The medical exam may seem like the most intimidating aspect of buying life insurance, but it’s actually simpler and quicker than a typical doctor’s appointment.

Contrary to some misconceptions, most insurance carriers won’t automatically deny you coverage for less-than-perfect health and lifestyle habits. Instead, they use the testing process to get an overall picture of your health that’s as accurate as possible, arriving at a premium rate that ideally works for both you and the insurer.

How the exam works

Life insurance medical exams are free for you (the insurer pays for them) and often location-flexible. While the initial tests are free, if you request a second test for reconsideration, you may have to cover the cost yourself.

Insurance carriers partner with medical testing companies, and the medical companies either set you up with an appointment at an exam center or send a rep to your home (or workplace). Telehealth options may even be available, depending on the provider.

The exam is brief, less than an hour — normally around 30 minutes — and has two parts: the health questionnaire and the physical exam.

Health questionnaire

First, the representative will go through a Q&A, covering a lot of the questions you answered on your initial application and then some. This helps them verify your info, which insurers double-check against the Medical Information Bureau and prescription databases, so I recommend being as honest as possible with the medical professional who is conducting your appointment.

Since they’ll do a deep dive into your medical history, you should attend your appointment with some details handy. These include:

- Contact info (email, phone, address) for your primary care provider and any other medical professionals you’ve seen in the past few years.

- A list of any medications you’re taking or have taken in the past few years, including dosage amounts.

- A list of any hospitalizations or medical procedures you’ve had in the past several years.

- Names of any major health conditions your biological parents have.

- Dates of any recent medical diagnoses, treatments, or hospitalizations.

- A driver’s license, state ID, or another document for ID verification.

They’ll ask some lifestyle-related questions too, including ones about smoking and recreational drug use. Be honest — I can’t overstate how important honesty is. The medical provider shouldn’t judge you, and the worst they can do is deny you coverage. You’ll be denied anyway if your bloodwork, urine samples, or prescription history show a drastically different picture than the one you gave in your interview.

Physical exam

The physical test mostly consists of the routine checks a nurse performs at a standard doctor’s appointment, like a physical. These include:

- Pulse, to check your heart rate.

- Blood pressure.

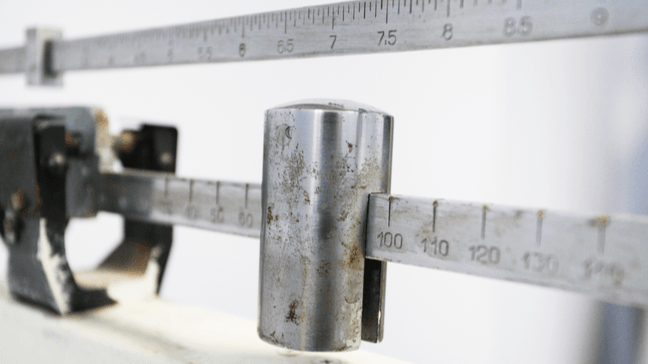

- Height and weight, to check height/weight ratio and Body Mass Index (BMI).

- Blood sample (a brief draw from your arm to fill a small vial).

- Urine sample (the standard pee-into-a-cup at the doctor’s office).

You don’t have to disrobe, though you should wear a shirt with sleeves that can be rolled up easily for a blood sample. And you can usually request any accommodations you need (I usually ask medical providers not to reveal my weight or BMI to me, and they don’t mind).

The major medical equipment tests, like the electrocardiogram or EKG, are reserved for older candidates seeking life insurance—if you have a heart condition or you’re applying for a super-high coverage amount, your insurer may want additional testing.

What conditions do insurance companies test for?

High blood pressure

High blood pressure increases the risk of heart disease, kidney damage, and other health problems. Stress can elevate a blood pressure reading, so stay calm during the test and take it easy on the caffeine beforehand.

Diabetes

Urine and blood samples can both indicate elevated glucose levels, and blood samples show high hemoglobin A1C levels — both indicators of diabetes or prediabetes. If you have diabetes and you’ve disclosed it, the test will check your levels to see how well your condition is being managed.

High cholesterol levels

High levels of LDL cholesterol (the bad kind) and triglycerides increase the risk of heart disease and stroke, so your blood test checks for both.

Sexually transmitted diseases

Insurers are mainly concerned with life-threatening STDs, like HIV/AIDS or syphilis, which can greatly affect a person’s health. If you have one of these conditions, you won’t necessarily be denied; insurers will look at how you’re managing it with medication and treatment.

Other STDs might be included in the testing (and if the medical rep asks about them specifically, you should be honest) but won’t affect your premiums.

Other diseases and disorders

Turns out medical science can get a lot of information from small bodily fluid samples. Here’s an incomplete list of what your samples get checked for:

- Nicotine, marijuana, and other drug use.

- Liver, kidney, and pancreas function, including signs of disease.

- Immune disorders.

- Red and white blood cell levels, including signs of blood disorders.

- Prostate-specific antigen levels (for prostate cancer in men).

- Hepatitis.

- Urine acidity (another sign of diabetes or kidney disease).

What else do the tests consider?

Height and weight ratio

Height and weight ratios determine your BMI, and a high BMI correlates with diabetes, heart disease, and other conditions, so it’ll likely bump up your premiums.

Marijuana use

Urine tests can detect THC, the psychoactive ingredient in marijuana or cannabis, for up to a month after you’ve used it. Will this affect your life insurance eligibility or raise your premiums? Not always — marijuana friendliness depends on the insurer, the reason for use (recreational or medical), and the frequency of use.

Some insurers treat marijuana like tobacco, which means you’re automatically bumped up to the more expensive smokers’ premium rates. Others will give better rates for infrequent users — think less than once a month — or those with non-smoking methods of ingesting marijuana. And if you only use CBD, the increasingly popular non-psychoactive cannabis compound, that’s not likely to be an issue at all.

People using cannabis for medical reasons can often qualify for low rates more easily than recreational users. Medical patients’ premiums are more strongly affected by the underlying conditions they’re using marijuana to treat. But even recreational users can often get decent rates through cannabis-friendly carriers.

Nicotine or tobacco use is a big deal for life insurers — it’s typically one of the first questions you’re asked in an online screening. Urinalysis tests for both nicotine and cotinine, a longer-lasting chemical that can stay in your body over a week.

The urine tests can indicate how recently you’ve used tobacco, but they don’t distinguish between forms of nicotine. Cigarettes, e-cigarettes, cigars, and chewing tobacco — even the nicotine in patches, gum, and other products designed to help you quit — all show up on the screen as tobacco. Any tobacco use automatically places you in a more expensive premium class, two to three times pricier than nonsmoker rates.

The best thing to do is disclose how and how often you use nicotine during the initial questionnaire. A celebratory cigar once or twice a year and a pack-a-week habit will be treated differently by insurers, even if they look the same in your test results.

If you’re using smoking cessation products and trying to quit, some carriers will offer more favorable rates and some won’t (another variable you can search for as you’re comparing insurance company fine print).

You do want to be upfront about exactly when you stopped smoking, whether it was recently or years ago. Most insurers won’t give you nonsmoker rates until you’ve been tobacco-free for a year, so quitting smoking a few weeks before your medical exam won’t get you a better price right away. After a year or longer without tobacco, you can ask for rate reconsideration, which involves another medical screening.

Other drug use

Let the medical professional that is doing your exam know about any prescription drugs you’re taking—have the prescription details ready, or contact info for the doctor who authorized them. Don’t skip taking your prescribed dosage just for the drug test.

Drugs like opiates, amphetamines, benzodiazepines, barbiturates, and anything in the “addictive” or “strong painkiller” category will show up as red flags on life insurance medical screenings. Unless you can prove you have a legitimate prescription, most carriers will deny you coverage or raise your rates.

People recovering from addictions can still get life insurance, depending on their individual situation. Many insurers require a certain amount of time in sobriety or treatment before you’re eligible. And some drugs used to treat addictions, like methadone, are still tested for in the exam screening but might not lead to an automatic denial—as long as you’re honest with the insurance company about how much you take and why.

One final note: don’t try to beat the drug test with last-minute over-the-counter “cleanses” or other products. Compared to the sophisticated screenings most medical companies use, these products won’t have much effect and will be a waste of your money.

How to prepare

Insurers look at sustained, overall health, not just your health on exam day. Still, a few pre-exam techniques may nudge your results in the right direction, or simply help you feel more calm and healthy.

A week or so pre-exam

Up your intake of “good-cholesterol” and “good-blood-pressure” food (nuts, fish, fruit, greens, whole grains) and limit fried, sugary, salty, and highly processed food, which can increase blood pressure and blood glucose readings.

Start drinking more water. Hydration opens up your veins for easier blood draws, rinses chemicals from your system, and is generally just a good idea.

A day or so pre-exam

Avoid caffeine and alcohol (at least keep your caffeine use on the light side) and skip strenuous workouts, since intense exercise can raise blood pressure readings. Remember, keep drinking water.

If you’re under the weather and temporarily taking nasal decongestants, allergy remedies, or over-the-counter cold and flu meds, see if you can reschedule your medical exam (some OTC medicines show up on a drug screen).

You may be asked to fast for 8-12 hours before your exam to get accurate blood sugar and cholesterol reading. If so, the insurer or medical company should let you know during the scheduling process of your appointment. So, a morning exam, which would allow you to fast the night before, is a good idea if that works for your schedule.

Exam day

If you have been asked to fast before your exam, make sure not to eat before heading to your appointment. Instead, make sure that you continue to stay hydrated, try to eliminate stressors, and show up to your appointment on time.

What to do after the exam is over

Next, it is time to wait. While it is easy to get impatient and wonder if the insurance company has forgotten about you, give them some time to get back to you. While some insurers will get back to you within a week, or so, of your exam, others will take weeks.

The length of the underwriting process varies by insurer, but you should get your lab test results within a few weeks—you’ll be contacted by your doctor, the medical testing facility, or the insurer themselves. You can request a copy of the exam results; they’re valid for up to six months for any other insurance applications that may require a physical. So, you will want to hold on to them.

Why is testing recommended?

From an insurer’s perspective, medical testing lets them estimate how much risk they’re taking on by giving you a life insurance policy. Underwriting isn’t an exact science, but health conditions and health history can suggest how likely you are to die at an early age, something neither you nor the insurance provider wants to happen — they’ll have to pay a hefty death benefit to your survivors.

To compensate for the extra risk, insurers charge higher premiums to people with medical conditions. Most insurance companies base their pricing tiers on applicants’ risk of early death, including some factors you can’t control; women pay a little less because they tend to live longer than men, for instance, and prices climb as you get older.

You can also save money by taking the life insurance medical exam, especially if you’re healthy with few or no major risk factors. If insurers confirm you’re a low-risk candidate, they’ll offer you low premiums. By contrast, if you’re a healthy, low-risk applicant who doesn’t opt for the exam, insurers don’t have the stats to prove your risk level — so they’ll default to charging higher prices.

What if the insurer declines coverage based on your test results?

First, get the specific reasons for their denial in writing. This will help you decide the next steps, like applying for a policy with more lenient requirements.

Some insurers have narrower ranges of “acceptable” diagnostic results than others, and if your cholesterol or glucose was just a tad too high for one carrier, it might be fine for the next carrier. And if the tests indicate you might have a medical condition you didn’t know about, naturally, you should follow up with your doctor.

If you’re offered coverage but your test results bump your premium rates up higher than you’d like, you still have options. You can purchase a short-term life insurance policy at the higher rate, then reapply or request a reconsideration when the term ends, after you’ve made some health and lifestyle changes (quitting tobacco, altering your diet, et cetera). Your prices do increase as you get older, but better health can often get you a steep enough discount to make up for it, especially if you drop from smoker to nonsmoker rates.

Another thing to keep in mind: insurance policies have a two-year “contestability period” after purchase, during which they can cancel your policy if they uncover any false information. That’s another compelling reason to be honest about your health and habits from the beginning.

No-medical-exam insurance policies

It’s possible to skip the medical exam altogether and still get life insurance. That said, no-medical-exam policies still require you to supply some basic health info and previous medical records, and they’re not available for all candidates.

Additionally, no-exam insurance can sometimes get you coverage much more quickly through an “accelerated underwriting” process that skips the weeks of waiting for lab results. You can find no-exam policies for term and whole life insurance, though you likely won’t qualify for a huge payout. Policies without exams tend to max out death benefits at $500,000 or so. For the high six-and-seven-figure coverage limits, you’ll need an exam.

For a young, healthy person buying a term life insurance policy, the no-exam process can be super easy – complete a phone interview, send over some records, and sign. There’s usually a waiting period before coverage kicks in. If you have time to take the exam, though, it’s a simple way to save on premiums.

Summary

Don’t let medical testing intimidate you, or prevent you from buying a policy. Life insurance is an important part of comprehensive insurance coverage, and it’s always cheaper to buy when you’re young, so don’t wait too long.