Bestow is our top-rated life insurance company for young adults. Bestow provides an easy way to quote and buy term life insurance policies online.

Bestow is an insurance provider offering term life insurance starting at $11 a month, with no medical exam required to apply. Receive an instant decision and a free quote after filling out the short online application.

- No medical exam or bloodwork

- Easy application process

- Lot of policy options

- Lower approval odds

- May have higher prices

What Is Bestow?

Bestow is a life insurance company that wants to make getting life insurance easy. They focus on using big data rather than medical exams and needles to underwrite the life insurance policies they offer.

Its goal as a company is to make life insurance simpler and more human. They do this by offering an easy-to-understand application that you can complete quickly online. Bestow aims to provide life insurance in minutes, not weeks.

The policies Bestow offers are provided by North American Company for Life and Health Insurance. This company is rated A+ (Superior) by A.M. Best, which is the second-highest rating available out of the 15 categories A.M. Best rates.

What Types of Insurance Can You Purchase Using Bestow?

Rather than sell both whole and term life insurance, Bestow only offers term life insurance which is a great option for most people. Selling one type of life insurance makes the process simpler, which is one of Bestow’s goals.

In particular, Bestow currently offers quotes for 10-, 15-, 20-, 25-, and 30-year term life insurance policies. You can apply for these policies in as little as five minutes.

The coverage available on the life insurance policies ranges from as little as $50,000 to as much as $1,500,000.

Bestow is available in every state in the US except for New York.

Related: Is Life Insurance Worth It and When Do You Need It?

My Experience Getting a Quote Through Bestow

Getting a quote through Bestow is easy and super fast. Here’s my experience getting a quote.

Step One: Getting Started

When you visit Bestow’s website, it’s easy to find where to go to start the quote process.

Click on “Get Quote” in the top right or “Let’s Get Started” on the left side of the page.

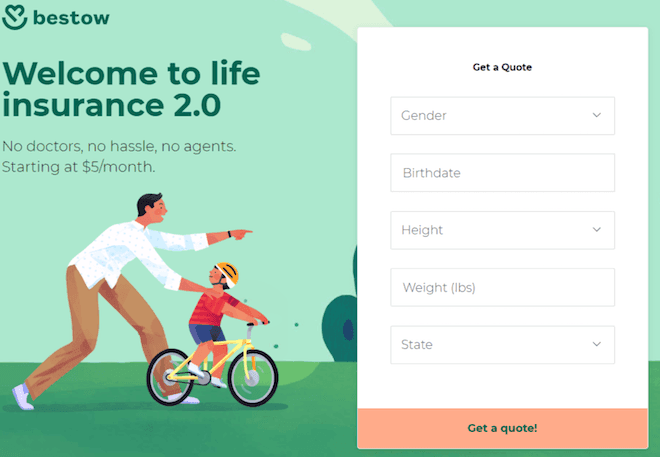

Step Two: Basic Info

Getting started with a quote is easy. Enter your gender, birth date, height, weight, and the state you live in to get started. Then, click “Get a quote!”

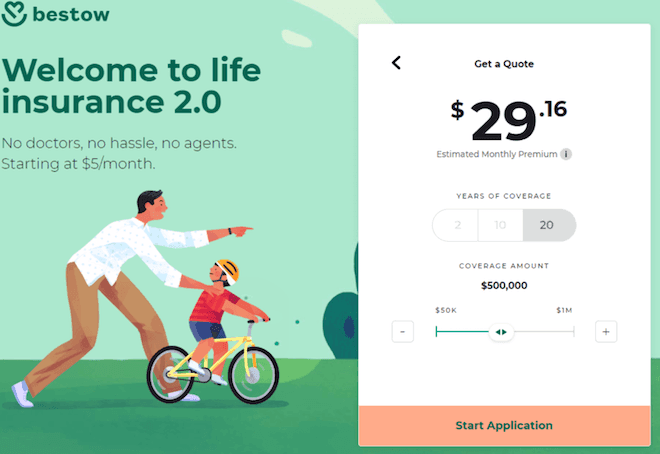

Step Three: Quote Estimate

Bestow gives you an estimated quote based on the term and coverage amount you select. Click “Start Application” to get a more detailed quote for your specific situation.

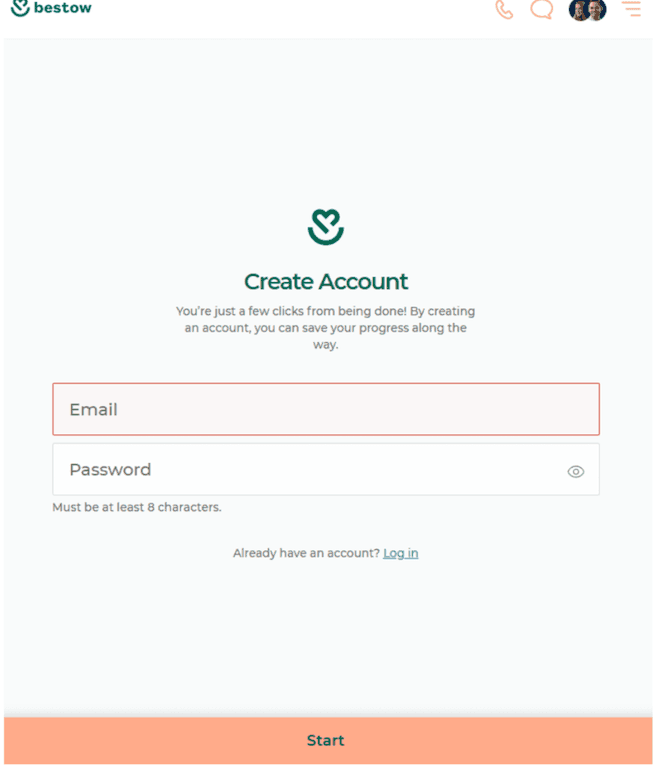

Step Four: Start the Application

To start an application, you have to create an account with an email address. Then, you have to create a password. Then, click “Start” to get started.

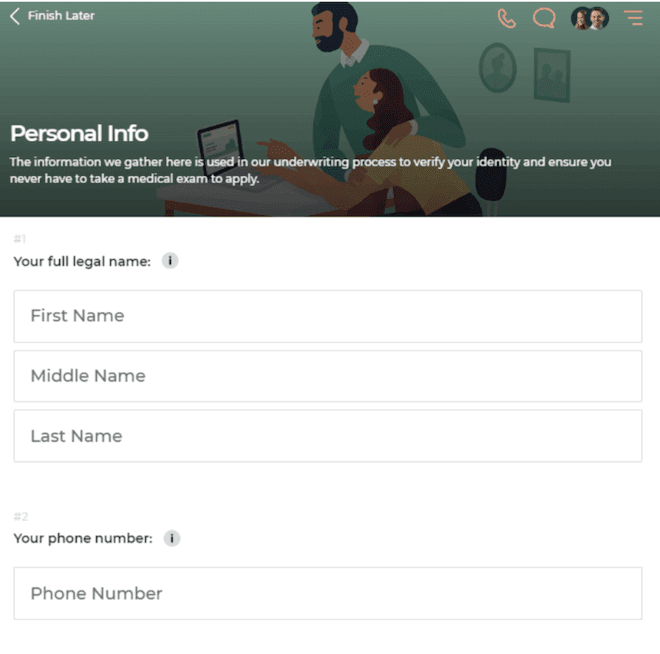

Step Five: Personal Info

Next, Bestow asks for more detailed information about you including your full name, phone number, address, gender, date of birth, height, and weight.

Fill in the requested information then click “Complete Section” at the bottom of the page.

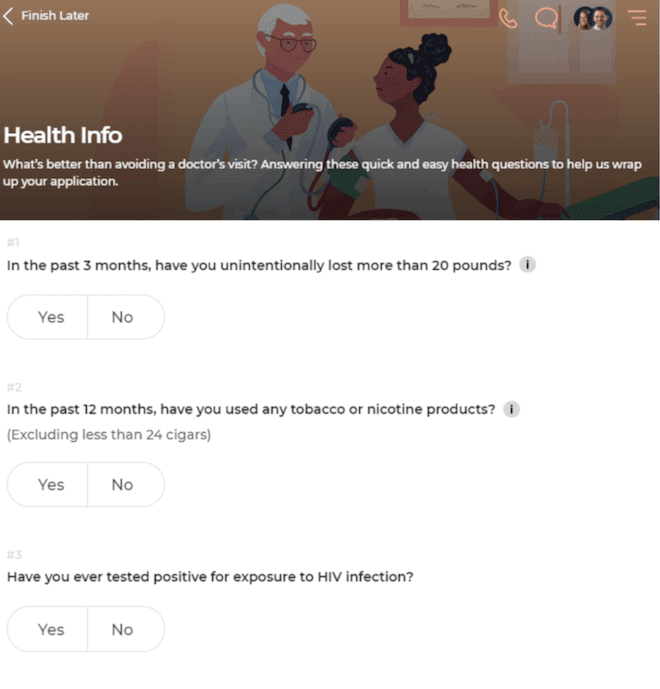

Step Six: Health Info

Bestow continues to ask seven main questions about health including weight loss, tobacco use, HIV, disability, medical history, and more.

Bestow may also ask follow-up questions based on your responses. Complete this section then click “Complete Section”.

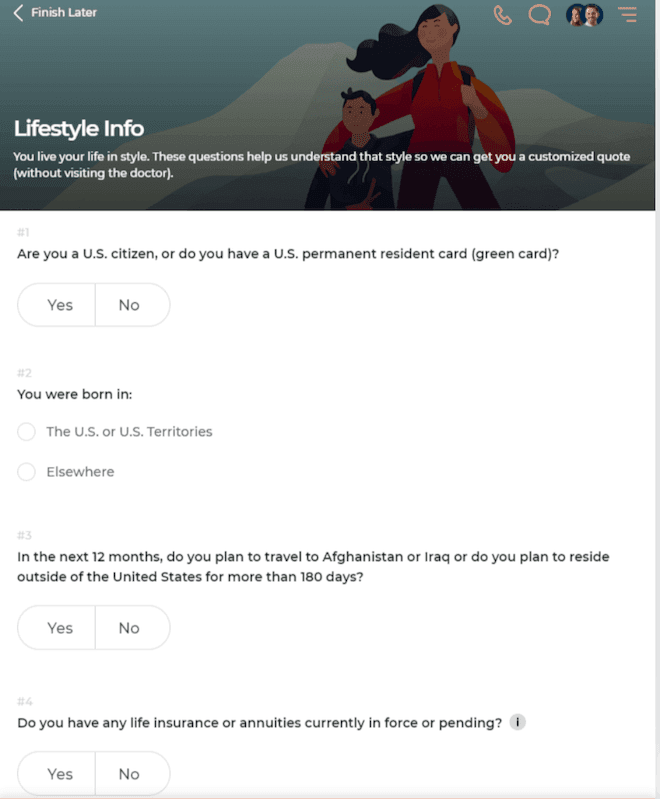

Step Seven: Lifestyle Info

Bestow then asks 13 main lifestyle questions including where you were born, residency, travel plans, employment, income, future hobby plans and more. Click “Complete Section” when done answering the questions.

Once all three major sections are completed, click “Submit Your Application”.

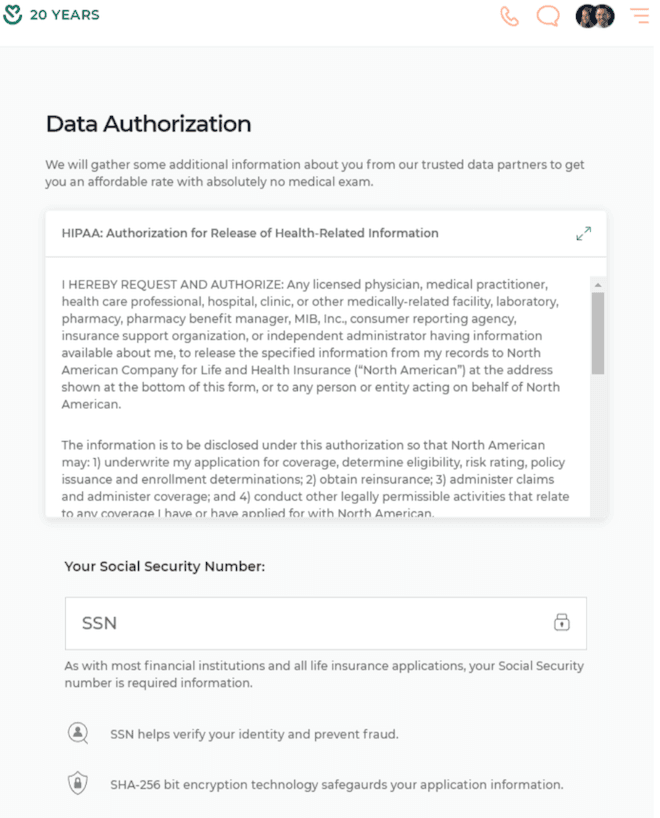

Step Eight: Data Authorization

Next, you’ll be asked to authorize Bestow to collect medical data about you. They’ll also ask for your Social Security Number.

Once completed, click “Sign and Continue”.

How Much Does Bestow Cost?

The cost of a term life insurance policy will vary depending on a wide range of circumstances. While there are obviously more factors than the ones listed below, some of the biggest factors that influence life insurance rates include:

- Gender

- Age

- Height

- Weight

- Health history

- Term length selected

- Coverage amount selected

Using Bestow’s initial life insurance pricing based on age, gender, height, weight, location, term, and coverage amount, here are a few example prices Bestow shows for healthy individuals (as of August 3oth, 2022):

- 20-year term, $500,000 policy, female, 25 years old – $17.25/month

- 20-year term, $500,000 policy, male, 25 years old – $27.25/month

- 20-year term, $1,000,000 policy, male, 25 years old – $48.50/month

- 20-year term, $1,000,000 policy, male, 35 years old – $63.50/month

- 30-year term, $250,000 policy, female, 25 years old – $16.21/month

- 30-year term, $250,000 policy, female, 35 years old – $21.00/month

- 30-year term, $250,000 policy, female, 45 years old – $34.54/month

- 30-year term, $100,000 policy, female, 30 years old – $12.00/month

- 30 year term, $1,000,000 policy, female, 30 years old – $51.83/month

Pros & Cons

Pros

- No medical exam — Bestow won’t need a medical exam or bloodwork to process your application. This is great if you don’t want to deal with the hassle of going to appointments or if you hate the needles that come with bloodwork.

- Easy application — Bestow’s application process is super simple and straight forward. You can answer all of the questions in just a few minutes and submit your application. As long as you meet their underwriting requirements, you could get your life insurance policy in just minutes after you get started.

- Not commission-based — Bestow won’t try to up-sell you to more expensive policies to earn more commissions. If you deal with a sales representative, they don’t work on commission.

- Lot of policy options — Bestow offers a wide variety of policy options. You can choose coverage from $50,000 – $1.5 million, with terms of 10, 15, 20, 25, or 30 years.

Cons

- No medical exam means less odds for approval — While no medical exam life insurance sounds tempting, it may result in you getting denied for life insurance coverage when a medical exam may have gotten you approved.

- Bestow may have higher prices — Prices for Bestow life insurance policies may be higher than policies that require a medical exam due to this lack of current information, so make sure to shop around for the best price and policy combination for you.

The competition

| Bestow | Policygenius | |

|---|---|---|

| Types of life insurance offered | Term | Term, whole (through other companies) |

| Coverage options | $50,000 – $1,500,000 | Up to $2 million |

| How long does it take to get your policy? | A few minutes | A few days |

Bestow vs Policygenius

Policygenius, rather than providing insurance directly, lets you compare multiple quotes from a variety of companies, saving you the headache of filling out a ton of applications to get the best quote.

Policygenius has a partnership with Brighthouse SimplySelect℠ and offers term life insurance (with coverage up to $2 million) with no medical exam required. What’s especially nice is that you won’t be stuck paying higher premiums just because you don’t want a medical exam.

Policygenius says, after the questionnaire, you can get your policy in just three to four days.

Summary

If you don’t currently have life insurance – and even if you do – it won’t hurt to get a free quote with Bestow.

Getting a Bestow quote could help you find a more affordable policy, or, if you decide to move forward with the policy, let you quickly secure the life insurance you need.

The process is quick, easy, and can help you get the life insurance you need without all of the hassles of traditional term life insurance that requires a medical exam.

Even though Bestow’s process is quick and easy, make sure to get quotes from other life insurance companies, too. That way you can compare prices and find the best policy for you.