So, you’re tired of being in debt and you are ready to put together a debt elimination plan. Awesome!

You may have heard of the debt snowball and it’s similar, yet different, partner the debt avalanche.

These two methods are almost exactly alike in that they both ask you to pay minimum payments on all your debts except for one focus debt.

With either method, you’ll send every extra dollar you can find until the focus debt is paid off. Once it is, then the next debt in line becomes you new focus debt. As you pay off your debts and your minimum payments go away, you will have more and more money to send as additional payments to the debt on which you are focused (hence the snowball analogy).

The only difference between the snowball and avalanche is the order that you will pay off your debts. Some personal finance writers zealously argue that one is better than another; we believe it’s a matter of personal preference (as long as your debt is going down!)

The debt snowball method

With the debt snowball method, you pay off your debts from smallest balance to largest balance, regardless of interest rates.

The reason for this is that often times people have a lot of little debts lying around. Lots of statements coming every month. Lots of minimum payments to pay and it gets overwhelming. Doctor’s bills from several different places, little balances here and there on store credit cards, or money borrowed from family members.

It all just feels overwhelming when it seems like everywhere you turn you owe more money.

When you pay your debts from the smallest to largest balance you start to clear those little debts away very quickly. Depending on your situation you might even get rid of an entire debt every month for the first few months.

That feels very empowering. You see progress quickly and you start to feel like you really can do this. Then by the time you start tackling the larger debts, like your car loan or the big credit card balance, you have the confidence, ability, and extra cash flow to make it to the end.

The debt avalanche method

In the debt avalanche method, you pay your debts from highest interest rate to lowest interest rate, regardless of balance.

Mathematically this makes the most sense. You will pay less in interest if you tackle your debts in this order. Saving money on interest means you will pay your debts off more quickly. Isn’t the whole point of getting out of debt to do it as quickly as possible?

You get the most bang for your buck when you tackle the highest interest rate first. Why pay a debt that isn’t charging any interest when you have a credit card that is charging 18%?

The secret no one is talking about

Some people have zealous opinions about which method is better. The Dave Ramsey crowd is hell bent on the debt snowball—it has a cult-like following. The avalanche group thinks math rules over all and can’t understand why everyone doesn’t see it their way.

But here’s the secret… it barely matters!

The best way to pay off debt is to make the minimum payments on all of your debts except one focus debt. Hone in on one debt and send every dollar you can towards that debt until it’s gone. Which debt you pick makes very little difference! Don’t believe me? Let’s do the math.

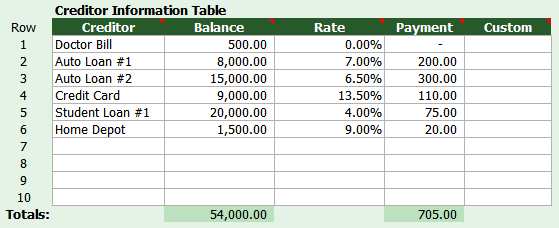

Let’s take a husband and wife, Joe and Suzie, with the following debts:

Together they have decided they can pay $1,000 a month towards debt payments, including all minimum payments. Joe wants to pay off their debts using the avalanche method, highest interest rate first. But Suzie wants to use the debt snowball and pay the lowest balance first.

- Using Joe’s avalanche the couple will be debt free after five years and four months. They will pay $8,394 in interest.

- Using Suzie’s snowball the couple will be debt free after five years and five months. They will pay $9,378 in interest.

The difference is one month and $985 over five years.

Now, $985 is a good chunk of money. But by month, there’s only a $15.15 difference in interest doing it the snowball way vs. the avalanche. The point is, it’s not worth fighting over. I say, pick the debt that bothers you the most and tackle it. Then move on to the next debt that is bothering you the most and so on.

Summary

The snowball and avalanche methods are nearly identical in that you’ll be able to pay off your debt quickly (depending on how much debt you have). Staying motivated is more important than a few extra dollars in interest that you’ll save through the avalanche method. Because the worst result is giving up on you plan or sliding back into debt.

Want to check it out with your own numbers? You can download a debt snowball calculator here that will allow you to compare the snowball, avalanche, and a custom order.