Depending on where you live, real estate can be a great deal or it could be ridiculously expensive. If you’re looking to invest in real estate by yourself to make money, you’re going to need to do a lot of reading to learn the in’s and out’s of real estate investing.

After you learn everything you need to know, there’s the issue of getting enough money to either buy a property outright or pay for a hefty down payment to get a mortgage. For most people, that’s simply not financially possible.

Thankfully, there’s another way to invest in real estate without having to do all of the research and fronting all of the money yourself.

You can use a real estate crowdfunding site, like RealtyMogul, to invest in real estate for a much smaller investment than it’d take to buy a property in your area.

Let’s dive into what RealtyMogul is and how it can satisfy your real estate investing needs.

RealtyMogul gives you a chance to invest in real estate without a hefty downpayment or a ton of detailed research on your local real estate market. While the service isn’t perfect, it does offer opportunity and diversification for those interested in investing in real estate.

- Open to both accredited and non-accredited investors

- Not limited to a single project

- REIT options

- Need to sign up to view some details

- Fees can be more transparent

What is RealtyMogul?

RealtyMogul is a platform that allows everyday investors to invest in something other than stocks, bonds ,and mutual funds.

RealtyMogul allows accredited investors to invest in individual real estate projects such as office buildings, retail real estate, and multi-family properties.

RealtyMogul also allows anyone with enough money to meet the investment minimums to invest in real estate investment trusts (REITs). REITs aren’t investments in a single particular property but instead are an investment in a portfolio of properties.

RealtyMogul has over 175,000 investors that have joined, over $400 million in real estate investment trusts and private placements, as well as over $100 million in investor disbursements so far.

How does RealtyMogul work?

RealtyMogul offers two different experiences depending on whether you’re an accredited investor or not. Becoming an accredited investor requires you to pass one of two tests:

- Income test. You either have to earn $200,000 or more as an individual or $300,000 or more for a joint couple for the last two years. In addition, you must expect to continue earning the same or higher income in the current year. You must use the individual or joint methodology throughout all years unless you got married during the period. You can’t mix and match for each year to qualify.

- Net worth test. If your net worth as an individual or in combination with your spouse exceeds $1,000,000 excluding your primary residence, then you pass the test.

To gain access to the accredited investor investment options that RealtyMogul offers, you’ll need to sign up for an account.

Signing up for a RealtyMogul account and viewing investments

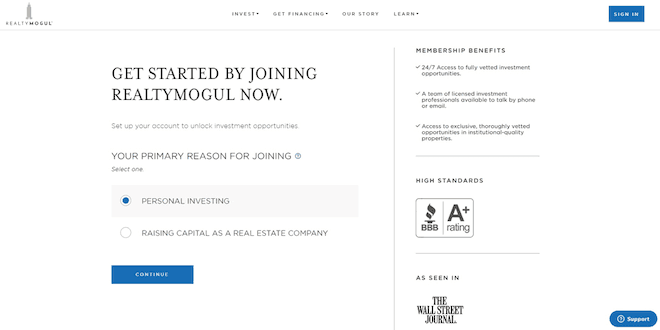

First, you’ll need to choose personal investing and click the continue button.

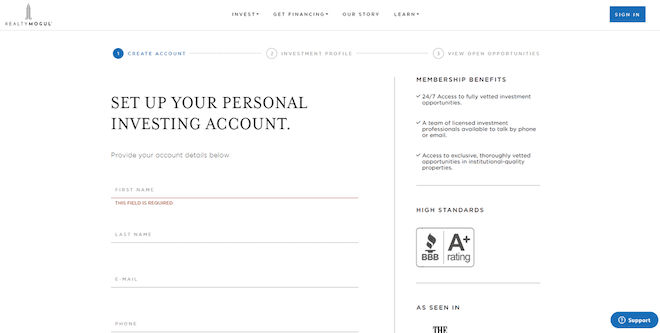

Next, you create an account. You’ll need to input your first name, last name, email address, phone number and a password.

You’ll also have to review and agree to their terms and conditions and privacy policy. Then, click to confirm you aren’t a robot before clicking the continue button at the bottom of the page.

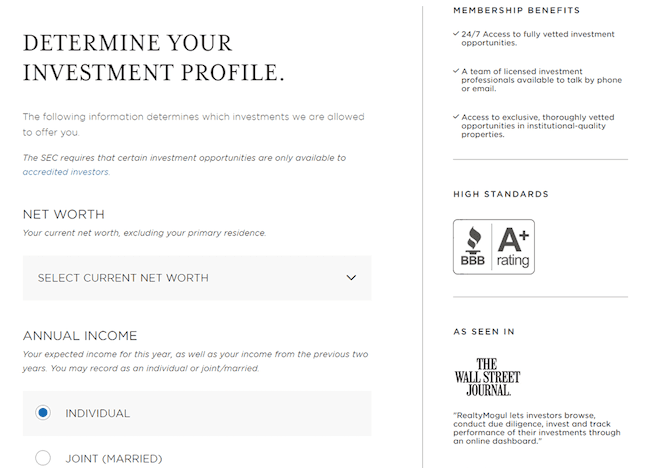

After you create an account, you’ll have to submit basic information to determine if you’re an accredited investor.

You’ll need to input your net worth (excluding your primary residence) and your income (either as an individual or joint) for the prior two years as well as this year’s estimated income before clicking the continue button at the bottom of the page.

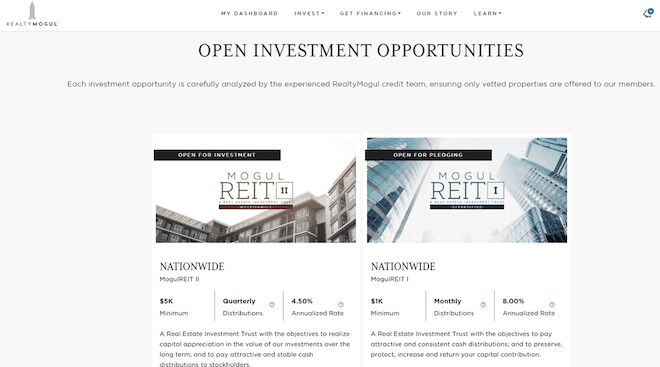

If you’re not an accredited investor, the site takes you to your investment options. You can only invest in the REITs RealtyMogul offers to non-accredited investors. The investment minimums for the two REITs offered are currently $1,000 or $5,000 depending on which REIT you choose to invest it.

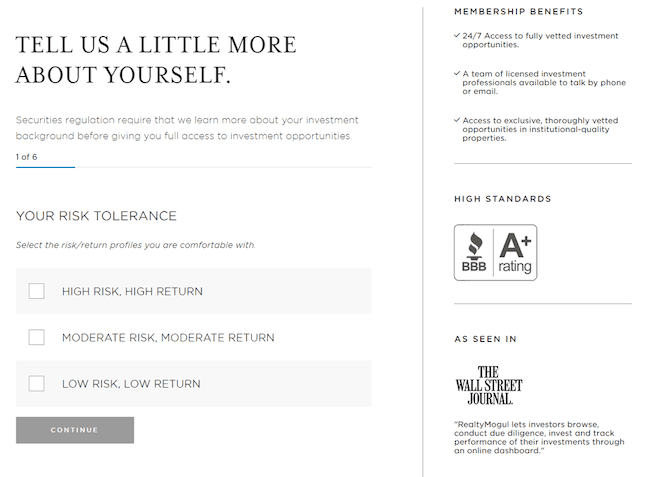

If you are an accredited investor, you have to fill out more information. First, they ask about your risk tolerance. Select one or more you’re comfortable with then click the continue button at the bottom of the screen.

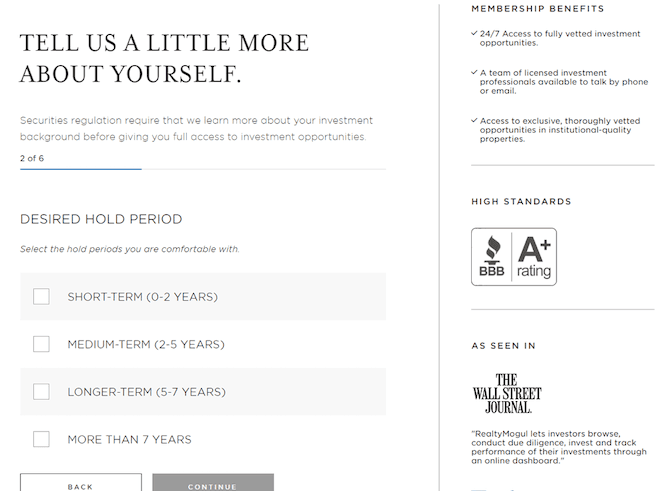

Next, RealtyMogul asks for your desired hold period also known as the length of time you want to be invested. Select one or more then click the continue button at the bottom of the screen.

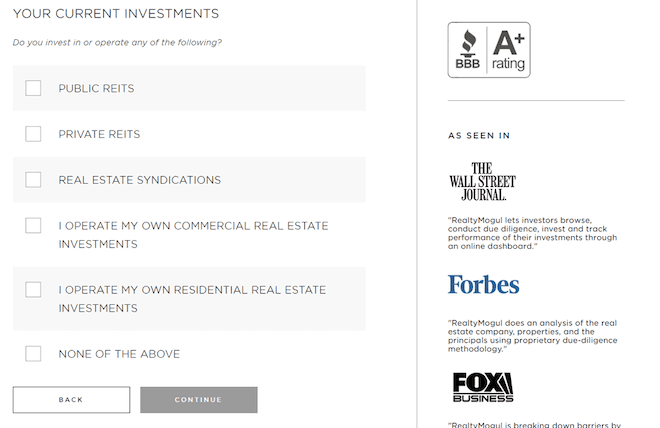

After that, RealtyMogul asks about your current investments. Select items you’re currently invested in before clicking the continue button at the bottom of the screen.

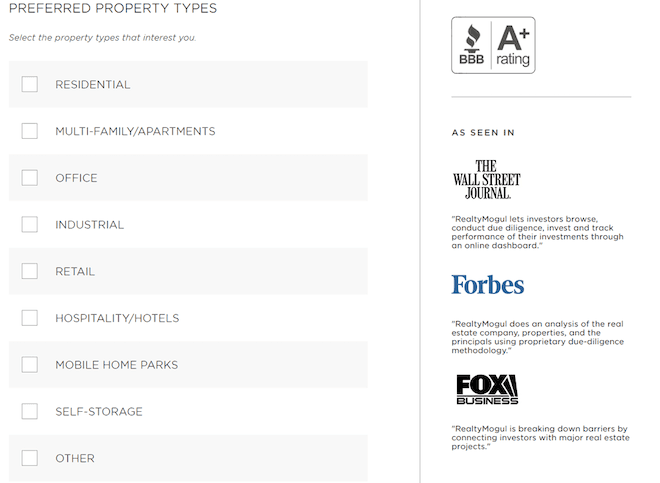

Select the types of properties you’re interested in investing in then click the continue button at the bottom of the screen.

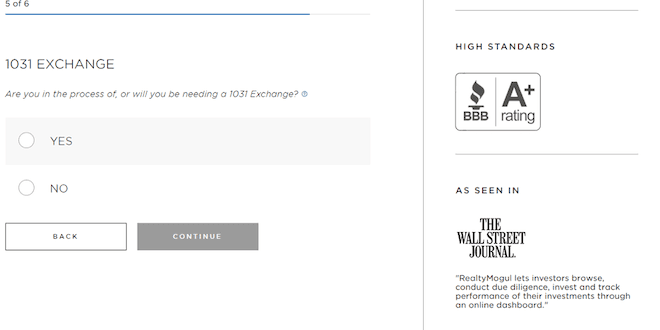

RealtyMogul also asks if you will need 1031 exchanges. If you don’t know what a 1031 exchange is, you’re probably not interested. Select an answer and click continue at the bottom of the screen.

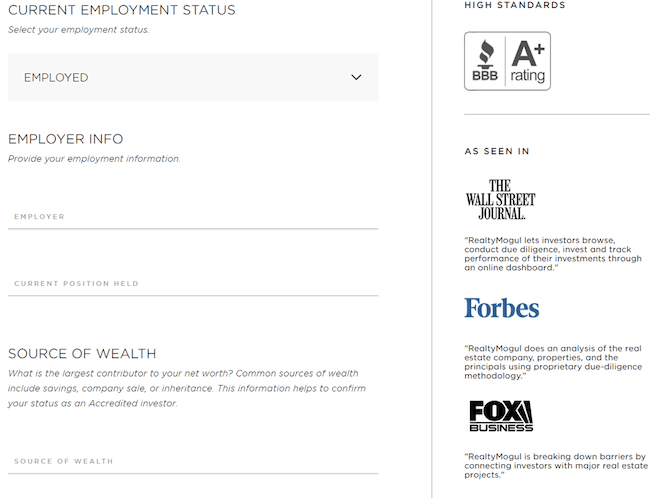

In the final step, you have to fill out your employment status, employer information including employer and position held and your source of wealth. Once complete, click continue at the bottom of the screen.

Before you gain access to investments for accredited investors, RealtyMogul must contact you to verify your accredited investor status. RealtyMogul will call you to verify information or, if you prefer, you can call them.

As an accredited investor, you’ll have more investment options. Accredited investors can invest in private placement opportunities with individual transactions on properties. These can include multi-family properties, office buildings, retail, residential, industrial, hospitality/hotels, mobile home parks, self-storage, and other real estate opportunities.

Unfortunately, I’m not an accredited investor so I could not access these investments to share with you.

Investing with RealtyMogul

The actual process of purchasing an investment at RealtyMogul is simple. Sign up for an account, pick an investment, and complete the transaction online. Then, monitor your investment on the RealtyMogul dashboard.

But how does RealtyMogul select the investments they offer and how do you know what you’re investing in?

RealtyMogul claims to provide due diligence and test every potential investment opportunity against their most conservative financial models. Then, each investment requires unanimous approval from RealtyMogul’s investment committee.

When looking at potential investments to offer RealtyMogul members, RealtyMogul looks at four core criteria and hundreds of data points. In particular, RealtyMogul looks at:

- The real estate company that will acquire the real estate and execute the business plan

- The market for the particular property in question

- The specific property including income, costs, tenants, rates and a site visit from a RealtyMogul team member

- The legal structure of the potential investment

Then, RealtyMogul provides specific information on every deal to potential investors in case they want to perform their own due diligence before investing their hard-earned money.

How much does RealtyMogul cost?

RealtyMogul isn’t very straightforward when it comes to the cost of their service. The fastest way to find information about their fees is to visit their investment options page nested under the “INVEST” tab at the top of the screen. Then, scroll down to the REIT offerings and click view details.

For example, The Apartment Growth REIT has organizational and offering costs limited to 3% of the total offering, a 1.25% annualized management fee paid to RM Adviser and other operating expenses.

If you want to understand all of the fees you’ll be charged, you’d be best off reading the Offer Circular document for the particular investment you’re interested in. Alternatively, you could call the investor relations phone number and speak with a RealtyMogul representative.

Should you consider investing with RealtyMogul?

Deciding whether to invest in RealtyMogul will depend on many factors. First, you’ll need to decide if investing in real estate is right for you. Real estate is typically a long-term investment, so don’t expect dramatic returns overnight or a quick exit from your investment.

You’ll need to make sure the investments they offer are both suitable for you and your investment goals. Read the Offer Circulars closely and ask questions if you have them before you decide to invest.

A big part of whether investing in RealtyMogul is worth it is your accredited investor status. If you’re an accredited investor, you have many more investment options than non-accredited investors. That said, some non-accredited investors may find the two REIT offerings suitable for their needs and investing goals.

If you are a non-accredited investor, you’ll want to check RealtyMogul’s REIT offerings against REIT offerings you can access elsewhere. You may be able to find a REIT investing option elsewhere that better fits with your specific goals.

Pros & Cons

Pros

- Low minimum investment — With RealtyMogul, you can invest in real estate without having to purchase a piece of property in full

- Accredited investor options — Their accredited investor options allow investors to own portions of real estate investments to spread out their risk across many properties rather than putting all of their money into a single project.

- REIT options — Their REIT options open up real estate investing to a much larger audience than the typical real estate landlord that can afford to buy a single property or multiple properties on their own.

Cons

- You have to sign up for an account to view their investments — You can view the two REITs they offer without an account but they’re buried under sub-menus on the home page.

- It’s difficult to find the fees RealtyMogul charges — It would be nice to see the information disclosed in a straightforward way everyone can understand. Make sure to read the detailed circulars about each investment or call investor relations to learn more before you invest.

- Investments aren’t as liquid as traditional investments — They aren’t publicly traded, so you may only be able to sell your investment under certain conditions. This means you may not be able to sell your investments quickly.

Summary

RealtyMogul gives you a chance to invest in real estate without a hefty downpayment or a ton of detailed research on your local real estate market. While the service isn’t perfect, it does offer an opportunity for those interested in investing in real estate, especially if you’re an accredited investor.

You can learn more and start investing by signing up for a RealtyMogul account today.