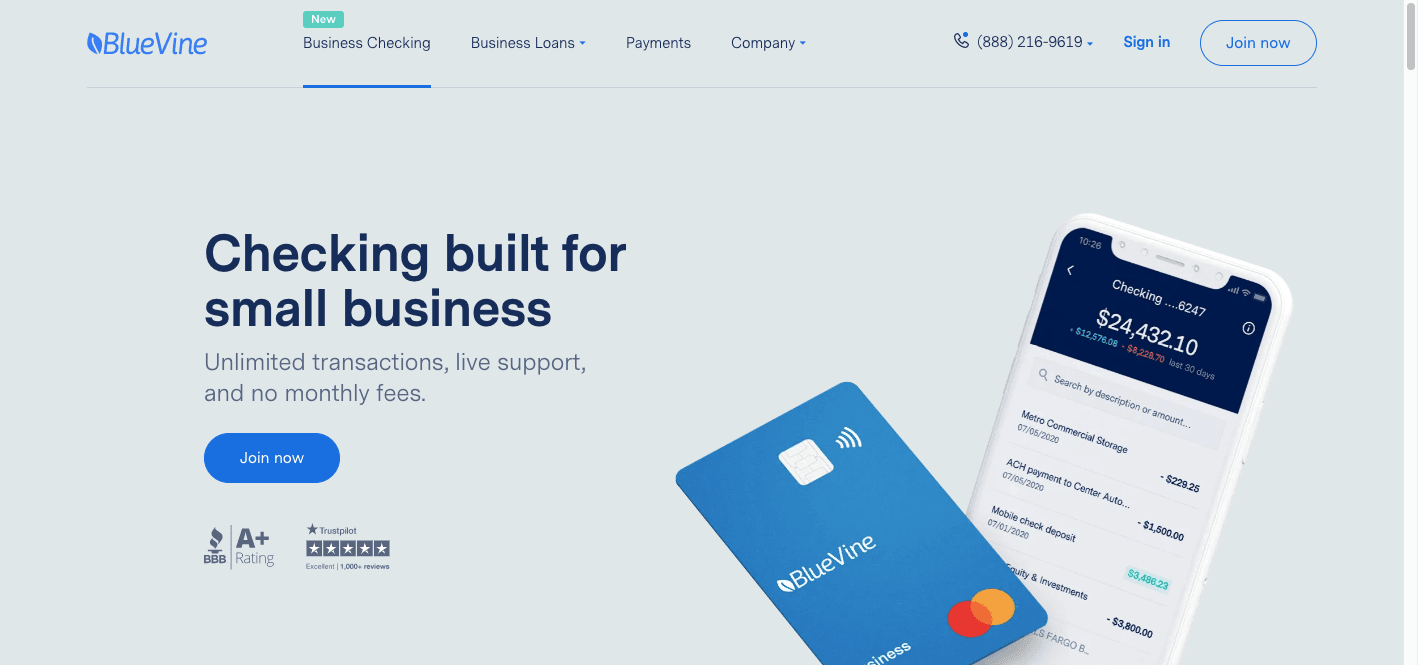

For small businesses, having a reliable bank that doesn’t charge a lot of fees can be so instrumental to your success. But all too often you have to choose: low fees, or reliable service?

Bluevine is a business bank that’s dedicated to giving you both.

What is Bluevine?

Bluevine is a bank that’s focused on small businesses and their unique needs. They offer everyday banking services like online checking, transfers, and ATM access — but with some cool features like 2.00% interest on balances up to $250,000 if you meet a monthly activity goal

Bluevine also provides small business loans, invoice factoring, and flexible business payments.

Founded in 2013, Bluevine has some major fintech street cred: Its leadership team and co-founders count PayPal, Xero, Google Capital, McKinsey, and Microsoft among their prior roles.

How does Bluevine work?

Bluevine is a bank for small business, so they’re dedicated to reducing fees and streamlining the banking process. Small business owners can count on easy, online access to their checking accounts with no monthly fees.

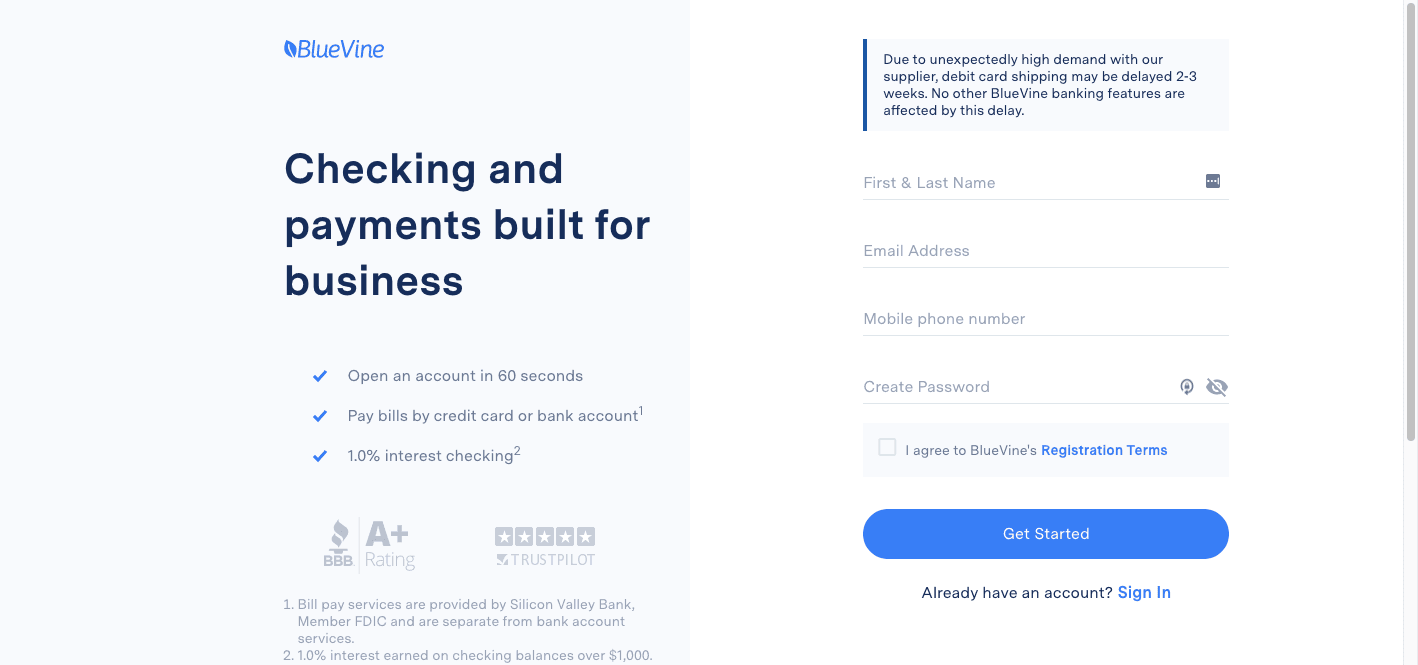

Signing up for Bluevine is simple—you can apply in 60 seconds. It really is that fast.

Make sure you sign up from the Checking Account page, otherwise you may find yourself applying for a Bluevine loan. Which is convenient and great if you’re looking for that, but if you just want fee-free checking, stick to the business checking page.

Also note that right on the first page of the sign-up process, Bluevine warns you that there will be a delay in receiving your debit card.

When you sign up, Bluevine will ask for some personal information to create your account:

- Name.

- Phone number.

- Email.

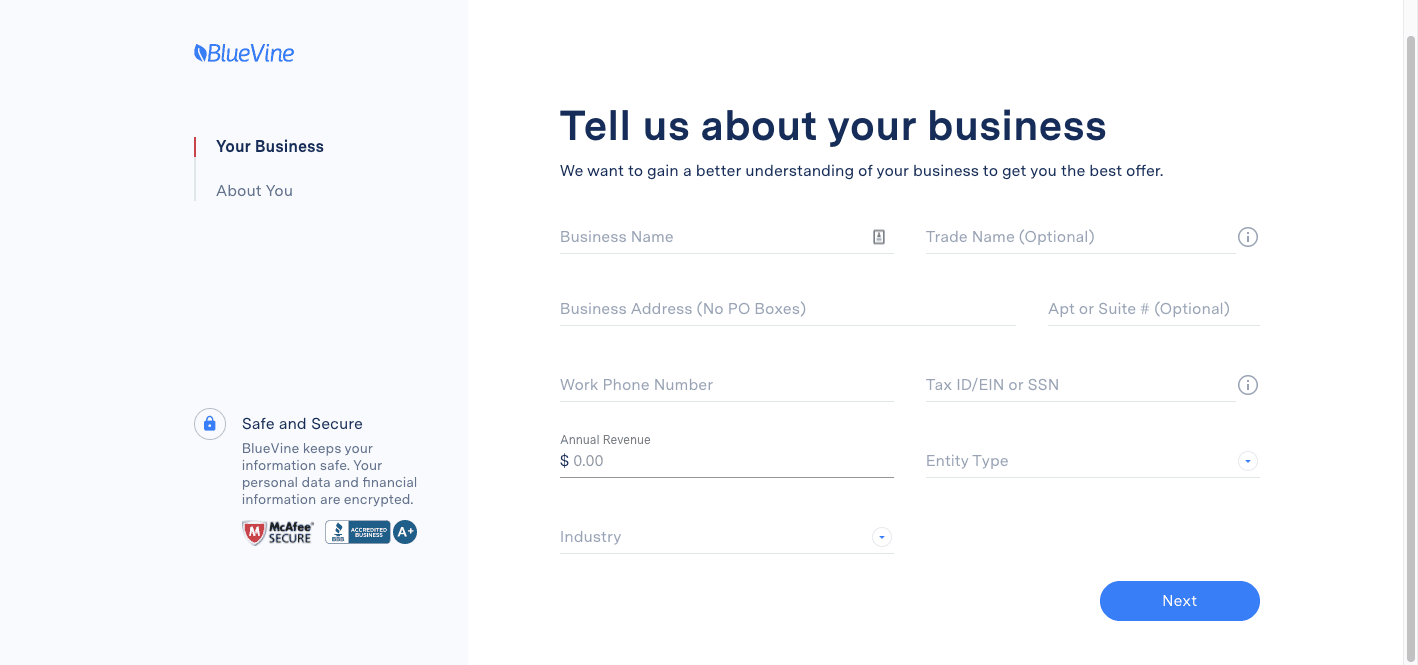

Create a safe and secure password to continue with your application. Next, Bluevine needs some information about your business:

- Business name.

- Trade name.

- Business address.

- Work phone number.

- Employer ID Number (EIN) or Social Security Number.

- Annual revenue (dollars).

- Entity type: corporation, general partnership, limited liability company (LLC), limited liability partnership (LLP), limited partnership (LP), or sole proprietor.

- Industry.

Bluevine promises your data will never be shared with unauthorized parties and is encrypted using “the most advanced tools.”

Pricing for Bluevine

Bluevine’s online business checking account is free, with no monthly fees, ATM fees, or NSF fees.

In fact, the only fees you’ll encounter are if you need to expedite delivery of a debit card, if you deposit cash at a GreenDot retail location ($4.95), or if you need to send a wire ($15).

Also, while Bluevine doesn’t charge a fee for ATM use, you may be charged an ATM fee by out-of-network ATM orders. That could happen even if you don’t complete the transaction.

Bluevine features

Free business checking

As an online bank, Bluevine doesn’t have to cover the kind of overhead that larger, brick-and-mortar banks do, so they can offer free online business checking accounts.

High interest rate

Bluevine will pay 2.00% APY on balances up to $250,000 if you meet a monthly activity goal. Not many other business banks pay interest on checking accounts.

Free checks, etc.

Along with your free checking account, Bluevine includes other freebies, too — free checks, for starters.

Here are a few other perks to Bluevine worth checking out:

- Free transfers between accounts.

- Mobile banking app.

- Mobile check deposit.

- Unlimited transactions.

Debit card

Withdraw cash and pay for purchases with your Bluevine Debit Mastercard©. You can also use it to shop online or conduct transactions at an ATM. Bluevine won’t charge you ATM fees at any of their 38,000 in-network ATMs.

Transfers

Link another bank account to your Bluevine account and take advantage of free transfers between accounts. Move money from bank to bank or pay yourself for a job well done.

You can also make ACH payments from your Bluevine account to a vendor or biller, or set up bill pay with one-time or recurring payments.

Mobile banking app

If you need to take care of business when you’re on the go, use the Bluevine mobile banking app. Deposit checks with your phone or check up on your transactions. It’s a streamlined way to monitor your cash flow.

Unlimited transactions

Unlike some banks, your Bluevine transactions are unlimited. So you don’t have to worry about nearing your monthly cap or paying out-of-pocket just because you’ve had a lot of transactions this month.

My experience researching Bluevine

It was definitely easy to sign up for Bluevine using their website once I hit the right link. Clearly, small business loans are a big component of Bluevine’s offerings, so it’s important to stick to the business checking portion of the site if that’s your focus.

I love a no-fee checking account and hate paying fees just to stash my money in a bank, so I was excited to see what else Bluevine had to offer. For example, the ability to pay vendors by check, wire, or ACH was much-appreciated flexibility. I don’t often have a need for writing checks from my business account, and it seems silly to pay a lot of money to buy checks when I’m only going to write a handful.

With Bluevine the checks are free, so I don’t have to choose between wasting money on something I only need once in a while or going without something that, hey, I actually do need once in a while.

Who is Bluevine best for?

No bank is perfect for everyone. So here’s who Bluevine is best suited for:

Small-business banking

Bluevine is tailored to the needs of small businesses. Larger companies are going to have more complex needs, so they’ll be better served by a bigger bank, but for small-business owners who don’t want to pay for services they aren’t going to use, Bluevine fits the bill.

No monthly fees

Small-business owners who don’t way to pay monthly fees to own an account will find peace of mind at Bluevine. Same with owners who are tired of trying to maintain a particular balance in their account to avoid penalties. There’s no minimum balance requirement with Bluevine.

High-interest business checking

Bluevine pays interest on your balance—not a common feature in banks for small businesses. No minimum balance required.

Who shouldn’t use Bluevine?

That being said, there are a few kinds of people who may not find Bluevine a good fit.

In-person banking types

For Bluevine to work for you, you’ll need to be comfortable using an online bank. I know some people simply prefer the face-to-face service of a local, brick-and-mortar institution, so if that’s you, you might not be satisfied with an online-only bank.

Separate savings

If you require a separate business savings account for your business, whether to set aside money for taxes, for capital improvements, or for a rainy day, you won’t find it at Bluevine. Bluevine only offers a business checking account, not a business savings account.

Cash businesses

Speaking of cash, if your business primarily does cash sales, you might find Bluevine to be a bit of a hassle. You can make deposits at GreenDot stores, but Bluevine charges $4.95 for that.

Pros & cons

Pros

- Almost no fees — No monthly fee, no ATM fee, no NSF fee, no transfer fee. Just a low fee for wires (outgoing only — incoming are free) and a separate fee for GreenDot store deposits.

- Interest-bearing — A rarity in business checking accounts, Bluevine pays 2.00% interest on balances up to $250,000 if you meet a monthly activity goal

- Variety of payment methods — Whether you want to send money by account transfer or pay bills or vendors via wire, ACH, debit card, or good old-fashioned check, you can.

Cons

- No in-person branches — Bluevine is online-only, so there’s no physical bank location to visit if you need help or want to talk to a friendly face.

- No separate savings account — Bluevine is a business checking account only, no separate business savings.

- Cash deposits — Each GreenDot deposit carries a $4.95 fee.

The competition

Bluevine is among the best business checking account options, but there’s a number of competitors you may find a better choice for your needs or business niche.

Bluevine vs Chase Business Complete Banking℠

Chase Business Complete Banking℠ account has a variety of fees and requirements, depending on how big your balance is.

Chase Business Complete Banking℠ is a small business checking account that offers a competitive suite of benefits for business owners providing you what you need to start or grow your business and keep it going.

- Convenient physical bank access

- Wide range of additional banking services

- QuickAccept℠ payment processing feature

- Monthly fee may apply

- There's a limit to free transactions

Chase does not pay interest on your balance, although it does permit up to $5,000 in cash deposits without a fee. Plus, Chase has more than 4,700 branches.

» MORE: Read more about Chase Bank review

Bluevine vs Lili

You’ll get fee-free checking with Lili, which is built for freelance workers (an often forgotten about niche). In addition to no maintenance or overdraft fees, you’ll also get free cash withdrawals with your Visa® business debit card at more than 38,000 MoneyPass ATMs across the country.

Lili is an online banking solution built for the freelancer. You’ll get all the tools you need to manage your money and file taxes, as well as the debit card and ATM access you’d get with a personal bank account.

With no hidden fees or minimum balance requirements, it’s the perfect platform for the busy independent contractor.

- No hidden fees

- Automatic savings buckets

- Get your paycheck early

- Limited ATM usability on deposits

- For freelancers (and other business types) only

As a freelancer, you’ll also have a suite of tools to help manage your finances. Those tools include expense tracking and automatic savings for taxes (which can be a lifesaver for freelancers who need to prepare their own taxes each year). At tax time, you can pull a report of all your expenses to ensure you don’t miss a single deduction.

» MORE: Read more in our Lili review

Bluevine vs Novo

Novo is an online-only business checking, and they also require nearly no fees — just $27 for insufficient funds and $27 for uncollected funds returned. There’s no minimum balance required at Novo.

Novo is an online business platform geared towards small business owners, startups, entrepreneurs, and freelancers. When you start your own business, you’ll quickly find that using your personal bank account can get overwhelming.

That's where Novo comes in with an easy to set up free checking account dedicated to separate business expenses.

- No monthly fees or balance requirements

- Unlimited fee-free transactions

- Smart Insights for your business

- No cash deposits (money order required)

Novo doesn’t pay interest on your balance, however, so you won’t earn more by banking with Novo. On the other hand, Novo does offer some small-business perks such as discounts on popular software and integrations with tools such as Slack and Quickbooks.

ATM fees are also reimbursed up to $7 per month, which is great for limited out-of-network usage.

» MORE: Read more our Novo Review

Summary

If you own a small business and you’re looking for high-interest business checking, Bluevine is a sensible choice, with no fees and mobile and online access.