The Discover it® cash back credit card is one of the very best cash rewards credit cards you can once you understand how the rewards work.

We rank the Discover it® Cash Back card among the best credit cards for young adults because of the card’s versatile cashback program, award-winning customer service, a competitive sign-up bonus, and an introductory 0% APR on purchases.

All information about Discover it Cash Back has been collected independently by MoneyUnder30.com. Content has not been reviewed or approved by the issuer. Unlimited Cash Back Match on cash back earned the first year. Earn 5% Cash Back on everyday purchases that rotate every quarter. Rotating categories include purchases at restaurants, grocery stores, gas stations, and more (up to the quarterly maximum). Earn 1% Cash Back on all other eligible purchases. $0 A decent all-around card with high rewards on everyday purchases, 0% intro APR period, and no annual fee. Offer details accurate as of 9/6/23Discover it® Cash Back

Welcome Offer

Rewards

Annual Fee

Our Thoughts

Overview

The Discover it® Cash Back card is a multi-purpose card for consumers who want to earn cash rewards with every purchase but also may want to take advantage of a 0% intro APR on a large purchase.

The Discover it® Cash Back Card offers:

Five percent cash back

The card has a 5 percent cash back program in categories that change each quarter, up to the $1,500 quarterly maximum and must be activated quarterly.

Unlimited one percent cash back

The Discover it® Cash Back card automatically offers unlimited one percent cash back on all other purchases.

Cash back match

Discover will match the cash back you’ve earned at the end of your first year, automatically. For example, if you earn $200 in cash back during the first year, you’ll receive an additional $200 cashback bonus. This feature is only for new card members and only valid the first year.

The cash back match feature is Discover’s answer to competing credit card issuers offering sign-up bonuses if you spend so much within three months of opening the card. Although you’ll need to wait a year to collect your matched rewards, this match is potentially more valuable than competing bonuses, because there’s no cap on the rewards you can earn. If you manage to earn $400 in cash back rewards the first year, you’ll get a $400 match. Earn $500, get an additional $500, etc.

No annual fee

Not only is there no annual fee for the Discover it® cards, but there’s also no over limit fee, and no foreign transaction fees.

No late fee

Discover also offers a rare waiver of any fees on your first late payment and no interest rate increases for paying late.

It’s important to point out that, in addition to issuing the credit cards, Discover owns its own payment network. While a majority of credit and debit cards issued in the United States are either Visa or MasterCard, Discover, like American Express, is a network of its own. So, you could run into merchants where Discover isn’t accepted, although that’s increasingly rare in the United States. (In my experience, you’re more likely to encounter merchants that don’t accept American Express than Discover.)

Student versions

The Discover it® Cash Back requires excellent credit, but in our experience, Discover is better at working with applicants who don’t yet qualify for the prime Discover it® cards. The Discover it® Student card is a good example.

This card is specifically for those who are just starting out with credit. But just like the non-student version it has some great cash back rewards.

Student cardmembers can earn 5 percent cash back in categories that change quarterly, up to the quarterly maximum when you activate, and unlimited one percent cash back on all other purchases, automatically. Discover will match all the cash back you’ve earned at the end of your first year automatically. This feature is only for new cardmembers.

The student card offers the Good Grades Rewards feature. Get $20 statement credit each school year your GPA is 3.0 or higher for up to the first five years*—see the application page for full terms.

If you are a student and would like to get started with Discover, you have two options:

Discover it® Student Cash Back: As with the Discover it® Cash Back, you’ll earn 5 percent cash back in categories that change quarterly when you activate ($1,500 max spend), and 1 percent on all other purchases.

Discover it® Student Chrome: The Discover it® Student chrome has a slightly different rewards structure: Get 2 percent cash back automatically at restaurants and gas stations, for the first $1,000 in purchases each quarter, and one percent on all other purchases. The Discover it® Student chrome card also features Good Grades Rewards and will match new cardmembers’ cash back earned in the first year.

What are Discover it® ‘5% rotating bonus categories’?

Discover’s 5% rotating bonus categories include gas stations, grocery stores, restaurants, Amazon.com, wholesale clubs, and more.

With Discover, you’ll also get 1 percent cash back on all other purchases.

How much cashback can you really earn with the Discover it® Cash Back?

So how much cash back can you get back if you spend $100? $500? $1,000? Let’s look at some examples:

Examples of earning 5 percent cash back

On restaurants…

Let’s start by basing your cash back amount on the restaurants category (When it’s at 5%). If you spend:

- $250 at restaurants, $200 on groceries, $50 on gas, and $100 at Target in a month using your Discover it® card, you’d get $16 in cash back for that month ($48/quarter).

On Amazon.com and at retailers…

Some years, Discover’s fourth quarter bonus categories should excite anyone doing some holiday shopping. For every $500 you spend in the current category of spending (let’s say Amazon.com), you’ll get $25 cash back. Plus, if it’s your first year as a Discover it® cardmember, remember that all of your first-year cash back is matched, with no limit.

Additional benefits

Beyond Discover’s competitive rewards and APRs, their approach to customer service and features is refreshing when contrasted to competing cards issued by just a few of the world’s largest banks.

24/7 U.S.-based customer service

Discover is the only major credit card company to offer 100 percent U.S.-based customer service, around the clock. No more frustrating calls with India. In my opinion, that alone is a reason to consider a Discover card as your everyday card.

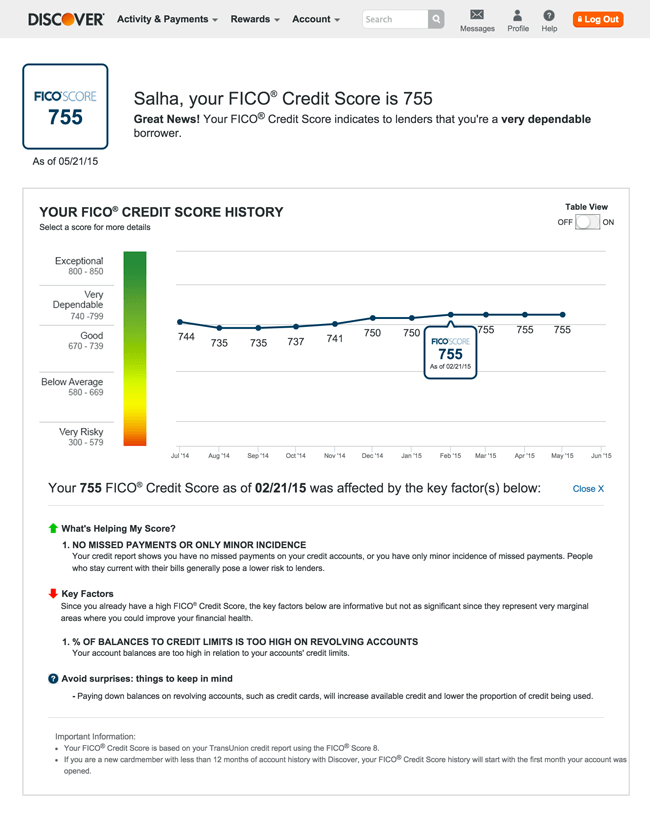

Track your recent FICO® Credit Scores for free

With Discover, you can track your recent FICO® Credit Scores for free in one easy-to-read chart on monthly statements and online. Here’s a preview:

This is a helpful benefit because it puts your credit score data on something you look at every month: Your credit card statement.

I once went six months without knowing an overdue electric bill had gone to collections…two years after moving. Had I been actively tracking my credit, I would have been able to act sooner and might have saved my score from a 100-point hit. It hurts to know that a $120 bill to Western Massachusetts Electric has cost me access to better credit options. Hence, I jump at the option for free tracking when I can (also remember to pull you free report each year from all three agencies) and recommend that you do, as well.

FreezeIt℠ fraud protection

The FreezeIt℠ feature acts like an on/off switch on your Discover card that lets you prevent new purchases, cash advances, and balance transfers on misplaced cards.

For example, let’s say you’re out one Friday night, pay for dinner, and walk out of the restaurant with your card still on the table. You can freeze your card until you retrieve it, then unfreeze your account when you get it back—this is handled in seconds via Discover’s website or mobile app, so there’s no need to call customer service.

Pros & Cons

Pros

- Valuable Bonus Rewards — Earn 5% cash back on select purchases each quarter. $1,500 max spend per quarter, activation required.

- Strong Introductory Financing Offer — Strong introductory offer on both purchases and balance transfers.

- Match Your Cash Back — Discover will match the cash back you earn during your first year.

- Low Fees — This card has no annual fee.

Cons

- Few Purchase Protection Benefits — Discover no longer offers benefits such as purchase protection, return guarantee, extended product warranty, and price protection.

- Little Travel Protections — Discover no longer offers travel benefits such as auto rental insurance, flight accident insurance.

- Not Accepted Everywhere — The Discover card isn’t accepted in some countries.

Summary

The Discover it® Cash Back card doesn’t offer the absolute longest intro APR or absolute highest reward rate on the market, but they come close with both. Combined with the year end cash back match promotion and way-better-than-your-average-bank customer service, the Discover it Cash Back card is a good choice for an everyday credit card.

You may still run into the occasional merchant that doesn’t accept Discover, but it’s increasingly rare in the United States. (Do find a different credit card for travel abroad, however.)