs, and a buy button — that’s about it. So if you’re worried about feeling overwhelmed by your first gold stock buy, Robinhood is a great place to start.

J. P. Morgan Self-Directed Investing

If you’re a Chase customer, J.P. Morgan Self-Direct Investing slides right into your existing dashboard making it extremely easy and convenient to make trades while you’re in “personal banking” mode. Its Portfolio Builder for those with a balance over $2,500 can also assess your risk tolerance and help you build a gold-focused portfolio that won’t give you anxiety.

When to buy gold stocks

Generally speaking, when words like these start cropping up in the headlines of major economic news outlets…

“Plunge”

“Uncertain”

“Inflation”

…it might be time to start putting some cash into gold. Especially if inflation is rising, since many folks convert cash into gold during inflationary periods in order to preserve the value of their savings.

Now, the challenge with treating gold as a hedge against inflation is timing your exit. Once folks feel like they’re “in the clear” and exit their gold positions, the value of a single gold bar can plummet 40% within months.

That’s why many people tend to hold it; gold and other precious metals tend to be volatile in the short term and stable in the long term.

Gold stock FAQs

How does gold protect against inflation?

Gold is traditionally considered a hedge against inflation because when the USD gets weaker, a large population of investors buy up gold to preserve their wealth. This in turn raises demand, which raises the value of gold bullion and creates a nice ROI that (ideally) beats inflation.

So you could say that investors treating gold as a hedge against inflation is a bit of a self-fulfilling prophecy. Do keep in mind, though, that the fixed-rate I-Bond is a more stable inflation hedge that’s also taxed much lower than gold.

Does gold go up when stocks go down?

Generally speaking, yes. Here’s a visual to illustrate their rough inverse correlation, with gold in orange. As you can see, it’s not a perfect 1:1 inverse relationship, so tread carefully before pouring cash into gold during inflationary periods; always diversify and consider ETFs and I-Bonds to be safer, less volatile alternatives to bullion.

Which is the better investment: gold stocks or bullion?

You can invest directly in gold by buying gold bullion or shares in a gold fund, or indirectly by investing in the gold industry (mining, processing, etc.).

Neither is objectively better — it just depends on how much direct exposure you want to gold in your portfolio. If you’re unsure, why not invest in both and diversify?

Does it ever make sense to buy physical gold?

You can still buy bullion aka physical gold the old fashioned way through ATMs and dealers — but you’ll pay high fees to buy it, high fees to sell it back, and will need a safety deposit box to store it.

That’s why most gold investors prefer to just buy shares of a bullion-backed ETF. They’re free to buy, cheap to keep, and don’t require storage.

Summary

Despite representing a single element on the periodic table, gold gives us tons of ways to invest and diversify our portfolio.

From stock in individual mining companies to shares of a bullion-backed ETF, there are plenty of ways to benefit from gold’s impressive, 2,500-year run.

For specific next steps, check out our feature how to invest in gold for beginners.

Lastly, if you’re not quite convinced that gold stocks will save you from inflation, there’s no shame in going the safe, boring route to protect your capital. Buy some I-Bonds from Uncle Sam.